INSTITUTE INDEX: States are taxing the way to greater inequality

A new report from the Institute on Taxation and Economic Policy underscores the regressive nature of state and local tax systems.

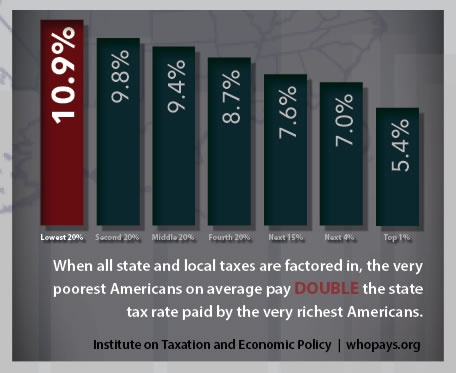

Adding together all state and local taxes that Americans pay, the nationwide average effective percentage rate for the poorest fifth of non-elderly individuals: 10.9

For the middle fifth: 9.4

For the top 1 percent: 5.4

Of the 50 states, number with tax systems that are regressive, meaning they tax the poor at a higher rate than the wealthy, which hurts state revenues while worsening economic inequality: 50

Of the seven U.S. states with the most progressive tax systems, number in the South: 0

Of the 10 states with the most regressive tax systems, number in the South: 3*

In Florida, with the nation's second-most regressive tax system, percentage tax rate for the poorest fifth of non-elderly taxpayers: 12.9

Florida's percentage tax rate for the richest 1 percent: 1.9

Of the 10 states with the most unfair tax systems, number that raise at least half of all revenue from regressive sales taxes and excise taxes on consumer goods like fuel, liquor, tires, etc.: 6

Factor by which sales and excise taxes paid by poor families exceed what the wealthiest families pay: 8

Of the 10 states with the most regressive tax systems, number that have no broad-based personal income taxes, which are typically more progressive than other state taxes: 5

Number with a personal income tax system that's flat or virtually flat: 4

Number that tax food at the state or local level, a particularly regressive tax since food is one of the largest expenses for low-income families: 5

Number of states in which an Earned Income Tax Credit (EITC) targeted to low-income working families with children results in a more progressive tax system: 25

Year in which the Republican-controlled legislature in North Carolina, with the nation's 31st-most unfair state and local tax system, allowed the state's EITC to expire: 2013

Number of North Carolinians who claimed the EITC in 2011: more than 900,000

Year in which the North Carolina legislature also replaced the state's progressive personal income tax with a flat tax while expanding some regressive sales taxes: 2014

Amount North Carolina state revenue collections are below projections halfway through the fiscal year: $199.2 million

Total cost to the state that North Carolina's new tax plan could reach by the end of the fiscal year: $1.1 billion

Percent by which North Carolina Gov. Pat McCrory (R) has already instructed agencies to cut their budget requests for fiscal years 2015-2017: 2

* Florida and Texas rank second and third after Washington state, while Tennessee comes in as the seventh-most regressive.

(Click on figure to go to source. Many of the numbers in this index are from "Who Pays? A Distributional Analysis of the Tax Systems in All 50 States" by the Institute on Taxation and Economic Policy.)

Tags

Sue Sturgis

Sue is the former editorial director of Facing South and the Institute for Southern Studies.