This article originally appeared in Southern Exposure Vol. 7 No. 4, "Tower of Babel: A Special Report on the Nuclear Industry." Find more from that issue here.

The end of World War II brought rapid expansion to the infant nuclear power industry. Arguing strongly against the “socialistic” nature of government control of the nuclear industry, corporations quickly harnessed both the peaceful and the warfare atom for private profit, first through the nuclear submarine fleet of Admiral Hyman Rickover and then through the commercial nuclear power industry in the 1960s.

Shortly after the end of the war, major nuclear-related government facilities opened in the South: the Savannah River Plant in South Carolina and the massive uranium enrichment facilities in Paducah, Kentucky, and Oak Ridge, Tennessee; Oak Ridge’s nuclear weapon and research operations also expanded rapidly. These government operations were followed by the construction of the first privately owned nuclear facilities. Babcock & Wilcox began a fuel processing plant in Lynchburg, Virginia, in 1955, and in 1957 Nuclear Fuel Services opened its Erwin, Tennessee, plant. Both facilities supplied fuel for the burgeoning nuclear submarine fleet.

Several companies saw the potential not only in serving the government’s nuclear needs, but also in the rise of a commercial power industry. From the mid-1950s on, large corporations scrambled to gain a share of what promised to be the profit bonanza of the last half of the century: nuclear power generation equipment. But as with all other facets of making and marketing the massive machines for electric power generating, control quickly centralized in the hands of the industry’s big two: General Electric (eighth in the Fortune 500) and Westinghouse (29th). Both led the way in corporate promotion of nuclear power; they rapidly cornered most of the market for themselves — and then squared off to fight each other for larger shares of the business.

The market for commercial nuclear power did not develop overnight, however. Even after the 1957 passage of the Price-Anderson Act protecting reactor operators from financial liability in the event of a major accident, utilities remained reluctant to invest in nuclear reactors until the economic advantages of these plants were more certain. So GE and Westinghouse developed the concept of the “turnkey contract” — for a set fee with no cost-escalator clauses, these equipment manufacturers would design, manufacture and install the reactors themselves; once the plant was completed, the utility could simply turn the key to the front door, walk in and begin operations.

These deals had a catch for the sellers: the price the utilities paid for turnkey reactors was far less than the actual cost to GE and Westinghouse; in some cases the company lost as much as $100 million on a single reactor job. However, since the reactor divisions of both these multi-billion dollar corporations represented only a fraction of their total operations — roughly three percent at General Electric and seven percent at Westinghouse — they could absorb substantial losses on these early turnkey contracts in order to convince skeptical utilities of the economic advantages of nuclear power. A 1976 study by University of Chicago professor Albert Wohlstetter concluded that GE and Westinghouse each lost over $500 million on their first few years of domestic reactor manufacture. (Wohlstetter also found that principal competitors Babcock & Wilcox and Combustion Engineering each lost over $100 million.)

Of course, the companies did not lose on all their nuclear power operations. While the reactor manufacturers subsidized the development of a domestic market for nuclear reactors, the government’s Export-Import Bank provided substantial loans to foreign countries to build GE and Westinghouse reactors under contracts that reaped big profits for the two giant companies. Both companies invested heavily in European reactor manufacturers and established European subsidiaries to market reactors abroad. And until the mid-1970s, virtually every reactor constructed in the world used designs developed by General Electric and Westinghouse; as part of the licensing arrangement for the use of these designs, the companies received a fee of two to three percent of the total cost of the reactors.

Once GE and Westinghouse had laid the foundation for both the domestic and international reactor markets, other corporations joined the race to profit from equipment production. And, attracted by the traditional advantages of cheap land, unorganized labor and fawningly receptive state and local governments, the companies looked South for new plant sites.

Combustion Engineering began the trend at their Chattanooga, Tennessee, facility, a 10-shop plant now employing 4,300 people in design, engineering and production of both fossil fuel (coal, oil, gas) and nuclear steam electric equipment. C-E had done some subcontracting for naval reactors as early as the late 1940s. The Chattanooga plant, which had opened for fossil fuel equipment production shortly after World War II, added a nuclear equipment complex in 1954 and delivered its first reactor vessel — to the Shippingsport, Pennsylvania, reactor — in 1956. Since that time, it has remained a principal supplier of reactor vessels for Westinghouse nuclear reactors, and until the mid-1960s supplied many of General Electric’s reactor vessels. However, in 1964 the company expanded its operations to become a primary supplier of complete reactor systems and now produces steam generators, pressurizers and pipework in Chattanooga as well as reactor vessels. Two of the 10 Chattanooga shops, employing almost 1,000 people, are now directly involved in the design and manufacture of nuclear equipment.

