INSTITUTE INDEX: The politics of debt

Date that House Majority Leader Eric Cantor (R-Va.) and other GOP leaders walked out of negotiations with the Obama administration on lifting the U.S. debt ceiling over their opposition to raising more revenue: 6/23/2011

Date that House Majority Leader Eric Cantor (R-Va.) and other GOP leaders walked out of negotiations with the Obama administration on lifting the U.S. debt ceiling over their opposition to raising more revenue: 6/23/2011Date that the U.S. is expected to run out of cash unless the debt ceiling is raised: 8/2/2011

Value of U.S. bonds set to mature on Aug. 4 that would be given a "D" rating by Standard & Poor's if the debt ceiling is not lifted: $30 billion

Date when the International Monetary Fund issued a statement saying the U.S. should raise the debt ceiling "expeditiously to avoid a severe shock to the economy and world financial markets": 6/29/2011

Number of times the debt limit has been raised since 1940: about 100

Current U.S. debt limit: $14.3 trillion

Percent cut in government spending that would be required if the federal government chose simply to prioritize payments without a debt limit increase, according to the Treasury Department: 40

Amount that Republican leaders want to cut from federal spending alone, without any tax increases for the wealthy or profitable corporations: $4 trillion

Amount in spending cuts that has already been identified by both parties during the debt negotiations: more than $1 trillion

Amount in revenue that the Obama administration wants to raise over the next 10 years by ending tax breaks: $400 billion

Amount that the federal government could raise in that period by ending a business tax break related to an accounting technique for inventory costs, known as the "LIFO provision": $72 billion

Amount in LIFO reserves that companies on the S&P 500 Index held in 2010: $62 billion

Percent of those reserves accounted for by energy companies: more than 82

Amount the federal government could raise over the next decade by tightening oil and gas tax credits: $41 billion

By eliminating tax credits for hedge-fund managers: $21 billion

By eliminating the tax break for owners of corporate jets: $3 billion

Of the 47 Republican senators, number that have signed Americans for Tax Reform's pledge not to increase any taxes: 40

Amount that the House Republican budget plan would add to the national debt over the next decade: $5.4 billion

Percent of the Republican Congressional delegation that voted for that plan: 97

Constitutional amendment that confirms the validity of the U.S. public debt, leading some Democratic senators to argue that the debt limit is actually unconstitutional: 14th

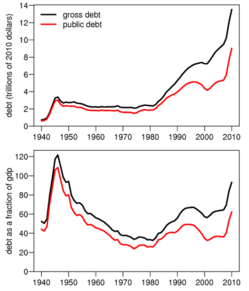

(Click on figure to go to source. U.S. government chart via Wikipedia.)

Tags

Sue Sturgis

Sue is the former editorial director of Facing South and the Institute for Southern Studies.