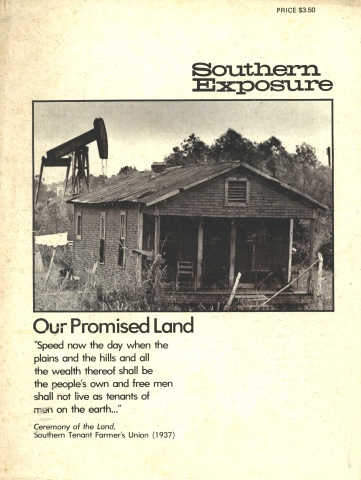

This article originally appeared in Southern Exposure Vol. 2 No. 2/3, "Our Promised Land." Find more from that issue here.

Call it "Manhattanization." Its distinctive trademark is the glistening office skyscraper and the luxury apartment complex. Downtown redevelopment is common to the modern city. So too is the suburbanization which radiates out from the city proper in a diffused blanket of fairly expensive homes, shopping centers and industrial estates. Trapped between the long shadows of downtown redevelopment projects and the suburban sprawl is a high concentration of poor and moderate income city dwellers. The South took a little longer to establish this metropolitan pattern but the urban centers of "The New South” now sport their Manhattanized images like every other city in the country. In fact, Atlanta's skyline lookes like Hartford's or Buffalo's. The distinctive topography, indigenous architecture and traditional economic activities of the nation's cities have been replaced by a corporate stereotype. Today's metropolises — whether northern or southern — share the same outlook and the same problems: They even share the same restaurants and hotels. They are the products of economic concentration, new technologies and government policy.

Metropolitanism imposes greater burdens on the inner city than stereotyping, however. The functions of the center city have changed. An increasing proportion of its population is poor and black. And it perpetually combats a gap between rising municipal costs and lagging revenues. Growing mass transit deficits and shorter school days are only two familiar manifestations of this budgetary bind. In fact, many people view these fiscal pressures as the crux of the city's problems, leading cities to spur downtown redevelopment in the hope of generating greater tax revenues. But while the private sector seems to flourish in its new office buildings, the public sector continues to languish.

The new buildings provide ample profits to real estate investors, jobs to suburbanites and desirable headquarters to various corporations. Yet they never seem to produce enough new revenues to relieve the city's problem. None of this activity seems to help the low and moderate income urbanite either. Their employment opportunities and housing conditions get progressively worse. Despite new growth and development all around them, a majority of the city's population finds it impossible to maintain their poor standard of living. This is the real problem of the nation's cities.

There may be a fairly simple economic explanation for this paradox. According to Gunnar Myrdal, " . . . the play of forces in the market normally tends to increase rather than to decrease, the inequalities between regions.''1 As a result, the rich get richer and the poor get poorer. Myrdal's description of regions concisely summarizes the urban condition as well. Despite a great deal of new and lucrative rebuilding on the one hand and suburban growth on the other, the city itself and the bulk of its population become economically and physically worse-off.

Andre Gorz also sees that uneven pattern of development, characteristic of overseas colonies, applies domestically. He writes that the geographic concentration of investment ”... has been accompanied, inevitably, by the relative or even absolute impoverishment of other regions, which have been used by the power centers as reservoirs of labor, raw materials and agricultural products.”2 Gorz cites Appalachia to illustrate his point. Similarly, at an earlier stage of the nation's development, agricultural production in the South financed the commercial and industrial development of the North. It appears that the equivalent of regional exploitation occurs in the city as it becomes the center of a fast growing metropolitan region.

Since the late 1960's, some radical and black analyses have viewed the ghetto as an internal colony. Although the comparison is most accurate when applied to the ghetto, it extends to many poor white and working class districts as well. Many semi-urban white working class suburbs, for example, conform to the colonial or neo-colonial profile: The local population of these internal colonies are predominantly poor with high levels of underemployment; their public service are inadequate and their housing is old and deteriorated. In effect they too are domestic colonies.

Communities, like farm land, need continual replenishment to remain productive. Just as farmers spread fertilizer over their fields to maintain their productivity, communities must reinvest capital to support their economic viability. Housing deteriorates and eventually falls into complete decay unless it is properly maintained. The same is true of public transportation systems and industry. In short, declining regions lack the reinvestment to sustain themselves. This can be as true for a sector of the city as it is for entire regions. Technological changes and economic concentration lure bank savings, company profits and other forms of capital from one place to another where they can be more profitably reinvested. In the city, capital is invested in new office buildings and suburban shopping centers rather than in maintaining older housing. As Myrdal observed, the process redistributes wealth. It leads to the decline of one region and to the growth and prosperity of another.

