The Government's Private Forests

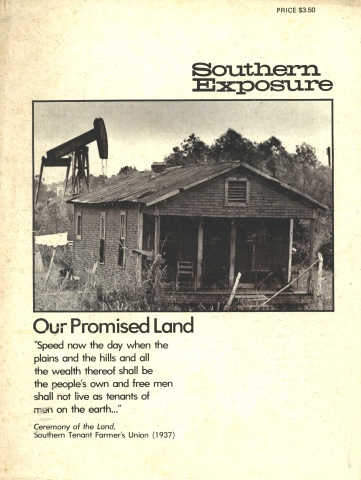

This article originally appeared in Southern Exposure Vol. 2 No. 2/3, "Our Promised Land." Find more from that issue here.

Much has been written about the effects of corporate and absentee ownership on the Appalachian land and people. The massive holdings of coal, oil, timber, land and power companies has been well documented — not to mention the ways in which these lands have historically escaped fair taxes. The acquisition of lands by private and semi-public (TVA) power companies has also been well researched. In fact, however, the largest single landowner in Appalachia is neither a coal/oil corporation, a land or timber company, nor an electric utility, but the United States government, through the U.S. Forest Service. Most of the National Forests lying east of the Mississippi River are concentrated in Appalachia. These include:

State Natl. Forest Acreage Square Miles

Georgia Chattachochee 738,076 1,153

Kentucky Daniel Boone 615,796 962

N. Carolina Nantahala 451,989 706

N. Carolina Pisgah 481,954 753

Tennessee Cherokee* 614,107 960

Virginia G.Washington** 1,033,874 1,615

Virginia Jefferson*** 621,473 971

W. Virginia Monongahela 831,329 1,299

Totals 5,388,598 8,419

* Includes 327 acres in North Carolina.

** lncludes 100,386 acres in West Virginia

*** lncludes 961 acres in Kentucky and 18,245 in West Virginia.

This is an area larger than the states of Connecticut, Delaware and Rhode Island combined! On the local level, the amount of National Forest land in many counties in the Southern Mountains is staggering. Within the Appalachian areas of West Virginia, Virginia, Tennessee, Kentucky, North Carolina and Georgia, there are 37 counties in which the Forest Service owns over 20% of the land.

In 14 of these counties, more than 40% of the land is in National Forests.

From the point of view of the U.S. Forest Service, its concentration of land ownership in the Southern Appalachians is highly desirable; and is, in fact, something they have been working toward for a long time. Their basic strategy in the southern mountains is set out in their official publication, Guide for Managing the National Forests in the Appalachians. It states in part:

The concept of the Appalachian Greenbelt is possible because of the unique physiographic characteristics of the area. It is a mountainous green oasis in the Eastern United States from which flows a continuous supply of renewable resources and which provides the large surrounding population with a place to recreate (sic) in a natural setting . . .Summer mountain temperatures are generally 10 degrees lower than the adjacent plains. This factor makes the mountains a highly desirable retreat for city dwellers and other nearby residents.1

As this statement makes clear, the National Forests are seen by the Forest Service as a resource to be used primarily by the "large surrounding population" of "city dwellers and nearby residents." This includes, of course, the urban population of the Eastern Seaboard. No one can deny that residents of the Eastern cities probably need to "recreate in a natural setting" from time to time. But it is also necessary to remember that there are some 10 million people living in the so-called “Appalachian Greenbelt”! What about us?

Well, we're pretty much out of luck, according to the Guide.

Population losses within the Greenbelt can be attributed to the fact that this area can only sustain a limited number of people year-round. Many of the narrow mountain valleys are unsuitable for industrial complexes. Plans for economic development must recognize the limitations of the area so that over emphasis on the wrong type of activities does not occur.2

The Forest Service is obviously not looking after anyone's interest except its own here. To write off industrial development for Appalachia because of its "narrow mountain valleys" is like saying that Pittsburgh can't support industry because of its many residential neighborhoods. In fact, Appalachia is for many reasons — raw material, electric power, access to population centers, transportation, labor force — well-suited for industrial growth. By ignoring the facts, the Forest Service is actively undermining the efforts of the ten million people who live in the mountains for economic, political and social self-development.

