INSTITUTE INDEX: Where is the tax justice?

Official federal percent tax rate for U.S. corporations: 35

Percent of their profits that consistently profitable Fortune 500 companies actually paid in federal income taxes over the past five years: 19.4

Number of those profitable corporations that paid no federal corporate income tax at all over the five-year period: 26

Percent tax rate paid by North Carolina's Duke Energy in that period: -3.3

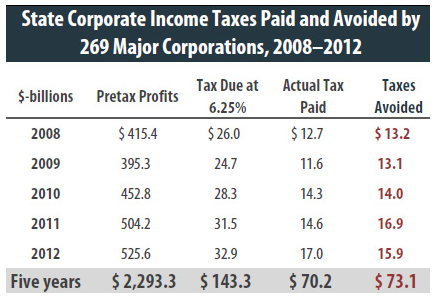

Of the Fortune 500 companies that were consistently profitable from 2008 through 2012, number that paid no state income tax at all in at least one year: 90

Number that avoided state taxes in two or more years: 38

Number that paid no state income taxes over the entire five-year period: 10

Profit earned in that period by Apache Corp., an independent oil and gas company based in Houston that paid no state income taxes over those five years: $7.6 billion

Total amount that the federal government has given to the oil and gas industry over the past century in tax breaks: more than $470 billion

Annual cost to taxpayers of Walmart workers relying on public assistance programs due to low wages: $6.2 billion

Total amount that Walmart and the Walton family, which owns more than half of the company's shares, receive in annual tax breaks and tax subsidies: $7.8 billion

The net worth of the six Walton family heirs: $148.8 billion

Rather than the 35 percent top individual tax rate, percent that private equity and hedge fund executives pay because of a loophole in tax law: 15

Percent of their income that the top 1 percent of U.S. earners pay in total taxes: 33.3

Percent of their income that the bottom 99 percent pay: 29.5

Under recent changes to North Carolina tax law, percentage of their annual income that residents who earn $17,000 or less will pay in state and local taxes: about 9.5

Percentage that residents who earn $345,000 or more will pay: about 5.5

Percent of taxes paid by Americans that goes toward current and past military expenses: 45

Percent of the federal budget that goes to fund social safety net programs: about 12

(Click on figure to go to source.)

Tags

Sue Sturgis

Sue is the former editorial director of Facing South and the Institute for Southern Studies.