Mortgage woes linger in states hit hard by Katrina

The number of U.S. homeowners who have fallen behind on their mortgage payments is climbing, and the delinquency problem is especially severe in storm-ravaged Mississippi and Louisiana, where many people face the threat of losing the roof over their head from a disaster of a different kind.

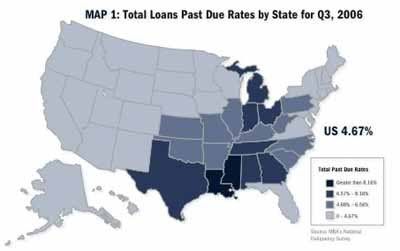

The overall delinquency rate rose to 4.67 percent from July through September, compared to 4.39 percent in the second quarter, while the delinquency rate for subprime mortgages rose to 12.56 percent in the third quarter, up from 11.7 percent in the previous three-month period.

That's the finding of a survey released yesterday by a mortgage banking industry group. About 16 times as many subprime loans are past due as in 1998, when the industry began tracking the statistics as part of its periodic delinquency analysis, the Washington Post reports:

About 223,000 households with subprime loans lost their homes to foreclosure in the third quarter of 2006, and about 725,000 had missed payments, according to the quarterly survey from the Mortgage Bankers Association, which analyzed about 42.6 million mortgages, including 5.8 million that were subprime. Subprime borrowers generally pay interest rates about 3 percentage points higher than "prime" borrowers with good credit.

The deterioration in the subprime market is likely to continue for several years, industry analysts said. They note that the growth of this sector has contributed to near-record homeownership levels, but it has also left some owners unable to handle the payments. Analysts expect more foreclosures in 2007 and 2008 because many subprime loans are low for a time and then adjust up.

The states with the highest overall delinquency rates in the latest survey were Mississippi at 11.05 percent and Louisiana at 9.5 percent. The good news is that the delinquency rates in these states have dropped markedly since the period immediately after Katrina and Rita, when they skyrocketed to 17.44 percent in Mississippi and 24.63 percent in Louisiana. However, the rates remain elevated from June 2005, when Mississippi's was 8.53 percent and Louisiana's was 6.67 percent, according to MBA's December 2005 delinquency survey.

The states with the highest overall delinquency rates in the latest survey were Mississippi at 11.05 percent and Louisiana at 9.5 percent. The good news is that the delinquency rates in these states have dropped markedly since the period immediately after Katrina and Rita, when they skyrocketed to 17.44 percent in Mississippi and 24.63 percent in Louisiana. However, the rates remain elevated from June 2005, when Mississippi's was 8.53 percent and Louisiana's was 6.67 percent, according to MBA's December 2005 delinquency survey.

In the latest survey, the South had the second-highest overall seasonally adjusted delinquency rate at 5.37 percent, behind the North Central rate of 5.44 percent and the national rate of 4.67 percent. Rates in the Northeast and West were 4.39 and 2.81 respectively.

Tags

Sue Sturgis

Sue is the former editorial director of Facing South and the Institute for Southern Studies.