But the Forest Service is not reacting to the needs of Appalachian people in its planning for Appalachia. As the Guide makes clear, it is motivated by a very different perspective:

Pressures on the forest resources and environment within this mountain region come from many users. As long as population growth continues, pressure for products and services from the National Forest lands will grow. Unless definite limits are set for the protection of the environment and use of the resources within the Greenbelt, population pressure will bring about their impairment and eventual destruction . . . This influence area for the Greenbelt area stretches far outside National Forest boundaries. Total planning must consider the overall emphasis area.3

The problem with this is that the population pressure the Forest Service is talking about comes from outside the mountains. After all, population is not growing in Appalachia; the mountains have been losing folks steadily for years. This attitude makes as much sense (especially since the Forest Service is actively encouraging people to use the National Forests) as saying that an Indian reservation is threatened by overcrowding because large numbers of tourists want to visit and camp there.

The emphasis of the Forest Service on the needs of people outside the Southern Mountains has, on occasion, been the root of conflict with local Appalachians. One incident is worth noting as an example of the extremes these conflicts sometimes reach. As reported by the Atlanta Constitution:

Vernon McCall was "the weakest one in the community” of Balsam Grove, a village in the heart of Pisgah National Forest. Vernon, according to Mrs. Leonard Griffin, "is a sick boy. He has epilepsy and he's disabled.”

On February 22, men of the U.S. Forest Service broke into Vernon's trailer house, dragged out a bed and a few other belongings, and then dug a hole with a bulldozer, rammed his home, his lean-tip, his pig pen and his little barn into it and buried the whole thing. Having erased every trace of his home, they planted pine seedlings over it ... .

The Forest Service claimed the government owned the land, not Vernon, and they had been trying to get him off it since 1968. But the community lawyer said no legal action had been taken to evict Vernon, and local authorities proceeded to charge Forest Ranger Dan W. Hile with willfull injury to personal property

Meantime Vernon, who is 40, has rented a new trailer, and scratches out a living on welfare and what he can make picking and selling ivy. And the seedlings the Forest Service planted over his old trailer have died.4

What makes all of this so intolerable is that the people of Appalachia are the ones who actually pay for these National Forests. Anyone who knows the area is familiar with the irony of high taxes on the one hand, and low public services on the other — a situation common to many southern mountain counties. It has often been noted that in the coal counties this is partly the result of the under-taxation of coal lands. What has not been recognized is that, in counties with National Forest lands, the tax-exempt status of these lands has undermined the tax base and increased the tax burden on local property owners.

FEDERAL LANDS AND COUNTY FINANCES

As Federal property, the nearly 5,400,000 acres of National Forests in Southern Appalachia are exempt from state, county and city/town taxes. While it is difficult to estimate the exact extent of the tax loss, it is probable that, based on average values for land and effective tax rates in the counties involved, the Appalachian National Forests cost local governments nearly $10 million a year in lost tax revenues — revenues that would go to support schools, roads, health programs, welfare, and other public services.

This has not often been recognized — partly because the Forest Service in its intensive public relations campaign emphasizes the financial gain to counties from National Forest lands. This type of publicity never mentions the fact that these lands are tax exempt; or that they had previously been on county tax digests; or what revenue was lost to counties when the lands passed from private to Federal ownership. But the fact is that, in 1972, the total Forest Service payments to Appalachian counties were only $734,641.08 — less than 14 cents an acre, and well under 10% of what the property taxes alone would have been if the land were still in private hands.

The small sums that are paid by the Forest Service to local counties come from its so-called”25% Fund,” authorized by the 1911 Weeks Act. This Act, in effect, authorized the National Forest system by providing for the Federal government to purchase lands necessary to protect the flow of navigable streams, including their watersheds. The 13th Section of the Weeks Act provides that 25% of the money received from The National Forest shall be paid on an average basis to the states for "the benefit of the public schools and public roads of the counties in which such national forest is situated.”5

The income from National Forests comes mostly from the sale of timber "on the stump,” although a certain amount also comes from other fees and from special permits, such as those for mining and recreational areas. Unlike the National Forests of the Western United States, which produce valuable old-growth saw-timber, the Appalachian National Forests have in the past produced trees suitable only for pulpwood. As any mountain landowner will tell you, selling pulpwood on the stump is no way to bring in money. If cut selectively, mountain land will make five to ten cords of pulpwood per acre; if clearcut, ten to twenty cords. The going price for Forest Service pulpwood on the stump in Appalachia is about $2.00 a cord. Selectively cut land can be logged again in about ten years; clearcut land in about thirty. Thus, on an average yearly basis, the income from an acre of National Forest land in the Southern mountains is approximately between $.66 and $2.00.

