This article originally appeared in Southern Exposure Vol. 10 No. 1, "Who Owns Appalachia?" Find more from that issue here.

The people who did the land study had a pretty good idea of what they were likely to find when they started looking. But the facts are nonetheless devastating, presented in all their stark detail. Several major topics are covered - inadequate taxation of land wealth, economic development woes, loss of agricultural lands, lack of decent housing - and the findings are summarized here.

How to say no to the tax collector

Property taxes are traditionally the main source of money for local governments and thus for services like schools, roads, welfare, health care, sewage treatment and so forth. By all rights, then, Appalachian counties with their vast wealth in land and minerals ought not to be strapped for funds, yet they are. They simply do not tax their land and minerals in anything like an adequate or just way.

Taxes paid on rural lands are low when compared to their rising market values. Overall, the tax per acre in the 80 counties surveyed is only 90 cents, and almost one-fourth of the owners paid less than 25 cents an acre.

In general, large and absentee owners tend to pay less per acre than small local owners. One reason is that absentee owners are often holding their property on speculation or for the value of its minerals and don’t make improvements, while the local owners are more likely to build on the land and thus increase its value.

But there are other factors at work, too. In Tennessee, for example, vast tracts of land owned for mineral development by coal-land holding companies and energy producers have been routinely assessed as “farmland,” allowing them the advantage of a 25 percent assessment ratio rather than the 40 percent ratio set for industrial and commercial uses. Kentucky also allows a reduced assessment rate on agricultural land. In practice, eastern Kentucky assessors apply it to any owner of large parcels. The major beneficiaries, of course, are the energy giants and speculators who practice not a bit of agriculture. Since 1968, when the reduction took effect, these large corporate owners have lowered their property taxes by as much as 50 percent.

More seriously under-assessed than the land itself are the minerals beneath it. More than three-fourths of the owners of minerals in the 80 counties paid less than 25 cents an acre in property taxes. In the 12 counties of eastern Kentucky — including some of Appalachia’s major coal producers — the average tax per acre of minerals is one-fifth of a cent. The total tax on minerals collected by these Kentucky counties is just $1,500. Though the tax is figured by the acre, the researchers wanted to show just how meager the tax bite is. They calculated that in 22 major coal counties, with more than a billion tons of coal reserves, the owners paid an average tax of one-fiftieth of a cent for each ton. A ton of coal reserves is currently valued at $35 to $40.

Probably the most important service affected by inadequate property taxation is the public schools. The case studies in this survey show time and again that finances are often shortest in the counties with the most resources. In Walker County, Alabama, the largest coal-producing county in that state, the 28 largest holders own more than 65 percent of the mineral wealth yet contribute only $8,807 in taxes on mineral rights. Of this, $5,020 goes to education, less than the salary of one teacher. For the last 16 years, the county has been forced to borrow money to open the schools each fall. For the past nine years, the teachers’ paychecks have been late.

Martin County is one of Kentucky’s largest coal producers yet must go on the state and federal dole for 86 percent of its budget. The largest landowner is Pocahontas-Kentucky, a subsidiary of Norfolk and Western Railroad, which owns one-third of the county’s surface and more than half its mineral acreage. The taxes “Poky” pays on its surface land — 35 cents an acre — are barely enough to buy a bus for the county school system, and the $76 it pays on its mineral rights won’t even buy the bus a new tire to replace one worn out on the county’s rough coal-haul roads. The un-mined coal the company owns is officially valued at $7.6 million. (See the report on Martin County, page 49.)

Several of the counties in this study have a different problem, though. They are the sites of substantial government land holdings — which are exempt from local taxes. When the owner is a state government, the county is out of luck; there simply are no programs to compensate counties for this loss to its tax base. In the case of federal lands, the government makes some payments in lieu of taxes. But the amount is rarely equal to the average tax paid by private owners.

The extreme case is Swain County, North Carolina, where the federal government owns 80 percent of the land — national park and forest, the Cherokee Indian reservation, the Blue Ridge Parkway and so on — and where, despite a relatively high tax rate, the county cannot support its schools or provide basic services. If Washington paid in an amount per acre equal to what private out-of-state owners pay, it would mean an extra $150,000 a year to Swain County.

Taken together, the failure to tax minerals adequately, the underassessment of surface lands and the revenue loss from concentrated federal holdings have a marked impact on local governments in Appalachia. First, the small owners carry a disproportionate share of the tax burden. Second, counties depend on federal and state funds while large corporate and absentee owners of the region’s resources escape relatively tax-free. Third, citizens must do without needed services despite the presence in their counties of great taxable wealth, especially in the form of coal and other natural resources.

