Dorothy Brown on racism in the tax code

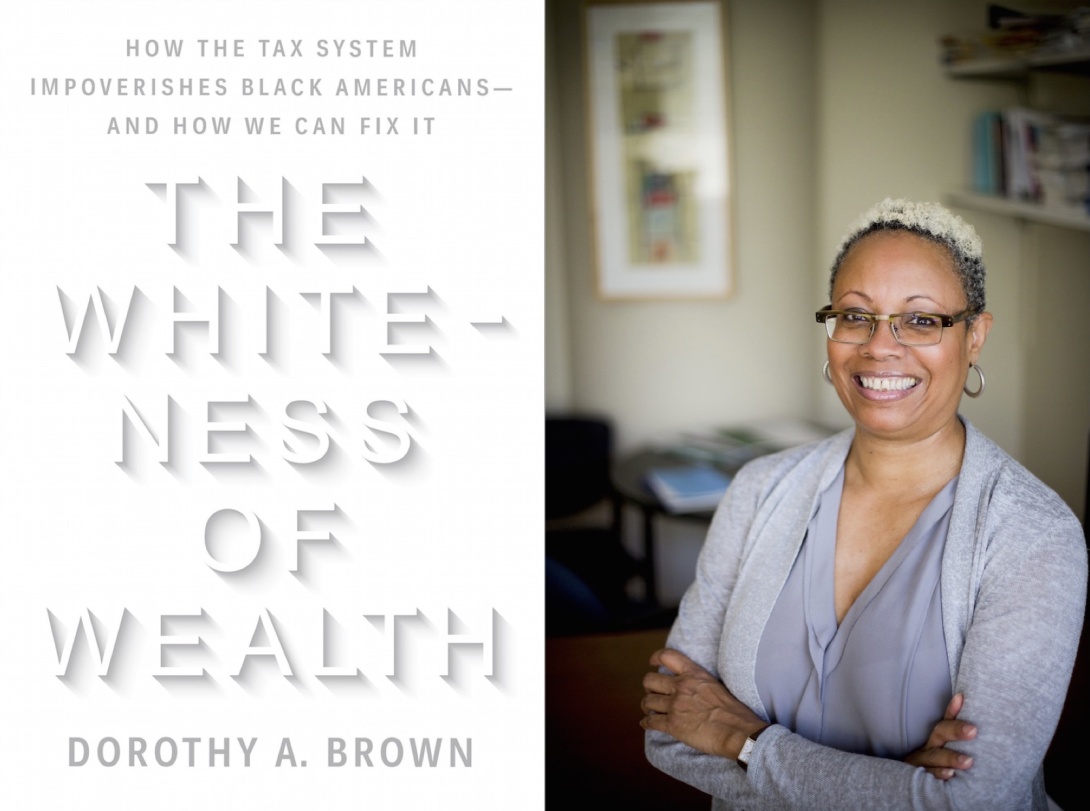

Dorothy Brown became interested in tax policy while helping her parents fill out tax returns and thinking something had to be wrong. Now a law professor at Emory University in Atlanta, Brown is the author of "The Whiteness of Wealth," which considers how racial injustice is embedded in the federal tax code. (Dorothy Brown photo by Ann Watson.)

A ProPublica report released this week documents how some of the richest Americans take advantage of legal loopholes to avoid paying any federal income taxes. While the report focused on billionaires like Jeff Bezos and Elon Musk, Dorothy Brown — a South Bronx native and law professor at Emory University in Atlanta who holds a master of law degree in taxation from New York University — took issue with how the story ignored the role of race. "Is there ANYTHING more racialized than wealth in America?" she tweeted.

In her new book "The Whiteness of Wealth," published in March by Crown, Brown details how the modern tax code is intertwined with racial inequality and contributes to the racial wealth gap between white and Black Americans. Her book details the barriers Black Americans face in contrast to white Americans when filing taxes, buying a home, retiring, and making other major financial decisions. And it argues that the tax system can be made fairer through three main solutions: publishing tax data by race, returning to a progressive income taxation system with no exclusions, and establishing a tax credit as compensation for systemic racism.

Brown draws on research in sociology, political science, and economics, and she includes anecdotes about Black Americans in the Atlanta area navigating finances and the federal tax system. She also provides historical context about the modern tax code, which started in the early 1900s when the government began to increase tax collection to fund public services. The tax code did not initially disadvantage Black Americans because they were not thought of as taxpayers, but World War II-era laws lowered tax exemptions while policies and initiatives like the GI Bill, Federal Housing Administration home loans, and redlining excluded and disenfranchised Black Americans, as Brown details.

Brown's book focuses on the modern federal tax code, but state tax policy has also contributed to racial inequality — especially in the South. During the period of Reconstruction after the Civil War, for example, supermajority requirements to change tax policy were included in state constitutions, while license fees and infamous poll taxes targeting Black people were created, according to a 2020 paper by Vanessa Williamson, a senior fellow at the Tax Policy Center.

Brown's book comes at a pivotal time, as the U.S. is grappling with systemic racism and the realities of wealth inequality that were exacerbated by the coronavirus pandemic. The Biden administration has taken steps to address injustices in federal tax policy. For example, the American Families Plan — a $1.8 trillion proposed federal investment in education, child care, and paid family leave — would increase the tax rate on the wealthiest Americans from 37% to 39.6% and raise the tax rate on capital gains, which are now taxed at a lower rate than income earned through work. Biden has also expanded the child tax credit; starting in July, qualified Americans with children will receive a monthly payment for a year of up to $300 for each child under 6 and up to $250 for children between the ages of 6 and 17.