Aside from the low revenue this gives to counties, the problem with this system is that it makes "25% Fund” payments — on which counties must depend to help finance roads and schools — completely dependent on an arbitrary factor: how much wood the Forest Service decides to cut that year. This produces a not-so-subtle pressure on local government to approve of the high rates of timber-cutting the Forest Service would like to set, and of locally hated practices such as clearcutting. For example, during the recent struggle over proposed Forest Service clearcutting in the Cohutta Mountains in Fannin County, Georgia — one of the proposed areas in the Eastern Omnibus Wilderness Bill — petitions were circulated which read:

We cannot afford the loss of revenues that are presently being returned to our county governments by the Forest Service from timber sales. We do not wish to retire our forests from production when we know that the local people will have to pick up the additional tax load; neither do we want the added tax to discourage local population growth, because this is already a problem for our rural areas.6

In fact, since timber-cutting revenues in any National Forest are lumped together each year before distributing to counties, Fannin County would have received 14.4% (its proportionate share of Chattachoochee National Forest acreage) of 25% (the Weeks Act formula) of whatever income clearcutting the Cohuttas produced — 3.6 cents for every dollar of timber cut!

Because the "25% Fund” payments are based on revenue from timber cutting, payments per acre vary widely from state to state, and even among National Forests within the same state. In Georgia, the Chattahoochee National Forest, which is located within the Appalachian area of the state, made payments to counties of 26.7 cents per acre in 1972. Counties in. Georgia's Ocoee National Forest, however, which lies in the state's pulpwood belt, were paid $ 1.39 per acre — more than five times what the Appalachian counties received.

From state to state, payments vary even more widely. In 1972, average payments were 41 cents in Georgia (this includes the high payment received for the Ocoee National Forest); 21 cents in North Carolina; 17 cents in Kentucky; 15 cents in Tennessee; 5 cents in Virginia; and 11 cents in West Virginia. By comparison, the average payment per acre was $1.03 in California; $2.16 in Louisiana; $1.40 in Mississippi; $2.12 in Oregon; $1.01 in South Carolina; $1.23 in Texas; and 95 cents in

Washington. The average payment per acre for all National Forests in all states was 58 cents. The average payment per acre for all Appalachian National Forests was 13.5 cents — less than one fourth the national average!

Two other ways of looking at this situation help make clear just how discriminatory it is:

1) If counties in Appalachia had received ”25% Fund” payments at the national average rate of 58 cents/acre, they would have received $3,125,868 instead of $734,641.

2) If all the revenue produced by the National Forests was divided among counties on the basis of their proportionate share of National Forest acreage, the Appalachian counties would have received $12,503,472 in 1972 — seventeen times what they actually got.

Another way of trying to evaluate the fairness or unfairness — as well as the constitutionality — of the way in which National Forest revenue is distributed is to look at it in terms of payment per person to affected counties. After all, ”25% Fund” payments were earmarked by the Weeks Act for support of roads and schools, the two items which usually make up the bulk of a rural county's budget. Since the National Forest funds are Federal payments, it stands to reason that they should be distributed on an equitable basis.

In the 37 Appalachian counties which have 20% or more of their area in National Forests, payments per person in 1972 ranged from a low of 9 cents per person (Smyth County, Virginia) to a high of $5.01 per person (Rabun County, Georgia). The average figure was 93 cents per person. By contrast, payments in Western counties with similar populations typically exceed $40 per person, and in several cases exceed $150 per person.