At this time of federal budget cutbacks, the generation of new local revenues is urgent. The land study explored various ways of taxing un-mined mineral wealth, determining that the alternative that makes the most sense is a tax on the capacity of the land to produce an “income stream” for its owner over a period of time. In simple terms, what would have to be done is: (1) figure the future income to the owner, taking into account the amount of recoverable minerals, and estimated market price and expenses to be incurred in developing the minerals; and (2) reduce the income to its present worth — that is, determine what a buyer would be willing to pay today for the promise of future income.

Using conservative figures and methods, the researchers have figured the present value of coal reserves to be mined over the next 50 years at $2.4 billion. If these reserves were taxed at nothing more than present rates, the coal counties in the study would realize $16.5 million a year in new taxes, or almost $300,000 per county.

The underdeveloped world

Appalachia is America’s Third World. The absolute control the coal companies had over people’s lives in the old company towns is no more, but the power of absentee corporate owners to affect the economic future of local communities is still massive. The situation is most severe in the coal counties, where half the land surface is corporately owned and 72 percent is absentee-owned.

In Logan County, West Virginia, 11 corporations own nearly everything. Roscoe Spence, who edited the weekly paper there for more than 30 years, sums things up: “By controlling land, they controlled the jobs; by controlling jobs, they control the payroll by controlling the payroll, they once could control where people bought; by controlling where people bought, they could control profit on earnings. It was a stacked-up thing. The effect of it is that people who control the land control everything.”

Land ownership patterns also worsen the problems that come with the booms and busts of the coal industry. Good times bring greater demands for nonexistent housing and for services dependent on already-strained county budgets. In bad times, few non-coal jobs are available, use of the land for survival — even tilling the hillsides — is limited for most people, and moving away is the only real choice for many. In the coal counties surveyed, in fact, there is a strong connection between corporate ownership and outmigration in the 1960s, a period of coal decline: the greater the degree of corporate ownership of a county, the greater the percentage of the population who left.

Everywhere in Appalachia people tout the wisdom of getting out from under the fortunes of coal. Take Russell County, Virginia, where local officials have resolved: ‘The area’s leaders should do everything in their power to attract other industry, so that the area’s economy is not so strongly tied to coal. The coal industry has a volatile history, and it is important our dependency on coal is reduced.”

Yet non-diversification continues as the order of the day. As a Harlan County woman says, “Mining will be the life of my three sons. If they don’t mine, they can’t make a living. Either you mine coal or you push a buggy at Cas Walker’s [supermarket].”

Government agencies cite any number of reasons for the lack of choices: isolation, topography, a poorly trained work force and so on. This study adds land ownership patterns to the list and suggests that it probably should be at the top. In the words of the manager of the Logan County chamber of commerce, “Logan County needs more industry, but the first thing they ask us when they want to come is if land is available. Then they ask about water and sewage. Of course, all of the answers are no.”

In county after county, the researchers heard stories of large landowners holding land for future energy extraction and refusing to sell parcels to local development groups. Lack of available land isn’t the only reason new industry is hard to attract. A company deciding where to locate also considers the presence of adequate services like water systems, sewers, transportation, hospitals, good schools. Decades of absentee corporate ownership have failed to produce them in the coalfields.

Development problems are different in counties dominated by recreational uses and tourism. Land is owned in huge chunks by the federal government, as national forests and parks, and in smaller individual parcels by absentee owners holding the land for speculation or for second-home developments. In these areas, it’s not land ownership itself that limits economic freedom, but the low wages and seasonal employment of the tourism and recreation industry. At the same time, local residents face rising prices for land, housing and other goods due to the spending and speculation of the more affluent outsiders.

Disappearing farmland

The Appalachian tradition of small farms is important both economically and culturally, but farming has gone into a dramatic decline. Using the records of the federal agricultural census, the land study documents the loss, in the 80 counties, of a million acres of farmland between 1969 and 1974, the latest year for which figures are available. More than 17,000 farmers (one in four) left the land during this time. If these rates continued through the late ’70s — and there’s no reason to think they didn’t — the new agricultural census will show that, in a single decade, more than half of Appalachia’s farmers stopped farming and better than a third of the farmland has gone out of production.

