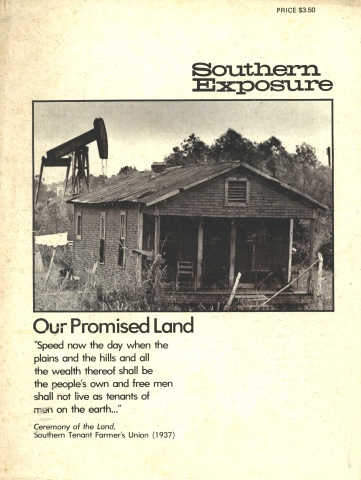

This article originally appeared in Southern Exposure Vol. 2 No. 2/3, "Our Promised Land." Find more from that issue here.

Harper and Brothers once published a children's book on the Mississippi River Valley, The Story of the Mississippi, with the letters "Mississippi” writ large across the jacket's cover from one side to the other. In red crayon, with large round confident dots over its i's and rounded serif points inside all the letters not so dotted, "Mississippi" stands with grace and authority at the top of a 1 9th century pastoral scene: a great American romantic vision of rich land hugging a river so brown and fertile that it has grown great white shellfish smoking and steaming their way in all directions along its warm, living flow. It is a dream that flowed, if ever so briefly, in the fertile years of American expansion before the Civil War — and it is a dream that is flowing again after 100 years of sleep, a narcotized slumber out of which arises an accumulated, raging energy not unlike that of the long, brown alligator itself when the spring rains pelt it awake.

"Others call it 'Old Al'," The Story of the Mississippi concludes, "the god of the River who lives in the mud at the bottom.” Once more the River is reasserting its power, and as the Republic approaches its second centennial, we can with increasing clarity see the way these waters — and the economic gods behind them — rule our land still.

The Gods Begin To Stir

The Mississippi River Valley possesses one of the world's great transportation systems — the River itself, whose main stem and tributaries drain 31 states and two Canadian provinces. Its value as a transportation and communication system has been long recognized: North American Indians had evolved a modest trading practice along its banks in the days before the white man decided to take it for his own. One major Indian ceremonial and commercial center was built in Illinois across the River from what we now call St. Louis, with the earth mound of its urban core still standing starkly in a public park. Another such trading "post” was in what we now call New Orleans and, in fact, the French explorers built their St. Louis Cathedral in exactly that spot where the Indians had gathered to trade.

The French were the valley's first imperialists, leaving militarily-strategic urban settlements and French names behind them everywhere. As rulers, the French were considerably more enlightened and progressive than their English-speaking successors: the land of the riverbank, for example, was owned communally with equal access to it for all — including the Indians, who had correctly perceived that assimilation awaited them at the hands of the French, while extermination awaited them at the hands of the English, and later, the English-speaking Americans. The Spanish and French-speaking Creoles of New Orleans — North America's second most important city in 1803, after Philadelphia — were in for their own share of distress at the hands of the Americans who took advantage of Napoleon's financial and military difficulties in that pivotal year. After the American purchase of the bulk of the Mississippi River Valley's territory, the River was to become engorged with the sweaty and greedy men the Creoles contemptuously called "Kaintocks.” (For their Kentucky origins, harsh language and bad manners.) Unlike the valley's Indians, however, the Creoles were not to be exterminated by the Kaintocks. Instead, the Americans in their own turn assimilated the Creoles; and in the New Orleans of the pre-Civil War era, the American newcomers' town homes and country mansions and imperial dreams were made all the more outrageous by their determined efforts to compete successfully against the thriving French settlement and "outdo” its culture. The haughty Creoles had been attending grand opera when George Washington was still struggling in the dirt of Virginia, and they never let the Kaintocks forget it.