A further problem caused by the fact that National Forest payments depend on timber-cutting revenue is that counties are not able to predict the amount of revenue they will receive in any year. For example, in 1969, during the period of greatest clear-cutting in the Monongahela National Forest, counties received 25.9 cents per acre. By 1972, the payment per acre had dropped to 11.9 cents. In Pocahontas County, West Virginia, this meant that income from National Forests in the county dropped from $73,050 in 1969 to $33,931 in 1972 — a loss of $39,119. For a county with some 8,640 people, this is a tremendous revenue loss. As rates per acre dropped between 1969 and 1972, other counties experienced similar losses. Rabun County, Georgia, lost $7,790; Fannin County, Georgia lost $5,199; Polk County, Tennessee lost $6,231; Randolph County, West Virginia lost $24,198; Tucker County, West Virginia lost $13,106. Throughout the Appalachian Region, despite the fact that National Forest acreage increased 3% in the three years from 1969 to 1972, the amount received from the Forest Service decreased $159,070. Of all regions in the country, Appalachia is one of those which can least afford this type of revenue loss.

The loss of this amount of revenue may not seem significant to some people who are used to urban budgets. But it is important to realize that — partly because of the lack of growth due to lack of land — the Appalachian counties in which the National Forests are concentrated are among the smallest and poorest counties in the nation. According to 1970 Census data, the average population of the fourteen Appalachian counties with over 40% National Forest land is less than 9,000. Their average rate of poverty in 1 970 was 29.2% — more than twice the average for the United States as a whole. Not one of these counties had a poverty rate less than the national average. In the thirty years prior to 1970, these counties combined lost 13.2% of their population — only one of the fourteen gained population in this period.

These counties are affected not only by revenue loss, lack of public services, high poverty incidence and outmigration rates, but — to add insult to injury — by local property taxes that are significantly higher than those in counties without National Forest lands. Looking again at the fourteen counties with over 40% of their land held by the Forest Service, the effective tax rate* for these counties is on the average 1 5% higher than the average effective tax rate for the state.** This situation is especially apparent in Tennessee and Georgia. Polk County, Tennessee, for example, with 54% of its land held by the Forest Service, has an effective tax rate of $ 1.38 per $100 compared to a state average rate of $.90. Out of 75 Tennessee counties with single tax rates, Polk County has the 5th highest rate. In Georgia, Fannin County, with 42% National Forest land, has the highest tax rate of all counties in the state — higher than the non-municipal rates for Fulton (Atlanta), Muscogee (Columbus), Bibb (Macon), Richmond (Augusta) or Chatham (Savannah) counties.

This situation has not gone unnoticed politically. The Commissioner of Roads and Revenues of Fannin County has made a summary statement of local attitudes toward the problem.

Fannin County does realize a good many benefits in ways that encourage people to live here, but must also tolerate some serious circumstances . . . The U.S. Forest Service now owns some 106,000 acres of land within Fannin County and this deprives the county of approximately $150,000 per year in tax revenue. A large portion of this land has progressively been acquired from private land owners who had formerly been paying taxes. This process has resulted in a steady undermining of our tax base.

This example, combined with the tax rate we pay in Fannin County, creates a constant hardship on a lot of our people who still own a fair amount of taxable property. Every time a piece of property falls into the hands of the Forest Service, the tax revenue formerly received from it is gone for good, and the remaining property owners must share this loss in revenue . . . They purchase private land as it becomes available with our Federal tax money, and use it, in fact, to undermine the local tax sources where our local revenue must come from to support our local government . . .

We can no longer ignore the seriousness of these problems. There must be some compatible adjustment when land is acquired and results in a revenue loss.7

Responding editorially to the above remarks, one of the local newspapers, The Blue Ridge Summit- Post, wrote:

The increase in taxes will no doubt place a great deal of strain on the working man's pocketbook . . . Our tax rate in the past has been in no way below average standards, yet we, as a county, have profited little from the revenue obtained from it. We see as one of the reasons for our county's tax problem that great land speculator and wild real estate dealer, The Forest Service.

