INSTITUTE INDEX: Tax policy widens gap between rich and poor

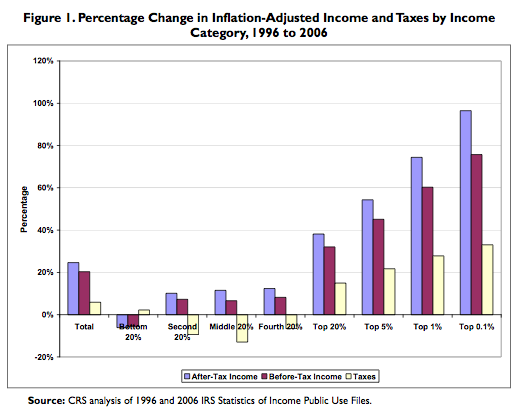

Percent by which average after-tax income, adjusted for inflation, grew between 1996 and 2006, according to a new report from the nonpartisan Congressional Research Service: 25

Percent change in after-tax income for the poorest fifth of tax filers during that period: -6

Average income for those bottom earners in 2006: $8,461

Percent change for the middle fifth of tax filers: +11

Average income for those middle earners in 2006: $39,301

Percent change for the top 0.1 percent of tax filers: +96

Average income for those top earners in 2006: $5,651,740

Percent increase in before-tax income inequality from 1996 to 2006 (as measured by the Gini coefficient) : 9

Percent increase in after-tax income inequality: 11

Percent by which taxes reduced income inequality in 1996: 5

In 2006: less than 4

Of the 10 states with the greatest income inequality, number in the South: 5*

Percent of the annual income earned by the top 0.1 percent that comes from wages and salaries: 18.6

Percentage-point increase in proportion of income from capital gains -- investments in stocks, bonds, real estate and other assets -- for the top 0.1 percent from 1996 to 2006: 6

Rank of capital gains among the biggest contributors to the increase in overall income inequality: 1

Year in which the Bush administration cut the capital gains tax from 20 to 15 percent: 2003

Number of times since then that this tax cut has been extended: 2

Percentage rate to which President Reagan increased the capital gains tax as part of his 1986 tax reform plan: 28

* New York is the top state in terms of income inequality, followed by Alabama, Mississippi, Massachusetts, Tennessee, New Mexico, Connecticut, California, Texas and Kentucky.

(Click on figure to go to source. Graph from "Changes in the Distribution of Income Among Tax Filers Between 1996 and 2006: The Role of Labor Income, Capital Income, and Tax Policy," Congressional Research Service, Dec. 29, 2011. Click on image for a larger version.)

Tags

Sue Sturgis

Sue is the former editorial director of Facing South and the Institute for Southern Studies.