INSTITUTE INDEX: North Carolina tax revamp helps rich, hurts poor

Under a tax reform plan the North Carolina legislature approved this week, revenue the state will lose each year for public schools, health care, and other vital services: $647 million

Years since the state undertook such a massive overhaul of its tax system: 80

Hours the Republican-controlled state Senate spent debating the plan: almost 1

Minutes state House Republican leaders allowed for debate: 25

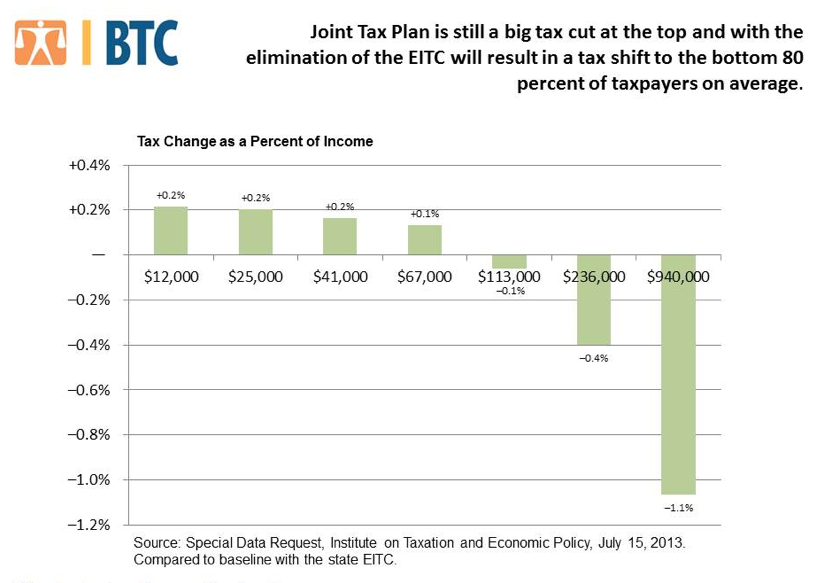

Percent of the net tax cut that will go to the wealthiest 5 percent of North Carolinians: 90

Tax cut that North Carolinians with average incomes of almost $1 million would receive under the plan: nearly $10,000

Amount the plan raises taxes for a two-child family earning $64,000 a year: $2,700

Taking into account both the new tax plan and the legislature's elimination of the state Earned Income Tax Credit (EITC), bottom percent of North Carolina taxpayers who will experience an overall tax increase next year: 80

Of the 300 tax breaks now on the state's books, number eliminated by the plan: 48

Cap on the sales tax for a yacht or a jet that the plan keeps on the books: $1,500

Number of weekends per year that North Carolina now offers a sales tax holiday for school supplies: 1

Number that will be allowed under the new tax plan: 0

Percentage rate to which the plan reduces the corporate tax rate to by 2015 from the current 6.9 percent: 5

By 2017, if revenue expectations are met: 3

Average percentage job growth rate for the five states that cut taxes the most during the 1990s: 0.3

Average for all other states in the same period: 1

(Click on figure to go to source.)

Tags

Sue Sturgis

Sue is the former editorial director of Facing South and the Institute for Southern Studies.