We feel that the state and Federal governments should find a means of returning some of the revenue on this untaxed land to the county, where it belongs. Federal preservation of forest land is a good thing; we believe in some land control; but taxes are taxes, and Fannin County is having to strain the wrong pay check. Our residents work hard for their living, and carrying the load for the Forest Service is not helping the situation. We suggest some type of revenue return to the county on the part of its greatest landholder, The Forest Service.8

THE POLITICS OF NATIONAL FORESTS

The U.S. Forest Service itself has at different times taken different positions on the effect its policies have on local counties. Its usual position is that the “25% Fund" payments are a tremendous benefit to local governments. Their public relations campaign to convince local, state and national political figures has been so effective that a preliminary draft of The Last Stand: The Nader Study Group Report on the Forest Service stated:

Local residents also receive generous public service benefits from National Forest timber cutting. To compensate counties containing National Forest land for their small amount of taxable property, the federal government pays them 25 percent of the receipts from National Forest timber sales within their bounds to support construction of public schools and roads.9

To term the token payments which the Forest Service makes to local counties “generous public service benefits" is, to say the least, not particularly accurate. The statement has been deleted from the final report, but the example does show the tremendous extent to which Forest Service public relations has been effective.

At other times, the Forest Service has downplayed the “25% Fund" and emphasized other benefits from National Forests. One Forest Service spokesperson has stated:

Without any doubt, the many other contributions to the economic development of the Appalachian Region made by the National Forests far outweigh the 25% return to the counties. It is not practical to place a monetary value on many of these contributions. I refer to such things as:

■ Recreation use plus hunting and fishing . . .In a National Survey of Fishing and Hunting by the U.S. Fish and Wildlife Service in 1965, they placed an economic value on a fishing man-day of $5.60 and a hunting man-day of $6.03. It would be higher to day. So, you can see that this item alone would exceed the value of the 25% fund which is used only on schools and roads in the counties having National Forest lands.

■ Watershed protection benefitting local areas as well as down stream flood protection.

■ Employment of people maintaining and administering National Forests plus those employed to harvest timber which we have grown, etc.

■ Construction and maintenance of roads and bridges which would otherwise have to be maintained by the counties or state.10

The inaccuracies in this statement are highly misleading. The “economic value” of fishing and hunting involves money spent at local stores — useful, but not to be confused with county income from taxes — which is spent on education, health, and welfare. Clearcutting on National Forest lands has destroyed many watersheds and has increased the hazards of flooding. Forest Service employees are paid out of money appropriated from the Federal budget — which comes from taxes paid by local residents. No one is “employed" by the Forest Service to harvest timber — the wood is sold on the stump to woodcutters and timber companies. Most of the timber on National Forest lands was not "grown" by the Forest Service — it was there when the land was acquired from private landowners. Few of the clearcut areas in the Appalachians have ever been reforested — nationally, the Forest Service is 733,000 acres behind on reforesting clearcut lands.11 As for road maintenance, this year alone the Forest Service closed 60 miles of roads in the Chattahoochee National Forest out of a total of 1,392. And the damage done to county and state roads by overloaded trucks carrying timber from the National Forests is a direct cost to local governments — and a hazard and inconvenience to local residents.

The fact is that other benefits not only do not "outweigh the 25% return to the counties"; they do not begin to compensate for the loss of tax revenue. In fact, the Public Land Law Review Commission in its 1970 report to the President and Congress concluded:

While benefits are national, the geographical distribution of the Federal lands makes their burdens regional and local, and, in general, Federal ownership of public lands provides no distinguishable benefits to state and local governments in lieu of the benefits they would receive if the lands were privately owned.12

The Forest Service has also argued on occasion that one third of the United States is owned by the Federal government and that it would be impossible to make payments for all these lands. But there is a difference between many of the western National Forests — which have always been public lands — and the National Forests in Appalachia, which have been bought up since the passage of the Weeks Act in 1911. Before 1911, none of the land now in the Appalachian National Forests was owned by the Federal government; all of it was owned privately, and was subject to local property taxes. The acquisition over the past 62 years of so much Appalachian land by the Forest Service has meant an increasing destruction of local tax digests — especially in those 37 Appalachian counties where between 20% and 61% of the land has passed into Federal hands.

