INSTITUTE INDEX: What can be done to close America's growing wealth gap?

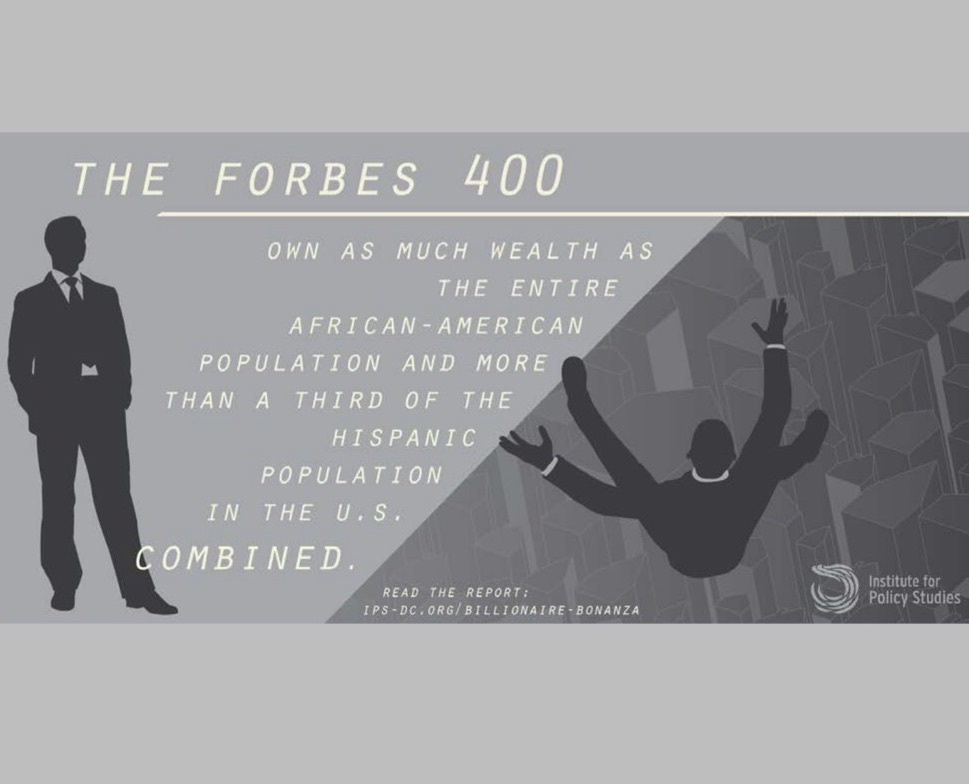

Two new reports document the growing chasm between the rich and the poor in the U.S. (Graphic from "Billionaire Bonanza: The Forbes 400 and the Rest of Us" by the Institute for Policy Studies.)

Year in which the middle class ceased to be the economic majority in the U.S., exceeded by lower- and upper-income households combined: 2015

Percent of U.S. aggregate income that went to middle-income and upper-income households respectively in 1970: 62, 29

In 2014: 43, 49

Number of the richest people in the U.S. whose combined wealth, defined as total assets minus liabilities, exceeds that of the bottom half of the entire U.S. population: 20

Number of the richest U.S. households whose wealth exceeds that of the country's entire 42 million African Americans: 100

Number of the richest U.S. households whose wealth exceeds that of the country's more than 55 million Latinos: 186

The total wealth of those on the Forbes 400 list of richest people in the U.S.: $2.34 trillion

Number of those on the Forbes 400 list who are Latino: 5

Who are African-American: 2

Number of households in America's richest 0.1 percent, whose net worth starts at $20 million: 115,000

Percent of total U.S. household wealth this economic elite owned in the 1970s: 7

Percent it owns today: 20

Of the 10 states with the biggest gaps between rich and poor, number that are in the South: 6

According to research by an economist with the International Monetary Fund, factor by which future U.S. economic expansions will be shorter compared to those of the 1960s because of the widening income divide: 1/3

Estimated amount the U.S. loses annually in tax revenue from wealthy individuals due to their use of tax havens and other avoidance schemes: $200 billion

Amount in tax revenue the U.S. could generate annually by levying a 1 percent tax on the wealth of the richest 1 percent of Americans, which would also help to reduce inequality: $260 billion

Amount of revenue the U.S. could raise over 10 years by taxing capital gains from the sale of stocks and other financial assets the same as income earned through work: $600 billion

Amount of revenue the U.S. could generate annually by taxing the richest 0.1 percent at a rate of 40 percent instead of the current 33 percent: $55 billion

(Click on figure to go to source. Most of the numbers in this index come from two new reports: "Billionaire Bonanza: The Forbes 400 and the Rest of Us" by Chuck Collins and Josh Hoxie of the Institute for Policy Studies, and "The American Middle Class Is Losing Ground" by Pew Research Center.")

Tags

Sue Sturgis

Sue is the former editorial director of Facing South and the Institute for Southern Studies.