The Americans were aided in their enterprise by two Yankee inventions: the steamboat and the cotton gin. As the French trade had exceeded by several quantum jumps the value and tonnage of the Indian trade, so the American trade was destined to exceed that of the French. Colonial trade was limited to one direction only: downriver, where it stopped on the levee batture in front of St. Louis Cathedral and was carried and carted over a "land bridge” to Bayou St. John and Lake Pontchartrain beyond, where ocean going schooners could profitably take it far away. New Orleans sits astride the shortest land bridge between the River and the Lake, which is why both the Indians and the French had chosen to settle here while the English took Baton Rouge and fumbled around with a number of alternative trade routes of their own until, finally, the Americans bought them out also.

French colonial agriculture reflects these technological restrictions: sugar and indigo in large, capital-intensive and labor-intensive plantations that were often dismal financial failures. The cotton gin and the steamboat changed all that, of course, and made New Orleans the unrivaled Queen City of the South and an eventual competitive threat to the same Yankee imperial ambitions that had supported the purchase of Louisiana in the first place. Steamboats meant trade could now move both ways on the River, making New Orleans an import center as well as an export center. The cotton gin offered Southern planters just enough labor-saving economies to make their agricultural enterprises spectacularly profitable.

Seeking these profits, capital investment flowed into the South and into its land on a scale unprecedented in the young nation's experience. Near the mouth of their new River, the Yankees established themselves an enormous granite customhouse (its foundations are made of cotton bales and its stones were brought down the River from the East), a mint to coin the exchange of the new realm, and a garrison that would — in the succeeding century — reach out for control of the Gulf and the Caribbean and the other Americas of the world beyond. When the River's carrying capacity eventually exceeded that of its modest land bridge in New Orleans, the Yankees brought in some ingenious capital investments to solve that problem, too: a railroad, America's second, which carted goods between the River and the Lake down a broad avenue New Orleanians called Elysian Fields. In the same way that the steamboat permitted two-directional trading use of the River, the railroad permitted four-directional trading use of the land. And a great economic battle began between the two modes of transportation, a battle which finally found military expression in the Civil War. Lincoln, a Midwesterner, threw in with the Yankees — and for the remainder of the nineteenth century, our national trading system grew East and West under the control of the Yankees and their railroads instead of North and South under the control of the planters and their River.

This little-appreciated aspect of our national history must be correctly understood if we are also to understand what is happening in the American South of today. There are some observers who have suggested that those in control of our country at the moment are divided into two competing camps: the Yankees, who tend to be found in East Coast cities and those financial or other corporate institutions under their direct and usually "liberal" control and the Cowboys, also known as the Southern Rimsters, an insurgent class of ultra-reactionary capitalist marauders who insist on playing the game by their own new sets of rules. In a certain general sense, it is true that this rising economic alliance stretches out like a fan from California and Arizona through Texas, the Deep South and on to Florida — and artifacts to corroborate this thesis (the route systems of the Southern Pacific Railroad or National Airlines, for example) are abundantly available. But the true Cowboy turf is to be found in the Mississippi River Valley, to which California and Florida are mere appendages of temporary convenience. We are witnessing the rise of a South Coast to challenge the power and prerogatives of both the East and West Coasts, which lack the transportation infrastructure necessary to compete successfully with the new technologies of the New South and its 31-state trading area. Houston is the South Coast's "capital" city, and that capital comes from its oil, brown rivers of oil over which the South Coast has had to learn to exercise its new-found political and economic control before it could hope to re-establish its control over the biggest brown river of them all. That oil has come to play a critical role in the economies of advanced capitalist societies: barge transportation was cheaper per gallon of fuel per ton of freight than airplanes, trucks or railroads even before the "energy crisis,” and for the forseeable future those relative economic advantages can only grow more pronounced.

