Banking services lacking for minority households

About a quarter of U.S. households lack banking services, making them vulnerable to costly alternative financial services like payday loans. The problem is especially severe for minority households and for states in the South.

Those are among the findings of a report released this week by the Federal Deposit Insurance Corporation, which guarantees deposits at the nation's banks and savings associations. The survey, which was conducted for the FDIC by the U.S. Census Bureau, represents the most comprehensive look to date at unbanked and underbanked households.

"Unbanked" households are defined as those in which no one has a checking or savings account, while "underbanked" households are those that do have such accounts but still rely on alternative financial services such as money orders, check-cashing services, payday lenders, rent-to-own operations or pawn shops.

"Access to an account at a federally insured institution provides households with an important first step toward achieving financial security -- the opportunity to conduct basic financial transactions, save for emergency and long-term security needs, and access credit on affordable terms," says FDIC Chair Sheila Bair. "By better understanding the households that make up this group -- who they are and their reasons for being unbanked or underbanked -- we will be better positioned to help them take that first step."

The report found that 7.7% of U.S. households are unbanked, and another 17.9% are underbanked. An estimated 21.7% of black households, 19.3% of Hispanic households and 15.6% of American Indian/Alaskan households are unbanked. In comparison, only 3.3% of white households are unbanked.

Nearly 20% of U.S. households earning less than $30,000 a year do not currently have a bank account.

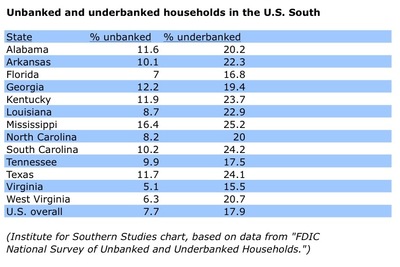

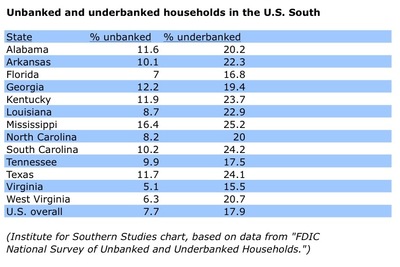

The incidence of unbanked and underbanked households is highest in the South, where only three states -- Florida, Virginia and West Virginia -- have a percentage of unbanked households lower than the U.S. as a whole. Even North Carolina, a center for the U.S. banking industry, has a higher percentage of households that are unbanked or underbanked than the nation overall.

Mississippi has the highest rate of unbanked households in the U.S. at 16.4%. It also has the nation's second-highest rate of underbanked households at 25.2%, surpassed only by Alaska at 25.5%. The state with the lowest rate of unbanked households is Utah at 1.7%.

Mississippi has the highest rate of unbanked households in the U.S. at 16.4%. It also has the nation's second-highest rate of underbanked households at 25.2%, surpassed only by Alaska at 25.5%. The state with the lowest rate of unbanked households is Utah at 1.7%.

The survey found that the most common reason that households choose not to participate in the mainstream financial system is that they feel they don't have enough money to need an account.

The report concludes that it's imperative for government and industry to expand access to financial services.

Those are among the findings of a report released this week by the Federal Deposit Insurance Corporation, which guarantees deposits at the nation's banks and savings associations. The survey, which was conducted for the FDIC by the U.S. Census Bureau, represents the most comprehensive look to date at unbanked and underbanked households.

"Unbanked" households are defined as those in which no one has a checking or savings account, while "underbanked" households are those that do have such accounts but still rely on alternative financial services such as money orders, check-cashing services, payday lenders, rent-to-own operations or pawn shops.

"Access to an account at a federally insured institution provides households with an important first step toward achieving financial security -- the opportunity to conduct basic financial transactions, save for emergency and long-term security needs, and access credit on affordable terms," says FDIC Chair Sheila Bair. "By better understanding the households that make up this group -- who they are and their reasons for being unbanked or underbanked -- we will be better positioned to help them take that first step."

The report found that 7.7% of U.S. households are unbanked, and another 17.9% are underbanked. An estimated 21.7% of black households, 19.3% of Hispanic households and 15.6% of American Indian/Alaskan households are unbanked. In comparison, only 3.3% of white households are unbanked.

Nearly 20% of U.S. households earning less than $30,000 a year do not currently have a bank account.

The incidence of unbanked and underbanked households is highest in the South, where only three states -- Florida, Virginia and West Virginia -- have a percentage of unbanked households lower than the U.S. as a whole. Even North Carolina, a center for the U.S. banking industry, has a higher percentage of households that are unbanked or underbanked than the nation overall.

Mississippi has the highest rate of unbanked households in the U.S. at 16.4%. It also has the nation's second-highest rate of underbanked households at 25.2%, surpassed only by Alaska at 25.5%. The state with the lowest rate of unbanked households is Utah at 1.7%.

Mississippi has the highest rate of unbanked households in the U.S. at 16.4%. It also has the nation's second-highest rate of underbanked households at 25.2%, surpassed only by Alaska at 25.5%. The state with the lowest rate of unbanked households is Utah at 1.7%.The survey found that the most common reason that households choose not to participate in the mainstream financial system is that they feel they don't have enough money to need an account.

The report concludes that it's imperative for government and industry to expand access to financial services.

Tags

Sue Sturgis

Sue is the former editorial director of Facing South and the Institute for Southern Studies.