Babcock & Wilcox also expanded into the South. In 1969 the company opened a commercial fuel fabrication plant alongside its naval fuel plant in Lynchburg, Virginia. In addition, the plant’s nuclear power generation division employs 1,100 people who design and install Babcock & Wilcox nuclear reactors, which are manufactured in Mount Vernon, Indiana. Finally, Lynchburg houses the company’s primary nuclear research and development operations. The complex as a whole employs 3,600 people.

A third competitor in the nuclear reactor field, General Atomic, started as a joint venture between Gulf Oil and Royal Dutch-Shell (who are also part owners of the Allied General Nuclear Services reprocessing plant in Barnwell, South Carolina). General Atomic in turn formed partnerships with two other corporations to produce equipment for its High Temperature Gas-Cooled Reactor (HTGR): one with Foster and Wheeler Corporation called Nuclear Power Products Corporation to produce equipment at a plant in Panama City, Florida; and another with Chicago Bridge and Iron to build General Atomic HTGR equipment in Cordova, Alabama (Chicago Bridge and Iron also produced other reactor equipment at an older facility in Birmingham, Alabama). General Atomic then announced plans for a fuel fabrication plant in Youngsville, North Carolina. It hoped to control 25 percent of the domestic reactor market by 1980.

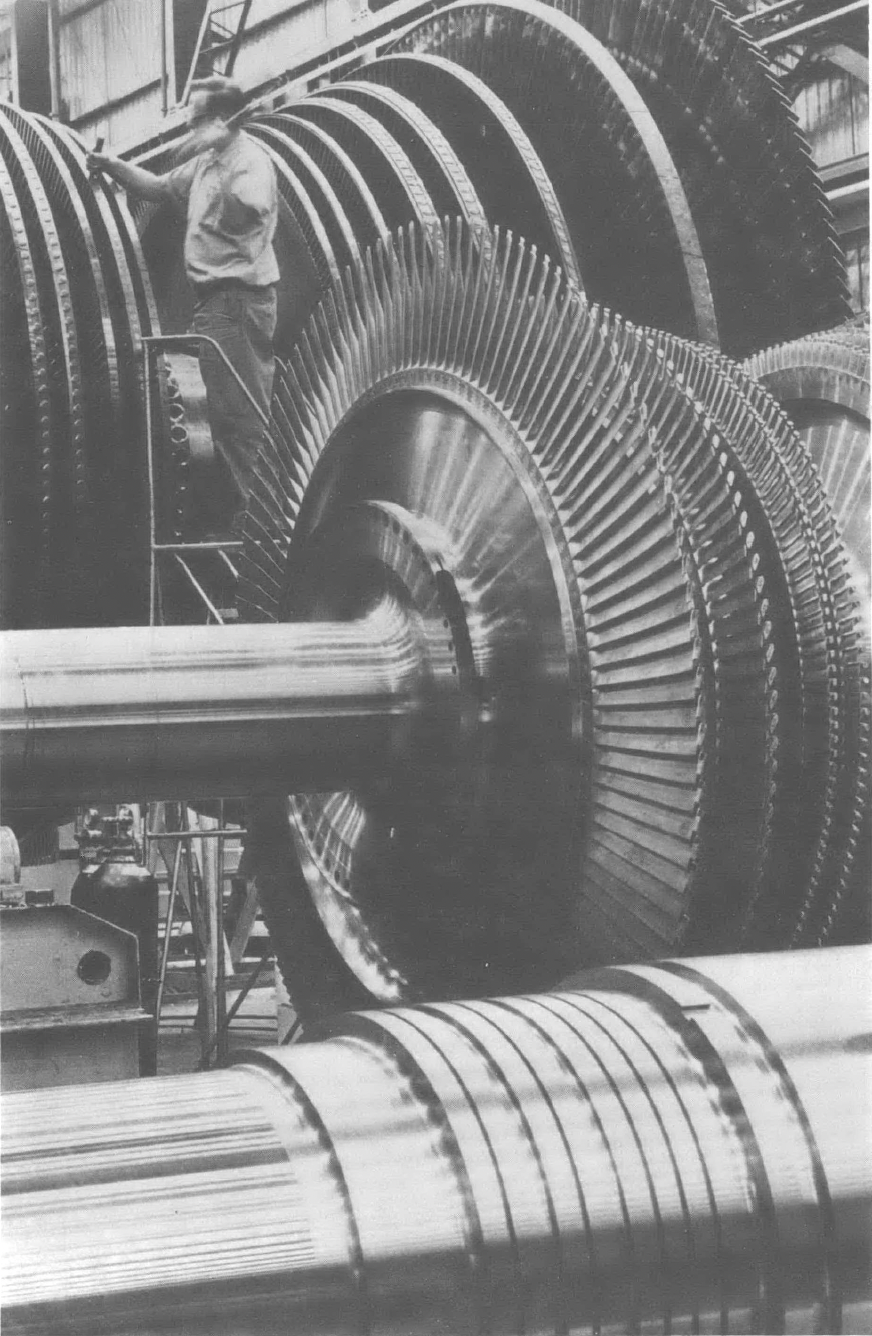

But, once again, industry giants GE and Westinghouse invested most heavily in the Southward shift of nuclear equipment production including such related equipment as turbine generators, pressurizers, pressure vessels and fuel fabrication. The two quickly gained a controlling percentage of the reactor market (General Electric has 30 percent and Westinghouse 36 percent), and they needed new facilities to produce equipment for the anticipated surge in reactor demand. In the late 1960s, Westinghouse spent $100 million on three new Southern plants that opened in 1968: the Tampa, Florida, plant produces pressurizers and steam generators; Pensacola, Florida, produces reactor internal parts, primarily involved in the housing of the fuel core; and Charlotte, North Carolina, produces turbines for both fossil-fuel-fired and nuclear generating plants. In 1970, the company opened a related facility in Winston-Salem, North Carolina; this plant manufactures and repairs the complexly crafted blades for steam turbines. Westinghouse also opened the world’s largest fuel fabrication plant in Columbia, South Carolina, and later announced plans for a second fuel plant in Anderson, South Carolina, which would produce plutonium fuels out of recycled materials from the AGNS reprocessing plant in Barnwell. Finally in 1971, Westinghouse announced a joint venture with Tenneco in Jacksonville, Florida, called Offshore Power Systems; this plant was to produce floating nuclear reactors that would be constructed in Jacksonville and floated to an off-shore location.

General Electric, battling Westinghouse for control of the industry, also moved new facilities into the South, though not as extensively as Westinghouse. The company opened a fuel fabrication plant in Wilmington, North Carolina, in 1969. Also that year, General Electric completed construction on a turbine plant in Charleston, South Carolina; in 1970, it opened a similar facility (which specializes in gas turbines) in Greenville, South Carolina. Finally, in 1970 it formed a 50-50 partnership with Chicago Bridge and Iron called CBI Nuclear. The partnership opened a plant in Memphis, Tennessee, operated by Chicago Bridge and Iron, to produce containment structures and pressure vessels for GE’s nuclear reactors.