Although they miss the similarities between urban decay and colonial exploitation, most observers of the city know that the city dweller carries a much heavier tax load than the affluent suburbanite. One reason is that the city, as the hub of a larger metropolitan area of suburban communities, provides many services for these outlying communities. Many of the services, like libraries, museums, universities and hospitals, enjoy tax exemptions as non-profit institutions. So the city's taxpayers support these institutions.

The daily influx of suburban commuters contributes much of the pollution, noise and congestion in the city. Here too the city's taxpayers bear the full expense of these nuisances. Road maintenance and traffic control, under these circumstances, demands a significant city subsity to non-taxpaying suburbanites. The suburbs, without these added expenses, can afford to spend more for education and the like.

Meanwhile, many of the new skyscrapers in the city's redeveloped centers sit where only a few years ago low income people lived. Barred by zoning and income from the suburbs, these displaced people are forced to compete for the remaining housing in the city. Although it became policy to build replacement housing for those displaced by urban renewal and highway construction, many more low and moderate income homes were destroyed than were subsequently built to replace them. The inadequate supply of housing also antagonizes the relationship between whites and blacks. In fact, banks and realtors exploit the racial competition for housing to force property values down. Once again, the expansion of the metropolitan economy imposes a dis proportionate share of the hardships on the poorer residents of the city.

Those city dwellers who escape the direct impact of renewal face its wake. Banks routinely "redline” whole neighborhoods making mortgages and rehabilitation loans unavailable after the introduction of renewal elsewhere in the city. Even banks with offices located in these neighborhoods refuse to invest the area's savings to maintain the neighborhood. Instead, they use the money to finance new skyscrapers and suburban subdivisions. If the banks are lucky, their decision to redline an area undercuts property values and prepares the neighborhood for its eventual conversion to luxury use like that which is transforming the downtown. Otherwise, in Gorz's words, they, like other colonized regions, " . . . become zones of unemployment and poverty, in some cases robbed of their substance to the point of no return — that is, the point at which . . . they can no longer be developed.”3

The city, in part because of its obsessive need to generate property tax revenues, facilitates the exploitation of its low and moderate income residents. This is most obvious in its promotion of new skyscrapers. The new and more intensive use of land yields more tax revenue. It also creates jobs. It is assumed that these benefits to the city and its residents off-set the many city-financed services to these buildings and their occupants. Some cities are so convinced of the economic advantages of these glass towers that they offer tax abatements as an inducement to business. Yet these benefits have never been established by a complete accounting of costs and benefits. White-collar suburbanites by and large fill the new jobs. Not one city, despite some phenomenal construction booms, can claim that it has closed its cost-revenue gap. At the very least, cities apparently overestimate the contributions made by their new taxpayers. They probably err by overlooking some of the indirect costs like traffic control. More likely, however, they fail to recognize the costs associated with the shift in wealth brought on by new development in the downtown area. As greater investments are made in these new redevelopment projects, the older residential and industrial areas of the city lose their economic viability. The people, as they become poorer, become more dependent on public services. Most cities, for example, adopt the health costs of its residents who naturally gravitate to the city's hospitals for even routine treatment. All these human services expand the municipal budget. The shift in wealth from the poor to the rich gets a boost from the property tax which pays for the bulk of local government expenses. It is a regressive tax that requires that poorer residents pay a higher percentage of +heir income to support public services than do the better-off. Thus, it fits the latent pattern of urban life today; the redistribution of wealth from the public sector and the majority of the city's residents to the private sector and its wealthier representatives. Urban growth and development is the medium for that shift.

The policies and practices of most city governments respond to the pressures, tastes and desires of the surrounding suburbs, realtors and the like rather than to the bulk of its residents. This adds the political element to what otherwise looks like an economic picture. City governments, which ostensibly represent a low and moderate income constituency, operate on behalf of the upper classes. In particular, city government has traditionally maintained strong ties with the city's major commercial interests. The city's "boosters and boomers,” like the Chamber of Commerce include bank officials, major employers, real estate developers and utility executives. These are the people who serve on organizations promoting "civic betterment." They lobby for urban renewal, provide contributions for political candidates and serve on the planning commissions. They represent the wealth, civic leadership and political muscle in most cities. They are the beneficiaries of the the cost-revenue squeeze mentality. And in the final analysis, they work the city government for their private gain with calculated productivity. Although the political conflict between rich and moderate to low income groups permeates the urban crisis atmosphere, the problems facing the city are defined as jobs, housing and transportation. But these are really symptoms. The problem is more basic. The inadequacy of these commodities arises from the uneven character of metropolitan development and the system of economic control that forms it. Replenishing the supply of housing for the low and moderate income resident and providing them with jobs for example, requires the resolution of a distributive question. Who should benefit from the economic and governmental decisions in the city? This, obviously, is a political issue. Professionals and experts cannot resolve urban problems because they invariably accept the political realities as they exist. Therefore, the only strategy capable of ever solving the city's problems is a political challenge to this system of exploitation.