It is clear that the National Forests are not contributing nearly as much as the Forest Service claims to the economic growth of the counties where they are located. The evidence suggests that the opposite is true. The loss of tax revenue has produced a scarcity of public services, including education and health care. The control of so much land by the government has artificially driven prices up for mountain land — due to the demand for summer homes and recreational development, as well as land speculation — to where farming is no longer economically possible in many places. These conditions have helped encourage many young people to leave the area — and have prevented many who have left from coming back. Whatever benefits the Appalachian National Forests provide to the nation as a whole, for the residents of mountain counties they mean higher taxes and decreased public services. In effect, the people of Appalachia are being taxed to provide recreation and relaxation for people from other, wealthier areas. No one can deny that there is a national need for recreation; but that does not make it right that mountain people should have their taxes raised and their public services cut back so that well-to-do tourists can enjoy their counties at no cost.

There are several Federal precedents which strongly suggest that the Forest Service's way of doing business in Appalachia is neither desirable nor necessary. A startling comparison comes when we contrast payments made to counties by the Forest Service with those made by the Tennessee Valley Authority (TVA). In 1972, for example, TVA paid $252,766 to Polk County, Tennessee, in lieu of taxes on the 3,418 acres it owns in the county — $66.05 an acre. The Forest Service paid the county $22,612 for 150,870 acres — 1 5 cents an acre. To put it a little differently, the Forest Service owns 44 times as much land in Polk County as TVA; but TVA paid the county 11 times as much!

TVA's responsibility to counties where it has operations, however, is very different from the Forest Service's. The Tennessee Valley Authority Act provides that TVA make payments to counties to “fully replace tax losses which result from the transfer of such properties to public ownership."13

It is obvious that it is way past time for the U.S. Government and the Forest Service to begin full compensation to Appalachian counties for tax losses caused by National Forest holdings — and perhaps to compensate these counties for their losses in past years as well. This has been recognized by two recent studies: The Last Stand: The Nader Study Group Report on the U.S. Forest Service and the Public Land Law Review Commission's One Third of the Nation's Land.14

There are a number of other Forest Service practices which often conflict with local needs. One is the charging of fees to use recreational areas in the National Forests. These fees range from $1.00 to $3.00 a day, or $10.00 for a "Golden Eagle" passport which allows entry to certain areas for a year. These fees may seem reasonable to tourists, but they are out of reach for most poor families. As a result, local residents are often not able to afford recreational facilities built by the Forest Service in their own counties.

Southern Mountain residents are also concerned by the rate at which the Forest Service is still acquiring land. A recent example of this process occurred in 1971 in Bland County, Virginia, in the Jefferson National Forest. One Virginia resident and forestry student who has been in close touch with the situation wrote:

Consolidation Coal Company owned 46,000 acres of land in the county, containing relatively small amounts of semi-anthracite coal. Consol sold the land (finding the coal too poor to be profitably mined), amounting to one fifth of the county, to the U.S. Forest Service which has incorporated it into the Jefferson National Forest. Combined with the county land already controlled by the Forest Service, it will put nearly a quarter of the county's real estate under government ownership.

Large opposition to the land sale was expressed by Bland County residents. By the government owning one-quarter of the county, local revenues will be severely hurt. When Consolidation Coal owned the land last year, the company, a subsidiary of Continental Oil, paid just 14 cents an acre in taxes, amounting to a total of $6,800. The Forest Service pays no taxes, but will pay a small compensation of $3,600 — or just eight cents an acre. The $3,200 loss, opponents say, could destroy the Bland County budget, which has had severe fiscal problems for some time.

Most of the biggest supporters of the land sale were non-residents and outside agencies, including various sportsmen's clubs. The Bland County Board of Supervisors voted against the land deal twice last year, but a new Board of Supervisors has now voted in favor of the sale, yielding to the heavy pressure by outside groups.

So now the land is destined for tourist and recreational development by the Forest Service. Just how this will benefit the residents of Bland County, only time will tell.15

Appalachian working people are also critical of the ways in which timber sales are conducted. These sales are carried out by sealed bid. However, the Forest Service requires the posting of a cash ''bid bond” with each bid. On a recent sale in which the minimum bid permitted was $2,297, the required bid bond was $300 — a hard amount for self-employed woodcutters to come by. "Performance bonds,” sometimes in the total amount of the contract price, are also required. These rules have the effect of making it extremely difficult for the small independent woodcutter to bid successfully on Forest Service timber. The contracts thus go more often than not to the large timber corporations.

