Report: Southern banks biggest recipients of TARP funds outside of Wall Street

Leading the charge against the Senate economic stimulus package this week are Alabama Senators Richard Shelby and Jeff Sessions -- both Republicans -- who insist the bill is both too costly and doesn't focus enough on helping banks.

But Alabama banks have already been among the leading beneficiaries of federal money used to buy stock in troubled finance institutions. As of January 30, banks based in Alabama had already received $3.6 billion -- making Alabama the 9th-highest recipient of federal bank infusions.

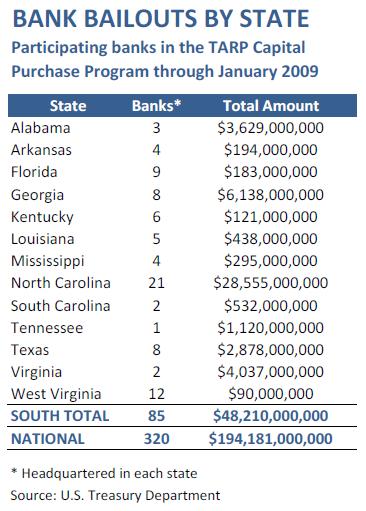

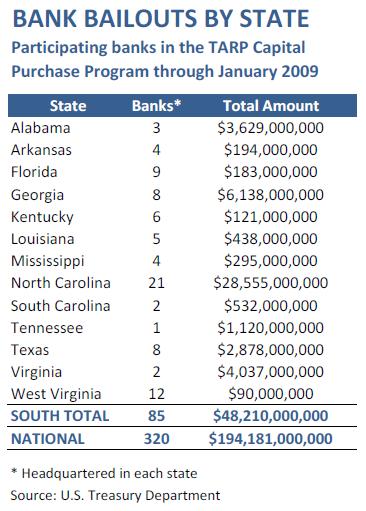

According to a Facing South analysis of Treasury Department data, banks headquartered in 13 Southern states have received 25 percent of the $194 billion so far used under the Capital Purchase Program, in which the government purchases stock in distressed financial companies.

North Carolina -- headquarters of financial giant Bank of America -- was the clear leader in the South, placing second only to New York nationally in amount of federal money going to the state's banks. Twenty-one N.C. banks have received $28.6 billion in federal infusions, with Bank of America accounting for $25 billion of the total. (This doesn't include a separate loan to BoA worth $20 billion.)

However, Alabama was one of five other Southern states were among the biggest program beneficiaries, with banks receiving over $1 billion in federal bank stock purchases: Georgia ($6.1 billion), Virginia ($4b), Alabama, Texas ($2.9b) and Tennessee ($1.1b).

Overall, five of the 10 states receiving the most Capital Purchase Program support are in the South.

With 85 banks throughout the South participating, the region makes up nearly 27% of financial institutions nationally involved in the program.

For a helpful map of where the bailout money has gone, also see this page at the Wall Street Journal.

For a helpful map of where the bailout money has gone, also see this page at the Wall Street Journal.

But Alabama banks have already been among the leading beneficiaries of federal money used to buy stock in troubled finance institutions. As of January 30, banks based in Alabama had already received $3.6 billion -- making Alabama the 9th-highest recipient of federal bank infusions.

According to a Facing South analysis of Treasury Department data, banks headquartered in 13 Southern states have received 25 percent of the $194 billion so far used under the Capital Purchase Program, in which the government purchases stock in distressed financial companies.

North Carolina -- headquarters of financial giant Bank of America -- was the clear leader in the South, placing second only to New York nationally in amount of federal money going to the state's banks. Twenty-one N.C. banks have received $28.6 billion in federal infusions, with Bank of America accounting for $25 billion of the total. (This doesn't include a separate loan to BoA worth $20 billion.)

However, Alabama was one of five other Southern states were among the biggest program beneficiaries, with banks receiving over $1 billion in federal bank stock purchases: Georgia ($6.1 billion), Virginia ($4b), Alabama, Texas ($2.9b) and Tennessee ($1.1b).

Overall, five of the 10 states receiving the most Capital Purchase Program support are in the South.

With 85 banks throughout the South participating, the region makes up nearly 27% of financial institutions nationally involved in the program.

For a helpful map of where the bailout money has gone, also see this page at the Wall Street Journal.

For a helpful map of where the bailout money has gone, also see this page at the Wall Street Journal.Tags

Chris Kromm

Chris Kromm is executive director of the Institute for Southern Studies and publisher of the Institute's online magazine, Facing South.