Bringing It Home: Guns & Butter in the '80s

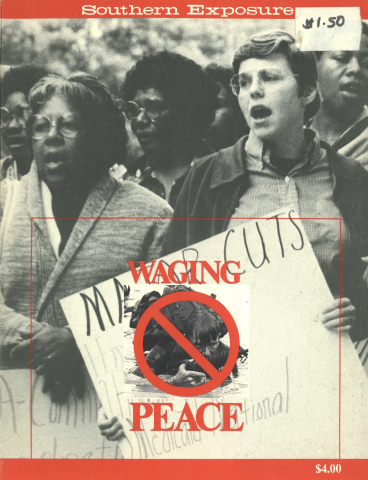

This article originally appeared in Southern Exposure Vol. 10 No. 6, "Waging Peace." Find more from that issue here.

Much of the recent success of groups working to reverse the nuclear arms race grows out of their effectiveness in translating remote questions of strategic nuclear doctrine into matters of immediate local concern. Educational groups, such as Physicians for Social Responsibility and Ground Zero, make the danger of nuclear war realistic to people by describing accurately and in painful detail the devastation a nuclear attack would bring to a particular community.

The Reagan administration's huge increase in military spending, coming largely at the expense of social programs, is not so apocalyptically destructive as nuclear war, to be sure, but its effects are more immediately felt and, for large numbers of citizens, more real. The guns versus butter issue will become increasingly important at the national level as the 1984 election approaches — the task is to bring home to people the meaning of budget decisions made in Washington.

It is often difficult to convey to people just how extreme a change the Reagan Administration's budget policies really are. One complication in presenting the facts is that the federal budget includes funds for programs, such as Social Security, which are actually financed out of their own, separate trust funds. Each year the Women's International League for Peace and Freedom (WILPF) "corrects" the Office of Management and Budget figures with pie charts showing military spending as a proportion of the non-trust fund part of the budget. In the Fiscal Year 1983 budget, which Congress is now completing, military spending is projected at 29 percent of the overall "Unified Budget" but takes up 46 percent of the "Federal Funds" budget, which excludes trust funds. WILPF also adds the cost of veteran's benefits and part of the cost of interest on the debt to the military side of the budget, since these expenses are attributable to previous military commitments, so that the military takes up a staggering 64 percent of the budget.

At the Coalition for a New Foreign and Military Policy, we make this same point by using the administration's own figures, which assume relatively small changes in Social. Security, Medicare and Medicaid, the programs reserved to the federal government under the New Federalism. By 1987, with military spending rising to 37.2 percent of the "Unified Budget," social programs which had taken up 35.2 percent of federal spending in 1981 (when military spending was 24.3 percent of the budget) will be reduced to 18.6 percent of the budget — almost a 50 percent cut (and even larger for many programs, since this part of the budget must cover the basic operating costs of government and a number of programs which will not be reduced.)

An obvious way to dramatize the impact of military spending on budget priorities is to contrast questionable military expenditures with alternative programs to meet social needs. The Washington-based Children's Defense Fund, for example, reported in last spring's "Children's Defense Budget" that Congress could restore money for immunizing 35,000 poor children if it cut out $1.4 million to subsidize shots and other veterinary care provided to pets of military personnel.

It is easy to take pot shots at the Pentagon with such comparisons, but they can make legitimate and important points; they also lend themselves to good graphic presentation. Comparisons make it clear that the Pentagon's budget is not subjected to the careful scrutiny which Presidential sermons on belt-tightening would seem to require, while social programs are slashed without regard to the value of the programs involved. Information on the costs of individual weapons systems is available from the Pentagon's Public Affairs Office in a document titled "Procurement Programs (P-1)." A number of organizations critical of the Pentagon, including SANE, Council for a Livable World and the coalition, provide such data in more accessible form, along with lists of social program cuts.

A number of local organizations have recently produced excellent analyses of the impact of military spending on their own communities, and these may be useful models. The Boston Jobs With Peace Campaign earlier this year prepared a brief, graphically appealing "Boston Peace Budget" and a longer, well-researched back-up study, "Towards a Boston Peace Budget." Minnesota Clergy and Laity Concerned has just completed a 32-page report titled "Jobs and Peace: Military Spending and Its Impact on Minnesota's Economy." Each of these reports reviews recent changes in overall federal budget priorities, the impact on local budgets, the effects on delivery of key services, the local tax drain due to the military budget, local job losses due to military spending, and ways to cut the military budget. The Minnesota study also reports on area companies with military contracts, and the Boston study provides a full-scale alternative local budget for funds freed up by military savings.