Besides providing new production facilities to meet the expected rush of reactor orders, the Southern shift of these two companies accomplished a second major corporate objective: eroding the strength of the electrical workers unions. Most indicative of this trend has been the fate of workers in turbine generator production, a market on which the two companies have a stranglehold — they control over 90 percent of the orders.

Until the late 1960s, General Electric produced all its turbines at its Schenectady, New York, and Lynn, Massachusetts, plants; workers at both locations were represented by the International Union of Electrical Workers (IUE). Westinghouse produced most of its turbine equipment in Lester, Pennsylvania, where workers were represented by the United Electrical Workers (UE). At the time, wages in the turbine industry were among the highest in the nation, on a par with those in the auto and steel industries.

Faced with two strong unions, both companies built new turbine production plants as part of their push South — at Greenville and Charleston for GE, Winston-Salem and Charlotte for Westinghouse. The companies defeated organizing attempts at these new Southern facilities largely by providing better wages, benefits and working conditions than the region’s norm, thus decreasing the workers’ incentive to unionize. By increasing the proportion of their employees who were non-union, and by demonstrating that they would move plants in response to militant union demands, the companies gained a stronger bargaining position when it came time to renew contracts with IUE and UE. And the lower the unionized proportion of the national workforce at contract renewal, the stronger the companies’ bargaining position will remain in the future. The unions were unable to crack the South until 1976, when the UE won an election at GE’s Charleston plant. In the meantime, the diluted bargaining power of the unions cost their members dearly: the average turbine worker now earns $4,000 less per year than his or her counterpart in auto and steel; the losses over the past 10 years amount to as much as $40,000 per person.

This same Southern strategy to weaken unions has been pursued in other arms of the companies as well. Westinghouse’s overall workforce is now only 50 percent unionized, compared to 90 percent in the 1950s. GE has experienced similar drops.

The prolonged slump in the reactor market since 1974 has had disastrous consequences for workers employed in Southern reactor manufacturing. Chicago Bridge and Iron and GE dissolved the CBI Nuclear partnership, and cut the workforce at the Memphis plant to around 300 (from a high of 700); Chicago Bridge and Iron is now redesigning the plant to produce offshore drilling rigs. CBI’s Cordova plant was expected to employ as many as 1,000 people; after the jump in natural gas prices made the gas-cooled reactor financially unfeasible, the plant was shut down, and now employs only a skeleton crew. The General Atomic-Foster Wheeler partnership has dissolved, and the Panama City plant closed. Tenneco terminated their partnership in Westinghouse’s Offshore Power Systems, and the two utilities which had projected orders for four offshore nuclear reactors cancelled their plans. Consequently, the Jacksonville plant, built to employ as many as 12,000 people, now employs only 300, mostly engineering and technical personnel.