Of the Forest Service practices, none is more deeply resented than their use of condemnation proceedings to acquire homes and farms for National Forests. Because of past abuses of its condemnation powers, the Forest Service's power to condemn land for National Forests was removed by Congress in 1964. This power is retained, however, in the case of National Recreation Areas. The pending Eastern Omnibus Wilderness Act (S.316) would restore condemnation powers to the Forest Service in the proposed Eastern Wilderness Areas. One developing National Recreation Area is located in the Jefferson National Forest in Southwest Virginia. One organizer who has been working with local residents to save their homes and farms from condemnation has written:

The Mt. Rogers National Recreation Area, as defined by Congress in 1966, covers 1 54,000 acres in five counties of southwest Virginia. These counties are: Washington, Smyth, Grayson, Carroll and Wythe. The National Recreation Area (the Forest Service's equivalent to a National Park) is to be developed to accomodate, by present plans, an estimated five million tourists a year by 1990. To do this, the Forest Service has begun acquiring lands for campgrounds, livery stables, lakes, ski slopes and other recreation facilities. Some of the land has been openly bought from residents who, according to the Forest Service, are "willing sellers." While the Forest Service claims that condemnation proceedings are necessary to acquire land efficiently, many residents resent this practice and point out abuses of it.

The central issue, as many local residents see it, is not simply whether or not there should be a National Recreation Area, but rather the fact that the people are having no say in the plans and developments of their communities and homes.16

This lack of local input into Forest Service planning is a complaint heard frequently in Appalachian counties where the National Forests are found. Traditionally, the Forest Service has carried out its plans without consulting local government or citizens. Lately, in response to public pressure from many sources, it has taken to holding "listening posts" at which local residents are asked to present their opinions. These "listening posts," however, have generally been held after the Forest Service has already prepared written plans of action for the areas in question.

There is also evidence that the hearings are not taken into serious consideration. At a recent hearing in North Georgia, over 90% of the witnesses spoke against Forest Service proposals. These proposals would have included clear-cutting vast areas of the Cohutta Wildlife Refuge — despite the fact that this area has been proposed as a Wilderness Area in the Eastern Omnibus Wilderness Bill. Yet, when a transcript of the hearing was requested, the Forest Service replied that it did not plan to transcribe the tape they had made of the hearing. It is difficult to see how a hearing could be a legitimate part of public planning process when the only record of it is a tape recording in a Forest Service office. This type of practice led one county official to react, in a letter to the Forest Service:

After attending your meeting at Etowah on the Hiwassee Unit, I came away with the feeling that the Forest Service has already drawn up a tentative plan. If this is the case, I think in the interest of saving time and effort, the Forest Service should present their plan and then have hearings before it is adopted . . . The U S. Forest Service (has) never attempted to work with local government on future plans for U.S. Forest Service lands within their political subdivision.17

Conclusions

It is evident that Appalachian people are bearing an unfair share of the cost of maintaining a National Forest system — and are getting very few of the benefits. If the National Forests in the Southern Mountains are to benefit Appalachians as well as other Americans, some changes in Forest Service policy must be made. The following are recommendations which, based on the facts set out in this study, are necessary to achieve this goal.

1) The Forest Service should make payments in lieu of taxes to all counties in Appalachia (and elsewhere) where National Forest lands are located. These payments should be equal to the amount of ad valorem tax these lands would produce if privately owned.

2) Until such a system is adopted, all income from the National Forests should be redistributed to the counties in which these lands are located, in proportion to the share which each county has of the national total. Such a system would provide each county in Appalachia with National Forests revenues approximately sixteen times its current payment.

3) To avoid destruction of county economic bases, a limit should be set on the amount of land the Forest Service is permitted to own in any given county.

4) Admission to Forest Service recreational areas should be free to residents of counties where these areas are located.

5) The Forest Service should be required to hold public hearings before closing any National Forest roads, and to show cause before taking action. Procedures should be established through which local citizens, without undue difficulty or expense, can stop such proposed Forest Service actions where they are definitely not in the interest of the local community.