The decline is, of course, a national phenomenon, and Appalachian farmers have much in common with other small farmers suffering government neglect, financial instability and corporate intrusion. But there are differences. The Appalachian farmer tends to be older, less educated and poorer. The average farm is smaller, and the uneven topography results in the division of cropland into such small and scattered fields that efficient use of machinery is often impossible. And the pressures on farmland from energy development and tourist development pose special problems; corporate control of land does not seem to lead to agribusiness — corporate agricultural production — as it does elsewhere in the country. In fact, the reverse seems to be true: corporate ownership takes land out of agriculture altogether. In the surveyed counties, the greater the corporate control of land, the lower the percentage of land devoted to agriculture. Similarly, the greater the level of coal production, the fewer farms in a county and the less farm acreage in a county. Most of the major coal counties are in central Appalachia and lost much of their agricultural land long ago. But to say that farming is no longer predominant there is not to discount its significance. The small farm plot has provided important security for miners in times of coal busts, for the elderly and unemployed, and for those working in the lower-paying jobs. As the loss of farmland continues, the last thread of independent economic security for residents of the major coal counties is finally breaking. The average coal county lost almost 30 percent of its farmland between 1969 and ’74, double the rate in agricultural counties.

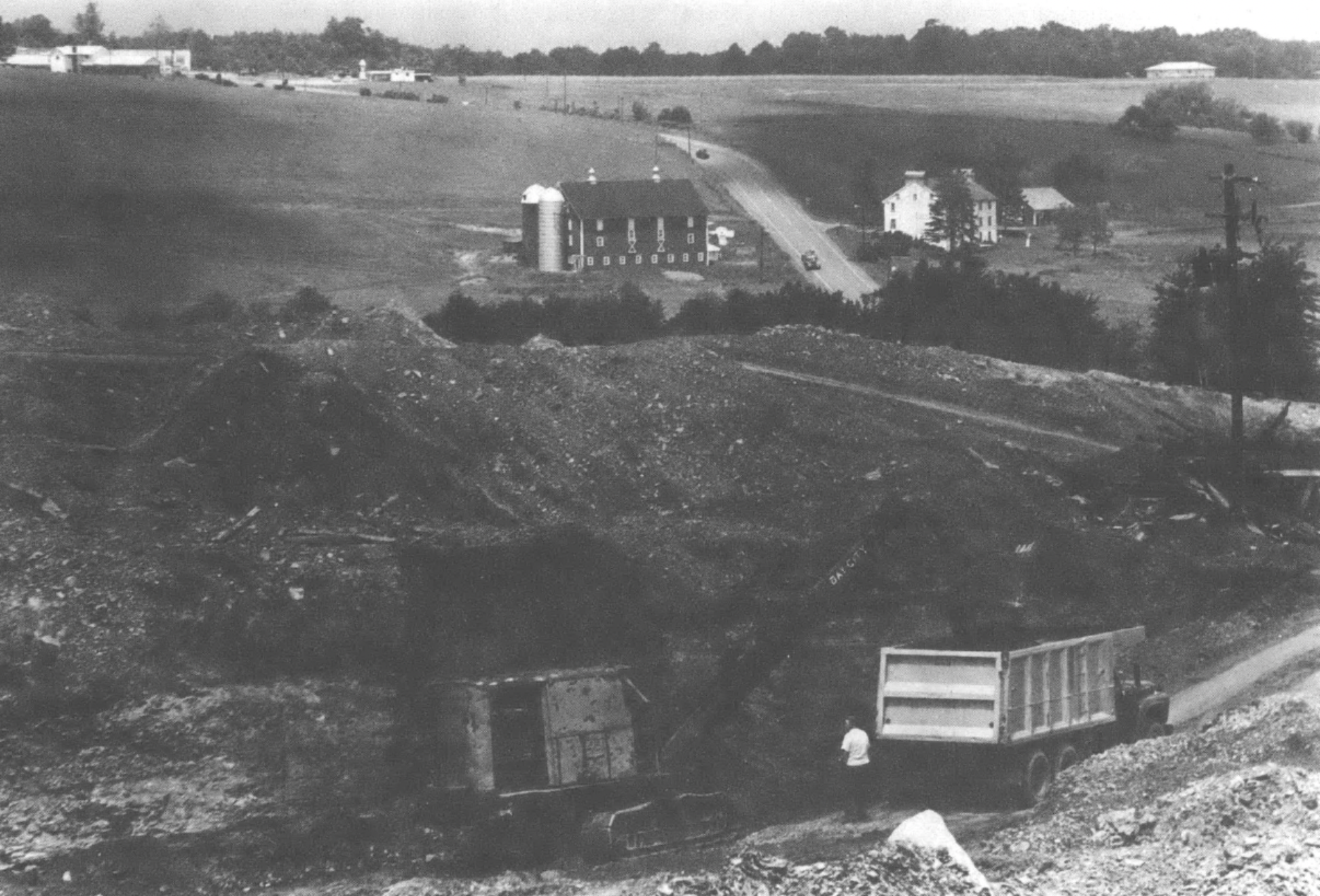

The land left for farming is still threatened by the effects of mining. Unchecked strip mining destroys the surface, fills creeks with silt that encourages flooding, and creates acid runoff that ruins the land it floods. Seventy-five percent of Cranks Creek in Harlan County, Kentucky, has been disturbed by strip mining. The creek is silted up and most of the land below the strip job is ruined. Becky Simpson, who lives on Cranks Creek, says, “Folks can’t farm anymore because the clay mud has washed over the soil; the land no longer absorbs water.”

On the fringes of the old coalfields, there are counties where agriculture is the traditional economic base. But minerals of increasing value — such as bauxite and oil and gas — are beginning to be exploited. In those counties, corporate and absentee ownership is coming into conflict with local farmers’ use of their land. In Tennessee, several court decisions in the mid-1970s upheld the right of mineral owners to strip-mine land without the consent of the surface owners; but a law requiring consent has since passed through the efforts of a state legislator from one of the affected counties and a citizens’ group called Save Our Cumberland Mountains. But it’s a battle still to be fought in other states.

Agriculture has also played an important traditional role in the counties now beset by resort development and second-home buyers. Tourism poses a grave threat, chiefly because the price spiral caused by land speculation tempts people to sell off their farmland; rising land prices also act as a barrier to those who would like to farm. One resident of Swain County, North Carolina, tells it all: “There really hasn’t been a young person getting into farming lately because of high land prices and outside pressure of people coming in from outside the county and who are willing to pay a high price for it [the land]. This has taken good land out of agricultural use and out of production.”