Brown spoke recently with Facing South's Elisha Brown. (They are not related.) She discussed the Biden administration's racial equity order and the lack of action so far from the Treasury Department, how earned income tax credits at a federal and state level could help low-income Americans, and who inspired her to write the book. The interview has been lightly edited for clarity.

A lot of your examples of tax inequity in "The Whiteness of Wealth" center around Atlanta. Tell me about the regional differences you saw in your research on racism in the tax code and how the South might differ from other regions or the country as a whole.

Well, you have a significant percentage of Black Americans living in the South, so what happens in the South is going to impact a significant percentage of Black Americans. I used Atlanta families because, nationwide, people think of Atlanta as this successful Black, middle-class community. I wanted to show just because you may have a middle-class job or just because you may be earning six figures doesn't mean you're not currently being disadvantaged by our tax system.

What do you think would be the most effective steps Southern states could take to combat racial inequality in their specific tax codes?

My book focused on the federal tax system, and the ways in which our tax laws advantage white Americans when they engage in the same behavior as Black Americans, while at the same time disadvantaging Black Americans. You want to talk about state provisions, we could look at the property tax, we could look at assessments. There have been a number of articles that have shown property assessments and how they are made differ in Black communities versus white communities. So, if a Southern community wanted to do its part to work on dismantling racial wealth gaps, it could start with its own property tax assessment system.

You talk about the earned income tax credit at a federal level in the book. Most states in the region that Facing South covers don't have state earned income tax credits, besides Virginia, South Carolina and Louisiana, and I believe Louisiana's is the only one that's refundable. Why are earned income tax credits important to curbing racial inequality?

The earned income tax credit is available to low-income wage earners, and in lots of parts of the South the minimum wage is low. They have right-to-work laws. So, what the earned income tax credit does is provide additional revenue to compensate for the fact that they're working full-time but their income is so low that the federal government says this is not acceptable. Expanding the earned income tax credit on a state level would provide additional resources for people who work full-time but still can't make ends meet.

You discuss three main tax policy solutions to help fix the racial wealth gap: publishing tax data by race, returning to a progressive income taxation system with no exclusions, and establishing a tax credit to address systemic racism. Is there one solution you think that is more important than the others, or do you believe without all three solutions we won't get closer to reducing the racial wealth gap?

I don't think with all three solutions we'll get closer. But if you said, "Dorothy, you only get one," the one I would pick would be publishing tax statistics by race, because that would give people the information that would hopefully get them angry enough to want to change it.

You also argue that under our current tax system Black people need to be defensive and strategic when choosing a college, buying a home, and planning for retirement, among other major life decisions. Are there strategies you think would particularly help Black people in the South to navigate the tax system and inequality?

I think my strategies are national, so yes, they'd apply in the South. When you think about where to buy a home, think about the difference in appreciation between an all-white neighborhood and a racially diverse or all Black neighborhood. Live where you want, but recognize there will be consequences associated with whatever choice you make.

At the end of the book, you said that you veered between pessimism and optimism when writing it. Has the reaction to it from the public and policymakers made you lean one way or the other?

Both. I testified before Congress recently, which was basically the second time it ever happened to me even though I've been doing research for over 20 years. The good news is there are people on Capitol Hill who are interested in it. I don't think the Biden administration's Treasury Department is up to speed the way they should be. That leads me to pessimism, but it's early yet. Hopefully I will see more coming out of the Treasury dealing with transparency around race and tax. I still veer between pessimism and optimism.

What is Biden administration's Treasury Department doing in terms of policy that you think could be improved?

For example, I've looked at what other government agencies have done in response to President Biden's racial equity order. I looked at the Department of Labor, I looked at the State Department, I looked at a lot of government agencies who seem to be doing many, many more things, and Treasury seems to only be doing press releases. I'm seeing Treasury as a government agency not doing what their peer government agencies are doing.

Circling back to the beginning of your book, you discuss how the late Duke professor Jerome Culp's article calling on Black legal scholars to create a Black Legal Scholarship framework and apply it to all facets of the law — including tax law — affected you. Besides his work, was there one particular moment in your personal life where you decided to sit down and start writing "The Whiteness of Wealth"?

I'd say doing my parents' tax return and thinking something was wrong but not figuring out what it was — that combined with reading Professor Culp's article. Reading it made me say I'm going to write about race and tax. When I started writing about race and tax, I figured out what was going on with my parent's tax returns, which just encouraged me to continue doing it. Without reading Professor Culp's article, I don't know that I'd ever write about race and tax.

In Chapter Two, you argue there should be tax subsidies for moving into predominantly Black neighborhoods — a 10% one, to be exact. What would you say to people who would argue that this could potentially lead to gentrification?

What I ultimately argue in the book is that there shouldn't be any tax subsidies for homeowners, period. But if you're going to have tax subsidies for homeownership, then it should be for the people who are disadvantaged, the people who live in racially diverse [or] all-Black neighborhoods. Gentrification is a very real problem, and it exists right now and it pushes out Black Americans who have been in the neighborhood a really long time once housing prices appreciate and they can't afford to pay the property taxes. Part of me says what that solution was designed to do was to compensate Black homeowners for being subject to market penalties. I don't know that a tax subsidy would actually cause white Americans to suddenly want to live around a lot of Black Americans when history shows that they have no interest in that. I just don't think a tax subsidy would be that much of an encouragement.

Tags

Elisha Brown

Elisha Brown is a staff writer at Facing South and a former Julian Bond Fellow. She previously worked as a news assistant at The New York Times, and her reporting has appeared in The Daily Beast, The Atlantic, and Vox.