Did Duke Energy's secret talks break the law?

Last year North Carolina-based Duke Energy became the biggest U.S. electric utility in a $32 billion merger shrouded in charges of deceit -- and new evidence raises fresh questions about whether its chief executive and the head of the state utilities commission broke the law in the process.

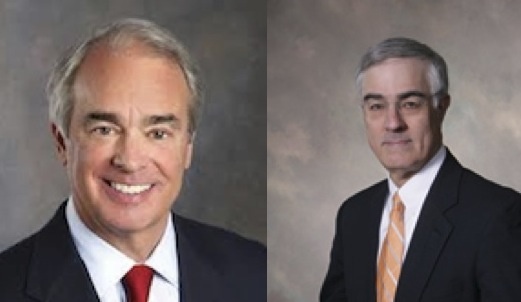

Earlier this month, Duke Energy CEO Jim Rogers gave his first interview about the merger with Progress Energy to The Charlotte Observer, his company's hometown paper. Pointing to remarks Rogers made in that interview, the environmental watchdog group NC WARN has filed a petition asking N.C. Attorney General Roy Cooper to reopen his investigation into the deal.

NC WARN has fought the merger from the beginning and is now contesting it in the N.C. Court of Appeals. The group charges that Duke failed to fully disclose the deal's potential costs to customers.

Filed Jan. 28, NC WARN's formal petition to Cooper points specifically to two statements Rogers made to the newspaper:

1. "'Sometimes in life you get sideways, and we got sideways with the commission because they saw this as a merger of equals,' he said. 'We saw this as an acquisition. They saw (the investigation) as an opportunity to rebalance what they thought was a merger of equals.'"

The petition notes that Rogers gave testimony in the September 2011 evidentiary hearings on the merger and in the July 2012 hearings related to the merger's investigation in which he and Bill Johnson -- then CEO at Progress Energy and now CEO of the Tennessee Valley Authority -- discussed the merger as an effort to combine companies into one -- as opposed to one acquiring the other.

"That this was a merger of equal companies was apparently the understanding of the [North Carolina Utility] Commission members," NC WARN states in its petition.

2. "Rogers said he personally negotiated the settlement terms with commission Chairman Edward Finley, after Duke's board vetted them, and with the help of current Duke and former Progress director James Hyler. Both he and Finley wanted to resolve the issue, he said."

NC WARN says this may be an an even more serious offense "as it appears to be an admission of a direct violation of the Commission's prohibition of ex parte communications under G.S. § 62-70." The petition states:

7. Although the Commission has authority under § 62-34 to “investigate companies under its control,” that does not allow its members to reach deals with the companies they regulate. In this case, the settlement agreement went outside the scope of the investigation and attempted to resolve not only matters being investigated but to resolve matters in the merger dockets. The agreement states that "the Settling Parties desire to resolve all matters and issues involved in the Commission's investigation and the Merger Dockets without further litigation and expense and to move forward in a positive manner." Settlement Agreement, page 3, paragraph 3. Many of the stipulations in that agreement materially and substantially change the substance of the initial merger order. The admitted communications by Mr. Rogers with Chairman Finley went well beyond providing information for an investigation. The result of the communication had a material impact on Duke Energy.

"Potentially tens of billions of dollars were riding on that settlement, which resolved not only the merger investigation but other contentious merger issues too," says NC WARN Executive Director Jim Warren. "Under no circumstances should the CEO of the regulated utility, which was then under investigation by both the commission and the attorney general, have negotiated directly with the chairman to make such a deal."

NC WARN notes the parallels to Duke Energy's ethics scandal in Indiana, where the effort to win state regulatory approval of the company's Edwardsport coal plant led to the firing of David Lott Hardy, the former chair of the Indiana Utility Regulatory Commission (IURC), and his indictment on three felony charges of official misconduct -- including failure to disclose private meetings he had with Rogers and Jim Turner, Duke's former head of utility operations, to discuss Edwardsport cost overruns.

Duke has defended itself by saying nothing improper was discussed at those 2008 meetings.

The Indiana indictment also faulted Hardy for letting Scott Storms, a former IURC attorney, work on Duke issues before the commission while negotiating a new job for him with Duke Energy Indiana. Following Duke's own investigation of the allegations, the company fired both Storms and Duke Energy Indiana President Mike Reed.

The N.C. Utilities Commission approved the Duke-Progress merger on June 30, 2012, and South Carolina utility regulators signed off on the deal on July 2. Later that day, Progress CEO Bill Johnson -- who was expected to head the newly merged company -- abruptly resigned and was replaced by Rogers, suggesting Johnson's ouster was planned in advance. The commission's consumer advocate, Roger Gruber, told The News & Observer that if the commission had known a leadership change was coming it might not have approved the merger.

The uproar over the CEO shakeup led to investigations by the commission and the attorney general, both of which were settled last month with the company admitting to no wrongdoing. NC WARN has formally opposed the merger settlement, which it has called a "sell-out of the public."

Tags

Sue Sturgis

Sue is the former editorial director of Facing South and the Institute for Southern Studies.