Scarce jobs and broke budgets: What can Southern states do?

Put together, states have a collective $160 billion budget shortfall for the current fiscal year. And some states are doing much worse than others: 10 have budget shortfalls of at least $2.5 billion, according to the Center for Budget and Policy Priorities, including Florida ($2.5+ billion), North Carolina ($3+ billion) and Texas ($10+ billion).

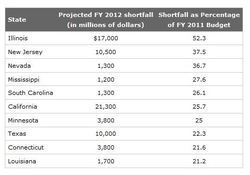

The situation is even more grim when you compare the shortfalls to the total money states have to spend. The following chart from U.S. News and World Report ranks the states where the shortfalls consume the biggest share of their current budget:

Even more alarming, many of these states are among those facing the highest jobless rates in the country. Here are how Southern states with big deficits are faring:

STATE - BUDGET SHORTFALL - UNEMPLOYMENT RATE

Florida - $2.5+ billion - 12%

Louisiana - $1.7+ billion - 8.2%

Mississippi - $1.2+ billion - 9.9%

North Carolina - $3+ billion - 9.7%

South Carolina - $1.3+ billion - 10.6%

Texas - $10+ billion - 8.2%

The severe state shortfalls have locked legislators into opposing camps: Republicans, which in most Southern states have the upper hand, insist that sharp cuts in state programs -- including schools and health care -- are needed to meet the deficits.

Democrats are fighting back by saying that cuts would only make the jobless situation worse: For example, cuts being proposed to schools in the Charlotte area of North Carolina would put 1,500 educators out of work, decimating core school programs. The only option, they argue, is to raise revenues through some form of taxes.*

Another approach which has yet to get as much play is closing tax loopholes, which largely benefit companies and upper-income individuals. In North Carolina, the state identifies some $5.8 billion in "tax expenditures," which refers to anything that causes a company or person to pay less taxes than the normal rate.

There's no doubt that many of these tax breaks have been good for the state. But according to Chris Fitzsimon at N.C. Policy Watch, it's a mistake to not even examine these loopholes when addressing how to keep states running:

[In North Carolina] there's a tax break for tobacco distributors if they file their reports and cigarette tax collections with the state on time. Alcohol distributors receive a similar break for timely collections and reporting. There's no break for citizens who file their taxes before the deadline [...]

One of the most egregious giveaways that didn't even make the report is the practice of allowing multistate corporations to shift the profits they make in North Carolina to other states to avoid paying the state taxes they owe. That not only robs the state treasury of revenue, it is patently unfair to North Carolina companies who compete with the multistate corporations but pay higher taxes because they have no place to hide

Tags

Chris Kromm

Chris Kromm is executive director of the Institute for Southern Studies and publisher of the Institute's online magazine, Facing South.