II.

Low and moderate income urbanites who have so frequently found themselves divided by competition for housing and by racial antagonisms have a common political interest in ending the exploitation of the city's resources — including their own savings — by wealthy interests. They have the most obvious stake in solving the city's problems. Although a complete end to private control of the economy remains a distant hope, important inroads can be made immediately on the local level without waiting for a change in national policy. In fact, local initiatives might be a precondition for a gradual change on the national level. If the colonized nature of the city population became widely understood among its residents, a coalition might form with the electoral strength to gain control of local government. This task alone would be vast. But community groups have gained a great deal of experience in recent campaigns to stop urban renewal, block interstate highways and inaugurate rent control. As economic pressures mount, city residents may respond to political organizing around the underlying issue of economic exploitation. With a new agenda, people will find that city government has greater potential for responding to urban problems than previously thought. Among other things, they will find that through urban land reform, municipalization of utilities, building code enforcement and rent control, city government can dramatically reduce the loss of its wealth.

If the coalition gained control of city hall, it might inaugurate an urban land reform program as a first step in ending its colonial status. Land is one of the few valuable resources left in the city. Unlike land reform in some Third World countries, this program would not dole-out a small plot to every resident. Even if the city had the legal authority to do so (which it does not), a few large landowners would eventually amass vast acreage leaving other people without any property. Instead, the city's policy might be to acquire the most valuable parcels.

Although speculators routinely profit from rising land values, many economists and city planners believe these values are socially created; that is, the value is not created by its owner. The value derives from community use. No land owner can claim to own the local labor force which lends value to his property. Nor can he profess to own all the people who buy goods in any particular location. He has done nothing to create these markets. Yet, these qualities add value to his property. Similarly, public services paid for by the community as a whole become a factor in land value. The dense urban population and heavy public investment in city services leads to intense land use and to the extremely high value of urban land. Fortunately, cities do possess the authority to control land use although the extent of that authority varies from state to state. This authority could be used to benefit the entire community.

Through its zoning powers a city determines how land is to be used. Generally, cities resort to "fiscal zoning If someone is prepared to use a parcel for a higher use — one that will increase the value and therefore also increase the city's tax revenue — the city zones it accordingly. It is almost like having no zoning at all. It helps to explain why most rapidly developing cities look essentially the same as Houston — the only major American city without zoning. Changing zoning from residential to some form of commercial use can double or even increase ten-fold the value of that parcel. Put into the hands of a private owner, that increment represents a very generous public subsidy.

Cities could retain the socially created increment if they first acquired ownership of the land. Then, after rezoning, the city could either resell the land at its new and higher value or rent it to a private developer. Each arrangement has its advantages. The first requires only a short commitment of municipal capital while it generates new revenues very rapidly. With long-term ownership, on the other hand, because the socially created value is recouped through land rents, the process is stretched over years rather than weeks or months. But with land values continuing to rise, long-term ownership has the added advantage of allowing the city to collect subsequent increases through periodic renegotiations of the land lease. The city forgoes these later increases when it resells the properties. Thus, prolonged municipal ownership can be expected to return more money to the city treasury than either reselling the land immediately after a zoning decision or collecting property taxes from a private owner as cities now do.

Therefore, urban land reform involves at the very least the municipal ownership of land that will be put to higher use. This strategy blocks one route by which community created wealth finds its way into private hands. It will also enhance the city's financial health by closing the gap between municipal income and expenses.4

Public land ownership offers yet another bonus. Despite a lot of moaning about big government and its meddling with individual property rights, ownership rights remain far more extensive than the authority of the public to tamper with them. The implications of that for a municipal land reform policy is illustrated by the rapidly growing town of St. George, Vermont. The town purchased 48 acres of land at the time it adopted zoning. It zoned the entire town for residential use except the town's parcel which was set aside for commercial use as a future town center. They were unwilling to allow a developer to erect a barren shopping center even if the town was going to capture the land values it created. St. George organized an architectural corn- petition as a means of eliciting an outstanding design for its center. Any city can follow St. George's example. Regardless of whether they resell parcels after rezoning, they are free to select a buyer who will implement a plan inspired by the city. Eventually, if a city has the capital and marshalls the expertise, it could finance and own the buildings as well as the land. Property ownership confers a great deal more power over land use than is available to the local government operating in its traditional role as a regulator. Thus, urban land reform can lead to improvements in the quality of urban development as well.