No place to live

Housing in Appalachia is a well-known national disgrace. In 1970, one of every five homes there was substandard, and in Central Appalachia the figure was one out of three. In the average rural county in the land study, 30 percent of the homes lacked some plumbing, 13 percent were overcrowded, and almost 60 percent were built before 1950. Ironically, the worst housing conditions are found amidst the greatest wealth. In the heart of the coalfields, houses are the oldest and most crowded. In the recreation and tourist areas, substandard locally owned dwellings stand side-by-side with modern absentee owned second homes. Throughout the region, mobile-home parks along the roadbanks and riverbanks are the principal answer for those with no place else to go.

Again, the study shows that tightly held ownership of large parcels means little land for housing, and competition for that little sends prices soaring beyond the reach of low- and middle-income residents. In general, the study found that the greater the degree of corporate ownership and the greater the degree of absentee ownership of a county, the more crowded its housing stock for local people.

Severed ownership of mineral rights, common all over the coalfields, is also to blame for poor housing in Appalachia. The homeowner who holds only his or her surface rights faces many uncertainties: the company may show up at any time to strip-mine the land, and conflicts can develop over titles. Even worse is the effect on the building of new homes. As a bank officer in Dayton, Tennessee, explained, lack of mineral rights acts as a “cloud” on the title, and title companies will not insure it. Without title insurance, lending institutions — including HUD and the Farmers Home Administration — will not make loans, and neither first nor second mortgages can be obtained. Raymond Weaver of Sale Creek, near Chattanooga, is one victim of this policy. He can show papers from at least five lenders that turned down his applications to renovate his home; the reason given: that he doesn’t own the minerals beneath his 46-acre farm.

It used to be, in the coalfields, that the corporate land holders were also the principal housing providers — in the form of coal camps. When the industry declined in the 1950s and ’60s, much of the housing was torn down. Now the industry is booming again and houses are needed for miners, but the housing sites aren’t available. In the four southern coalfield counties of West Virginia, for example, new housing is desperately needed, but there were 12,579 fewer housing units in 1970 than in 1950. In these four counties, well over two-thirds of the surface land is owned by corporations.

For many Appalachian people, coal camp life is still the fact of life. Because they have no alternative, they remain dependent on the company landlord, facing the insecurities of short-notice evictions, dilapidated homes and fear of the company’s power. Take Logan County, for example, where hundreds of coal company homes were demolished in the ’50s and ’60s. Now, even though the housing crisis is desperate, the land where the old houses stood lies vacant and the companies refuse to give it up. Along Rum Creek, where the Dingess Rum Coal Company owns it all, the industry is expanding and the miners need houses. But Dingess Rum persists in tearing down livable houses as tenants die or move out, and residents have heard that the company plans to get rid of everything that remains soon. Richard Cooper, a union mine safety inspector, says that Dingess Rum officials recently forced tenants to sign forms agreeing to vacate their homes within 10 days if asked.