Military contracts are by far the largest pieces of bacon in American pork barrel politics. Even in the South, however, most congressional districts pay out more in federal taxes for military purposes than they receive back in business from the Pentagon. James and Marion Anderson of Employment Research Associates, regularly prepare state-by-state and congressional district-by-district figures on military-related tax flows and employment. Their publications are indispensable sources of detailed information for local work on these issues.

"Bankrupting America: The Tax Burden and Expenditures of the Pentagon by Congressional District" gives specific figures for every district on the inflow and outflow of Pentagon dollars. It also calculates the net gain or loss per family in each district — Representative Wynche Fowler's Atlanta district, for example, will experience a net outflow of $2,800 per family in Fiscal Year 1982.

"The Empty Pork Barrel: Unemployment and the Pentagon Budget" gives related figures for the job losses due to military spending, though only in those states in which there is a net job loss, rather than a gain. The coalition has published the results of this study in a shorter pamphlet, titled "Unemployment: Fallout of the Arms Race."

By now it is becoming widely recognized that military spending creates relatively fewer jobs than almost any alternative use of the same amount of money — this is because military spending is relatively capital-intensive, and because the jobs it does create tend to be relatively high-skilled (lots of engineers, scientists and lobbyists, for example) with relatively high pay. An excellent discussion of the issue, and other key questions, along with a review of several important studies, is included in a 64-page report titled "The Costs and Consequences of Reagan's Military Buildup," prepared by the Council on Economic Priorities.

The high skill levels required by military-related jobs also leave minorities and women at a special disadvantage. Employment Research Associates has recently produced two detailed studies on this issue: "Bombs or Bread: Black Unemployment and the Pentagon Budget" and "Neither Jobs Nor Security: Women's Unemployment and the Pentagon Budget."

To make all of this as concrete as possible, however, requires a little more digging into the details of local military expenditures. The Pentagon's Washington Headquarters Service Directorate of Information provides a listing of relevant reports and an order form — individual reports can often be obtained free by calling (202)697-3182. "Prime Contract Awards Over $10,000 by State, County, City" for each fiscal year is probably the most useful document in tracking down military contractors in your area. Your state's Economic Development Department may also publish an indexed directory of state businesses.

Detailed information on each company — numbers of jobs provided locally for a given size of contract, its record in hiring women and minorities, etc. — needs to be tracked down separately. Often military businesses in an area have gone through a "boom-and-bust" cycle to the detriment of local workers and communities. The most important local issue may be the implications for the overall economic health of the area of excessive "defense dependency." To address the question fully requires an effort to review the overall economy of the area. Advice and help in doing research on the local military is available from the Council on Economic Priorities.

The Reagan budget cuts will affect local communities in three major ways: 1) individuals and organizations will see benefits and funding either terminated or reduced; 2) the local economy will suffer from the loss of federal funds; and 3) state and local taxes may be raised to offset the loss of federal money.

Two federal publications can provide basic information on federal programs in your area. The first is the "Catalog of Federal Domestic Assistance," available in many public libraries and in all Federal Information Centers located in the federal building at a state capital. The catalog includes a complete description of federal programs, including eligibility criteria, application procedures and amounts allocated.

The second, "Geographic Distribution of Federal Funds," lists all federal programs and the expenditures for each, broken down by state, county and large city. Reports for individual states come out near the end of each fiscal year (September 30) and should be available through local Community Action Agencies, County Commissioners' offices, and some public libraries.

In addition, State Information Reception Offices (SIROs) keep track of federal programs and where their money goes within each state. Local or regional clearinghouses, which can be located through the SIROs, keep track of local uses of funds.

These resources can help in determining how much federal aid currently comes into a particular community and how much will be lost because of the cuts. Additional information concerning how many people currently receive benefits or services, how many people will have benefits terminated or will receive reduced services, and whether state and local taxes will be increased because of federal cutbacks can be tracked down through offices and agencies administering the various programs, or through groups such as teachers' unions which are especially concerned with particular services.

Up-to-date information on federal social programs is available from a number of special interest organizations in Washington. Each year the U.S. Conference of Mayors produces a response to the administration's budget proposals as soon as they are released in late January or early February. The response is titled "The Federal Budget and the Cities," and is available very shortly after the official budget becomes public.

A number of groups cooperate in producing manuals reviewing the administration's various proposals. The manuals also include directories of organizations by issue area. One will be produced by the Coalition on Block Grants and Human Needs titled "Briefing Book on Block Grants and Human Needs." An updated "Organizer's Manual" is being planned by the Fair Budget Action Campaign, and the Center for Community Change produces a very useful multi-issue newsletter and acts as a clearinghouse for information.

Tags

Steve Daggett

Stephen Daggett is Budget Priorities Coordinator for the Coalition for a New Foreign and Military Policy. (1982)