One hundred years ago the Yankees won a few crucial battles, but the Cowboys have now won the war. The water-based civilization under construction in the Mississippi River Valley is —technologically, at least — destined to outstrip the power of all its predecessors: Mesopotamia, Rome's Mediterranean "lake,” Great Britain, all of them combined. The technology used to control the Mississippi River Valley and channel its trade through the South Coast is being "exported" to the Rhine basin of Europe, the Amazon basin of Brazil, the MeKong basin of Southeast Asia, and all the other vulnerable outposts of the post-World-War-II American empire. It is the purpose of this essay to explain some — but by no means all — of the elements of this South Coast phenomenon, exploring first the inland waterway system itself; then the oil and energy monopoly which is being manipulated in such a way as to cause the greatest of all possible benefits to this waterway system; the agricultural production and distribution system that is arising in response to these energy and transportation trends; and finally, the effects these economic forces are having on the cityscape of the South Coast metropolis.

America's Ruhr Valley

The levee is not as wide or as deep as the River — just high enough to elude its reach, the true secret of the levee's functional success. Levees must be built wherever men hope to wrest control of the land from the River, and therein lies their potential for political intrigue. One of the South Coast's leading capitalist sports of the moment is that of levee building: publicly-financed levee building permits private speculators to gain and drain "free" land for relatively little private investment and relatively high return; the contractors' pile-up-the-pay-dirt bonanza is guaranteed to keep South Coast Congressmen's campaign treasuries amply replenished; and if the planners can manage to levee in an entire river or stream, some lucky industrialist or two can pick up a free barge canal to his plant site(s) in the bargain.

Publicly-financed construction of levees, however, is a relatively recent wrinkle on the inter national river valley civilization scene. Before the Civil War, the South's riverside planters had their levees built and maintained for them by the labor of slaves — but the Yankee soldiers who freed the slaves lingered on to perform those tasks instead. Since 1879 the U.S. Army Corps of Engineers has spent two billion dollars all over the Mississippi River Valley building the world's largest network of levees (more than 2000 miles of them), spillways, navigational locks and canals.

The economic consequences have been astonishing, especially in the field of trade. Mississippi River commerce quintupled between 1940 and 1969 alone, transforming the following cities into prosperous inland ports: Tulsa and Little Rock on the Arkansas River; Omaha and Kansas City on the Missouri River; Minneapolis, St. Paul, St. Louis and Memphis on the Mississippi main stem; Pittsburgh, Cincinnati and Louisville on the Ohio River; Knoxville and Nashville on the Cumberland and Tennessee Rivers. In addition, Chicago and the other Great Lakes cities are connected to the Mississippi via the Illinois River. And an unprecedented cross-country barge canal — the Gulf Intracoastal Waterway — connects the Rio Grande River and Mexico to the South Coast deep water ports of Corpus Christi, Houston, Beaumont, Port Arthur, and Lake Charles west of the Mississippi; Baton Rouge, New Orleans, Gulfport, Mobile and Pensacola east of the Mississippi. Birmingham is connected to the Intracoastal Waterway and the South Coast via the Warrior River much as Dallas-Ft. Worth are connected to the rest of the coast via the Trinity River. And several new projects are either on the drawing boards or underway: the so-called Tennessee- Tombigbee barge canal in Alabama to open up a "second” direct Gulf outlet to Mississippi Valley commerce, this time via Mobile; the Red River "improvements" and the ill-fated Cross-Florida Barge Canal, which would have permitted the Intracoastal Waterway's Gulf loop to extend up into the Carolinas.

All these pathways lead — by barge — back to New Orleans, where the so-called "Centroport, U.S.A." is being built (modeled after the Europort of Rotterdam) to serve as a giant marshalling yard for the new generation of super-sized container cargo vessels. One system which picks up the barges and carries them piggyback across the seas — a system designed by a New Orleans naval architect and under mass reproduction at the city's Avondale Shipyards — is being used by Lykes, Central Gulf, Delta and several other New Orleans steamship lines to convert and expand their foreign trade routes. The aggregate international trade of the cities interconnected by these navigational and technological improvements is approaching half the national total and rising (the Russian wheat deal was arranged through South Coast ports).