Financing land purchases will be fairly easy at first. Even those few cities that approach their state-imposed ceiling on municipal indebtedness will be free to sell more bonds for urban land reform; state limitations on municipal debts to not extend to revenue generating activities. Municipal bonds have the additional appeal of below market interest rates. Careful analysis of city budgets with the goal of retaining the city's wealth will readily reveal other sources of capital. Many cities, for example, have large municipally financed pension funds. New York City's totals six billion dollars. Most of this money comes from the city's budget. It is invested by a six member committee comprised of four bank chairmen (including David Rockefeller), the president of a large insurance corporation, and the chairman of another corporation's investment committee. They, of course, adhere to the same market rules that have bilked the city for years; they invest in secure but lucrative activities. The retirement system's portfolio in New York, according to one report, includes many major corporations. Of its $391 million invested in mortgages, less than half ". . . are invested in New York City real estate,” Marlys Harris found. "And only one-third of this . . . amount is devoted to housing mortgages — on luxury apartment buildings. On the other hand, the system owns military housing in Hawaii, garden apartments in California, and shopping centers on Long Island.”5 The system clearly employs money raised primarily through taxes to finance corporate growth and suburban sprawl. Relatively little of it finds its way into the city's economy. What does get invested in the city is devoted to that small redeveloped core. Retirement funds are a casebook example of the exploitation of the urban poor. It is also a great potential source of capital for municipally-owned projects.

Just as public investments and other essentially public attributes of a city account for its premium property values, they also create the conditions for scarcity and monopolization of indispensible commodities such as housing and utilities. A city government elected by a coalition of low and moderate income residents to end the extraction of its wealth would have to move to end this form of profiteering, too. Because public utilities have a natural monopoly, the country has found it necessary to regulate them. In over 2,000 cases, the public owns and operates them as well. But private investor-owned utilities "serve” most of the country; particularly the more profitable urban areas. Nonetheless, the publicly-owned municipal utilities have compiled an impressive record of low rates and higher payments to municipal treasuries than their privately owned counterparts. They have achieved this record despite frequent reliance on privately generated power sold to them at inflated prices. In Massachusetts, where over ten percent of the municipalities operate their own electric utilities, the municipal power systems reduced electrical rates slightly between 1961 and 1971 despite a 122 per cent increase in operating expenses. Their residential rates were 15 per cent lower than those of the state's private utilities. Still, they increased their contributions to the municipal treasury by more than 100 per cent during the same ten year period. These public utility payments to the towns in lieu of taxes is far in excess of the taxes ordinarily received from private utilities. In some states, like California, city purchase of utilities is made easy by a constitution that permits private utilities to be taken through eminent domain. Where it is possible, the municipal purchase of utilities should be considered. They can be counted on to improve the economic health of the city by blocking the flow of urban resources to wealthy outside investors and by direct payments to the treasury. Residents can look forward to relatively lower taxes and utility bills. Perhaps best of all, municipalization will replace high-handed management with city personnel who can at least be made accountable to those they serve.

Housing has a lot in common with utilities. People require both in our society, and for the most part, both threaten the consumer with abuses due to the failures of the free market to provide either an adequate supply or a competitive environment. The urban housing market is characterized by a chronic shortage — particularly for the low- and moderate income. Consequently, many states permit cities to impose rent control for the same reason that states regulate utility rates. But rent control, like utility regulation, guarantees landlord profits and leaves the tenants prey to many market abuses. Also, under rent control the housing supply stagnates and housing maintenance continues to be poor. On the positive side, rent control relieves some of the speculative pressures including perhaps the frequent resale of rental properties with its persistently rising refinancing costs. But as Ed Kirshner and Eve Bach, two inventive city planners with the Community Ownership Organizing Project, have noted, the introduction of strong pro-tenant rent control can undermine residential property values.6 This in turn creates an opportunity for the city government that is prepared to adopt an active role in producing low-moderate income housing to find some fairly good buys. Strict code enforcement would bring the price down even lower.

Kirshner and Bach recommend the establishment of a city-wide cooperative housing corporation to own and manage new and rehabilitated housing. The cooperative approach is a proven system. Through the state's Mitchell-Lama Act, many publicly-financed cooperative housing units were built in New York. It is possible to reduce the cost a great deal more than even New York managed. If properly organized, cooperatives have the inherent advantage of removing property from the market and insulating it from supply and land value distortions of housing costs. Thus all cooperative economies can be made self-perpetuating. People who join a cooperative years after it is established continue to pay the same low monthly payments enjoyed by the original occupants.