6) Any Forest Service plans for land acquisition, recreational development, road construction, logging, subcontracting, mining, land swaps, special use permits and other uses of the National Forests should be subject to the prior approval of an elected county committee.

7) The Forest Service should be absolutely prohibited from using condemnation proceedings to acquire any owner-occupied farms or homes in National Forests, Wilderness Areas or National Recreation Areas. Where such lands have been acquired by condemnation, they should be returned without cost to the previous owners.

8) Timber tracts should be bid off in small enough lots so that small, independent woodcutters can compete. Bid bonds should be abolished, and a different system established to end discrimination against individual woodcutters. It should be required that half of all National Forest timber be sold to independent woodcutters, cooperatives or small wood companies which are located in the county where the timber is located. This will help reduce abuse of the current bid system by the giant timber corporations.

9) Where the process of removing National Forest timber damages county or state roads, the Forest Service should be required to pay for their maintenance and repair.

10) Clearcutting — a process which destroys timber, land and water resources — should be totally prohibited on National Forest lands. and town governments should have the right to acquire National Forest lands

11) County and town governments should have the right to acquire National Forest lands through eminent domain proceedings to build public facilities such as schools and hospitals.

The situation as it now exists in the southern mountains violates the letter, and certainly the spirit, of equal protection laws. It is grossly unfair that the financial burden of providing recreation for the eastern United States should fall so heavly on some of the poorest citizens in the country — yet this is exactly what is happening. It is ridiculous to spend millions for campsites in communities which lack funds for schools, hospitals, health care, transportation, water systems, sewage disposal, housing — yet this is what is happening.

The National Forest lands in Appalachia could become a real resource to mountain people, providing jobs, land for public facilities, and the revenue for badly needed service programs. Even more, these lands, which have been taken from Appalachian people, could some day be returned to them to live and work on: lands which their grandparents settled and cleared, and which their children are being forced to leave.

*"effective tax rate" figures combine millage rates with assessment rates to reach a figure which can be compared with others on a tax rate per $100 of true property value basis.

**In fact, the actual tax rates for these counties exceed comparable rates for rural counties by more than 15%, since the state figures include urban and metropolitan counties.

FOOTNOTES

1. Guide for Managing the National Forests in the Appalachians, pages 7, 33.

2. Guide, page 8.

3. Guide, pages 7, 8.

4. Atlanta Constitution, May 12, 1971.

5. The Principal Laws Relating to the Establishment of the National Forests and to Other Forest Service Activities, page 45.

6. Undated petition beginning "We, the undersigned are against S.316, H.R. 1 758, Wilderness Study Act H R. 2420 and such Eastern Wilderness bills . . author's possession.

7. Blue Ridge Summit-Post, Blue Ridge, Georgia, October 11, 1972.

8. Blue Ridge Summit-Post, October 11, 1972.

9. The Last Stand: The Nader Study Group Report on the Forest Service, page V-13. from W.W. Huber, Chief, Division of Information and Education, Southeast Region, U.S. Forest Service, dated January 18, 1971.

11. The Last Stand, page III-9.

12. One Third of the Nation's Land: A Report to the President and to the Congress by the Public Land Law Review Commission, page 238.

13. "TVA Power: Payments in Lieu of Taxes," TVA Information Office, Knoxville, Tennessee, November, 1972. For another example of federal compensation of "impacted areas," see: "Administration of Public Laws 81-874 and 81 -815: Nineteenth Annual Report of the Commissioner of Education," Office of Education, U.S. Department of Health, Education, and Welfare, Washington, D.C., June 30, 1969.

14. The Last Stand, page VI-37; and One Third of the Nation's Land, pages 4, 236, 238.

15. Letter from Dave Tice dated January 22, 1973.

16. Letter from Dave Tice dated February, 1973.

17. The McCaysville Citizen, McCaysville, Georgia, September 23, 1971.

Tags

Si Kahn

Si Kahn is a veteran organizer and songwriter living in Charlotte, North Carolina. His records, available from Flying Fish Records, include “Unfinished Portraits,” “Doing My Job,” “Home” and “New Wood." (1986)