Cooper knows the company well. He grew up on Rum Creek in a company house, and he lives in one now with his wife and three children. It’s at least 50 years old and has a gaping hole in the roof and broken water pipes beneath it. But he doesn’t do much to fix things up; the rent will go up if he does. The Coopers would like to buy land on Rum Creek for a house, but the company won’t sell. “I could go up and offer $100,000 for this house and they’d laugh in my face, even if I had it in $100 bills.”

The only other option is mobile homes, and in parts of Appalachia the trailer park has replaced the company town. That’s what seems to be happening in Logan County, too. As another resident put it, “It seems that the general policy of Dingess Rum is to make their housing as unbearable as possible to coax county residents into trailer camps. Today, Dingess Rum makes as much renting families plots of land on which to place a trailer as they used to make renting housing. And they pay less taxes, because the land is considered idle for tax purposes.”

Figures collected for the land study indicate that the rise in this form of housing is staggering. In seven coal counties of southwestern Virginia, a record number of occupancy permits was issued in the first six months of 1979, and 76 percent of them were for mobile homes. In Wise County, Virginia, mobile homes accounted for over 70 percent of the new housing units between 1970 and 1976. In Pike County, Kentucky, mobile homes represented 98 percent of new housing units between 1970 and 1977.

Trailers may be the only way out for many, but they don’t satisfy the family which wants a house and can afford one if only there were one to buy. Their numbers are legion in Appalachia — especially among the miners, whose incomes increased substantially in the 1970s — and their frustration is mounting.

New minerals, new owners

The land study not only documents an old story for residents of the region’s central coalfields; it also uncovers evidence warning that history is about to repeat itself in other areas. With large corporations worried about their dependence upon Third World nations for energy resources and minerals, their agents are again scouring the countryside for land and mineral rights. This time they are moving beyond the coalfields to other parts of the mountains and the deep South. The search is leading to a new corporate takeover, and — the land activists say — “Watch out for the Appalachianization of Dixie.”

Oil shale rights are being leased in central Kentucky, west of the coalfields. Lignite mines are being stripped from Alabama to Texas. Millions of acres of oil and gas rights are being leased throughout Appalachia, known to the geologists as the Eastern Overthrust Belt. And, in the name of national defense, major exploration has begun in Virginia and western North Carolina for “strategic minerals,” especially uranium, bauxite, gibbsite, monazite and chromite. These developments mean a vast expansion of the corporate and absentee ownership of new areas, and extraction of these minerals is likely to have major environmental consequences for the rural areas where they’re being discovered.

The land study also documents a continuing takeover of the traditional coalfields by energy conglomerates, primarily the big oil companies. The new owners throw around capital and technology on a whole new scale. They plan strip mines of a size never before attempted in the East, the removal of whole mountaintops. They also plan a synthetic fuels industry to turn coal into oil, with unknown environmental effects, and the construction of new, enormous power plants, like pumped-storage facilities, that promise to take still more land out of local production and control.

What is to be done?

Land use planning and regulation are next to nonexistent in most rural Appalachian counties, and so decisions are made, de facto, by the large, powerful owners according to their own interests. Even though these decisions dramatically affect the region’s course of development, the people who live there have little say in them.

The local people who did this land study have come to the conclusion that conditions must change. They end their report with a recommendation for fundamental land reform, initiating a broad public discussion mechanism by which people can gain access to, control over and benefit from the land and its resources. Options range from local governments’ using their eminent domain powers to condemn land needed for community use to statutory limits on corporate and/or absentee ownership of land.

Recognizing that the land reform battle could take a long time, they’ve also called for less direct actions to mitigate the adverse effects of ownership patterns and to hold on to the little land that’s left for local use.

Mitigating actions might include tax reform, new and diverse economic development or housing development projects. Land retention policies might start with a comprehensive land-use plan developed with broad public participation and might lead to statutory prohibitions of land transactions that would take still more land out of local control.

Now, though, in the face of all this bad news revealed, or simply confirmed, by the land study, there is much to report that is good. For one thing, the research is not being relegated to the library shelves. It’s being used all over Appalachia to turn things around, and Southern Exposure turns now to a few reports from some of the activists at work in the Southern mountains. □