The Kirshner-Bach strategy offers additional advantages like municipal financing and public land ownership. In brief, this is how the plan works: The city working in partnership with the cooperative buys residential property or acquires it through tax foreclosures and eminent domain proceedings. Stringent rent control and aggressive code enforcement can reduce the price to realistic levels but should include guarantees to protect small local property owners. The city could retain ownership of the land as part of its long-range municipal land reform program. The cooperative, however, would buy the structures. Financing for the cooperative's purchase could be made through the city which would raise the capital through bond sales and other mechanisms at its disposal. In this manner, the cooperative would gain the economic advantage of the city's low interest rates. This is actually done in New York. In addition, the mortgage would be nearly 100 per cent of the cost of the structure and rehabilitation. If the city chose to defer land rents until after the cooperative retired its mortgage, monthly payments by coop members could be further reduced. After all the economies are totaled, Kirshner and Bach predict that families making $7,400 could afford these units if they devoted one fourth of their gross income to housing. But if the same housing were privately owned, families would have to earn $14,300to live there. Built into this plan is continued maintenance of the housing stock and neighborhood stabilization, factors normally undermined by speculative pressures. It should be emphasized that this scheme is self-supporting. It will cost the city nothing. Even the expense of city administration is billed to the cooperative.

As beneficial as these reforms may prove to be, they will fall short of liberating the city from its colonial status. After all, the problems facing the city are structural. National as well as local forces shape the city's economy. The legal powers available to city government are greater than generally assumed but they are still restricted by the state legislature and federal courts. Those steps a city can legally take to cut its colonial ties will meet the organized resistance of those business interests who now profit from those ties. They can be expected to resort to legal challenges, newspaper advertisements and political pay-offs to undermine the city's initiatives. They may convince the state government to enact legislation that reduces the authority of city government. Although this opposition will reduce the effectiveness of the city's new policies, it will have a hard time scuttling them altogether. These political conflicts are even beneficial. The traditional response to such conflicts has been to treat them as professional problems. But political conflicts that are forced to play themselves out provide a more accurate reflection of the interests at stake than a "rational" planning approach. While political dissension may be chaotic and unpredictable, it results in a better representation of the issues. The issue that will emerge from these battles is the issue that underlies the city's problems — the exploitation of low and middle class urbanites to benefit wealthy corporate interests.

Machiavelli reflected on the same conflict as it faced nations and cities centuries ago. "The Spartans held Athens and Thebes by creating within them a government of a few; nevertheless they lost them," he observed. The Romans on the other hand, successfully held Capua, Carthage and Numantia by ravaging them. So Machiavelli concluded, " . . . whoever becomes the ruler of a free city and does not destroy it, can expect to be destroyed by it, for it can always find a motive for rebellion in the name of liberty and of its ancient usages, which are forgotten neither by lapse of time nor by benefits received . . . "7 There is enough population and governmentaI power in the nation's cities to support a challenge to those who now exploit them. The question is whether the people will summon the political imagination to use the tools available to them to create an urban society where they too can share in the general wealth. Hopefully, they will even find a way to stem the trend toward metropolitanism.

FOOTNOTES

1Myrdal, Gunnar, Economic Theory and Underdeveloped Regions, Harper & Row, New York, 1971, p. 26.

2Gorz, Andre, Socialism and Revolution, Anchor Books, Garden City, N.Y., 1973, p. 221.

3Ibid. p. 221.

4Because of variations in legal decisions between states, some cities may have to adopt variations of this approach.

5Marlys J. Harris, "An Untapped Resource: New York City Retirement System," Social Policy, Nov/Dec, 1972, Jan/Feb, 1 973, p. 113.

6From a draft of "Low-to-moderate Income Housing: A Proposal for Local Communities," by Kirshner and Bach, Dec. 20, 1973, Community Ownership Organizing Project (COOP), 349 62nd Street, Oakland, Calif. 94618.

7Niccolo Machiavelli, The Prince, New American Library, 1952, N Y. p. 46.

Tags

Carl Sussman

Carl Sussman is a fellow of the Cambridge Policy Studies Institute in Cambridge, Massachusetts. This article and a book he is writing entitled New Towns and Old Cities: Creating an Urban Land Reform Movement is supported by grants from The Graham Foundation for Advanced Studies in the Fine Arts and the Norman Foundation. (1974)