The Corps makes its contribution principally through an agency called the Mississippi River Commission, authorized by the Congress to make these navigational improvements all over the River and its tributaries. It pursues this control mission with the aid of a toy river study model in Vicksburg and three large emergency drainage ditches in Louisiana that dump excess River water into either the Atchafalaya River basin and swamp to the west or Lake Pontchartrain to the east. This attempt at continent-tide River stabilization has not always proved successful (at least one group of South Coast scientists believe valley levees disrupt Gulf of Mexico salinity ratios in a way that causes increased rainfall in America, as if the River were trying to flush its constipated excretory tract clean), but the attempt has nevertheless succeeded in enhancing the interest in and value of private investments along the meandering 31-state pathway of The Big Brown Road. Investment in petrochemical and mineral refineries, grain elevators, and other manufacturing or trading facilities on the banks of the River between Baton Rouge and New Orleans has now advanced to the point where the area has been dubbed by South Coast business interests as "The Ruhr Valley of America."

Not all the economic consequences have been positive, of course, but the negative consequences have been largely ignored. The Mississippi River has become a stinking sewer draining 650 billion gallons of water a day, some three billion gallons of it pure, poisonous filth left over from industrial processes, human sewerage and other wastes. For those comm unities that drink this water, that means one glass out of every 200 is a deadly elixir of 21 dangerous organic substances (at least three of which are known to cause cancer) plus lead, mercury, arsenic, chromium and cyanide. The fish in the Gulf of Mexico also consume these wastes, an alarming revelation when you consider that the Gulf fisheries off the Louisiana coast alone produce 25 per cent of the nation's annual domestic fisheries harvest.

That harvest has been on the decline, however, for reasons also related to the Corps and its levees and the systemic destruction they occasion: the levee system has completely disrupted the River's historic siltation and land-forming activities. The levee-caused absence of floods and their silt deposits across the broad delta from Texas to Mississippi, complicated by natural land settlement and an increased subsidence of the coastal marshes caused by oil and gas and sulphur extraction, is causing the Gulf of Mexico to chew up sixteen square miles of fisheries-productive marsh in Louisiana every year. At an estimated value of $83,000 in biologically-related benefits per acre per year, that's almost one billion dollars in annual loss just in Louisiana alone.

But the entire Gulf of Mexico fishery is also suffering because of where that marsh-robbed silt is being deposited: at the mouth of the River, where it has been sprawling out closer and closer and closer towards the edge of the Continental Shelf. Fish spawn in the estuaries that feed into the Gulf's big bowl of seafood gumbo, and they migrate around the warm, shallow rim of the Continental Shelf that makes the Gulf into such an extraordinarily fine and delicate soup plate. But, the River has dumped so much silt onto the rim that it has broken the flow and restricted the fish to a gradually narrowing passage past the chemically poisonous funnel we have placed there, with both silt and poison spewing quite out of control.

The industrial installations that are the source of this pollution have also heated up the water in the River, and there are those South Coast scientists who theorize that 1965's Hurricane Betsy "homed” in on this heat source — like one of the American military's "smart bombs" over Indochina — catching the hurricane on the River's heat like a fly on a languid lizard's tongue. But the installations and the heat are growing. Louisiana Power and Light (part of the private enterprise Middle South Utilities combine controlling most energy production and distribution in a four-state stretch of the Middle Mississippi River Valley) advertises that 375 miles of sites in the American Ruhr Valley are still available, with full access to Louisiana's oil reserves (1/6 of the nation's total), Louisiana's natural gas reserves (1/3 of the nation's total), salt, sulphur, shell, glass sands, chemicals, and mineral and petrochemical feedstocks from the industries already here, plus agricultural products including lumber, cotton, soybeans and sugar that can easily be barged in. It is everything you need to feed, clothe, house and control a whole country, perhaps even the whole world.