The slump does not hit the companies quite as hard as it does the workers. Many of the Southern power generation facilities are not exclusively devoted to the production of nuclear-related equipment, particularly the Charleston, Charlotte and Winston-Salem turbine plants. And, given the long lead time for reactor production and construction, all four major reactor manufacturers — Babcock & Wilcox, Combustion Engineering, Westinghouse and General Electric — have a backlog of orders from the growth period of the late ’60s and early ’70s that should keep its remaining workers busy for another few years. The total value of these backlogs has been estimated as high as $15 to $20 billion, with the bulk of that belonging to GE and Westinghouse. None of these remaining orders are under turnkey contracts; therefore, the suppliers are now insulated against heavy losses by cost-escalator clauses and penalties utilities face for postponing orders. Westinghouse predicts that both it and GE will continue to have an average backlog of five to six reactors, and Combustion Engineering and Babcock & Wilcox one or two each, over the next several years. Combustion Engineering also has enough subcontracting business from Westinghouse and others to keep its nuclear shops in Chattanooga busy until the 1990s.

But the nuclear power equipment industry undeniably remains in a very precarious state. Combustion Engineering has had periodic layoffs at its Chattanooga nuclear shops and is currently discussing alternative production plans for its nuclear-related facilities. General Electric, which relies on nuclear power for less of its revenues than any of the other three major reactor vendors, periodically threatens to leave the business altogether unless the government takes stronger steps to promote nuclear power. Westinghouse Power Systems Company president Gordon Hurlburt confidently predicted in 1978 that his company might receive as many as 10 domestic orders and 10 foreign orders per year over the next several years; however, the experience of 1979 hasn’t borne out his optimism — the company has received no new orders.

In fact, though it has received more reactor orders than any of its competitors, Westinghouse’s nuclear operations — and the company as a whole — are in dire straits financially. When its other corporate enterprises proved losers, Westinghouse relied on the nuclear equipment market as its long-term profit-maker, but the declining market has wreaked havoc with this plan. The company defaulted on long-term contracts to supply fuel rods to 29 utility companies after the price of uranium skyrocketed; as a result, the company lost millions of dollars in out-of-court settlements with the utilities. Company chairman Robert Kirby still touts Offshore Power Systems as the answer to these woes, but the practical drawbacks to the fanciful notion of floating nuclear reactors have effectively killed Kirby’s hopes; Offshore Power Systems reportedly loses $5 or $10 million each year.

All these factors leave the companies — and more importantly, their Southern workers — in a holding pattern with an uncertain future. Westinghouse capitalized on industry-wide uncertainty in combating an organizing drive at the Charlotte turbine plant by promising to keep the plant operating full speed if it remained non-union and to make any necessary layoffs at its militantly union Lester plant. Although this “deal” was certainly not the only factor in the election, UE lost by a three-to-one margin.

In the early days of the nuclear boom an increase in orders for new plants and a streamlining of their production design seemed to tie the jobs of workers to the expanding nuclear industry. However, the companies built many of these facilities, particularly the turbine plants, to accommodate possible shifts from nuclear unit production to coal unit production. Consequently, many of the workers do not rigidly identify their own job security with the fate of nuclear power, though they have not always been receptive to anti-nuclear arguments. They are suspicious of company rhetoric and desire both a safe workplace and safe community, but they also desire a consistently high standard of living.

The challenge to the anti-nuclear movement becomes one of refuting the company line on nuclear power by presenting clearly the problems that remain with nuclear power and proposing ways to minimize the economic impacts of a shutdown on workers in the nuclear industry. Only by attempting to educate themselves about workers’ issues, by listening to, discussing and acting on workers’ needs, can anti-nuclear activists hope to undercut the companies’ efforts to drive a wedge between anti-nuclear activists and blue-collar workers.

Special thanks to Bob Arnold for his diligent research assistance.

Tags

Jim Overton

Jim Overton, a board director and former staff member of the Institute for Southern Studies, is publisher of the North Carolina Independent. (1986)

Jim Overton is associate publisher of The North Carolina Independent, a progressive statewide newspaper — and a veteran of six-and- a-half-years with Southern Exposure. (1985)

Jim Overton is a staff member of the Institute for Southern Studies. (1983)

Jim Overton, a founding member of the Kudzu Alliance, directs the Energy Project of the Institute for Southern Studies. (1979)