The industrial plantations rising in these riverside fields are not unlike the agricultural plantations they are gradually replacing. Both the congruities and the contrasts of the old and new can be easily seen from any afternoon drive along the Great River Road; but they can perhaps be best seen from the Chalmette Battlefield south of New Orleans where General Andrew Jackson, the Valley's first President of the United States, helped the pirate Jean Lafitte and the other residents fight off the British nine years after the Louisiana Purchase. The Battle of New Orleans was in 1815 (four years after the New Orleans, the first steamboat to tackle the River, had completed its maiden voyage) and it took place after the rest of the country's War of 181 2 was supposed to be finished. The Chalmette Battlefield survives to tell us more about what has happened to our land than any other comparable such piece of southern real estate.

Nestled against the River's levee is a small, pink plantation house — under-scaled, as if for dolls at 3/4 the human size — and it looks out over a broad field growing only grass over the bones of the martyred defenders who have, by now, been long consumed by the earth. They died, we are told in a small exhibit maintained by the National Park Service, to protect the Mississippi River Valley from foreign invaders so that the Valley's Freedom could prosper even unto today. An obelisk and ellipsed roadway in the middle of this enshrined planter's field do not compare favorably with their more celebrated counterparts in Washington, D.C., but, then, neither is the backdrop quite the same. North, towards New Orleans, there stands an enormous metallic machine. Its superstructure of airborne conveyor belts connects together a row of storage bins in such a manner as to suggest the appearance of a giant preying mantis or perhaps a locust descent onto the land.

On the modern South Coast industrial plantations that replicate this scene, the slaves live in rows of blue collar subdivisions on the back lot instead of the previous century's more characteristic rows of wooden shanties. The white steamships that call at the levee no longer move on paddle wheels. And something else is different, too. All of these boats run on petroleum; and all of the industries run either on oil or on electricity produced from oil, natural gas, coal or uranium resources owned by the big oil companies; and many of the plantations also turn oil and natural gas into gasoline, plastics and other consumer products. An elaborate production and distribution system for oil and energy has been evolved to service this riverside manufacturing and trading system, and, ironically enough, its geographic structure offers up a parallel lesson in the multi-layered nature of South Coast economic control.

The Great God Oil

The largest oil refinery in North America is owned by Standard Oil of New Jersey, now Exxon, and is located on the banks of the Mississippi River in Baton Rouge — an undistinguished city which houses Louisiana's state capitol and government center, the main campus of Louisiana State University, and not much else. The Exxon reservation houses the plants of other industries that consume its feedstocks, and all of them together belch so much of so many kinds of pollution into the air that occasional shifts in the direction of the wind will mix up an unanticipated batch of tear gas.

Louisiana is rich in oil and natural gas — the reason the refinery was built here in the first place — but the growth of both the nation's consumption and its refining capacity requires more oil than can be pumped out of the ground immediately adjacent to the refinery or brought that far inland by oceangoing tankers. Hence the technological necessity for pipelines, an invention of as much importance to the future direction of American trade as the steamboat and railroad before it. Pipelines are the cheapest form of long-haul transportation possible, and the only form of transportation cheaper than river barges. Pipelines are capable of operating their flow in both directions, but in actual practice almost all American pipelines operate in one direction: from the South and West to the North and East. Needless to say, the nation's most important petroleum and petroleum product pipeline runs past its largest refinery: the aptly named Colonial Pipeline, which runs from Houston (where Exxon also owns an enormous and expanding refinery) through Lake Charles and Baton Rouge, turning up to the East Coast refining centers around Philadelphia and New York where Exxon owns a few more refineries.

Pipelines are an expensive business proposition, and despite the government construction of a few of them for national defense purposes during World War II, all the nation's pipe lines a re owned, and all of them are now also built, by the oil companies themselves. The pipeline companies are jointly owned by our allegedly competitive oil companies — which is one of many reasons why antitrust aficionados are so determined to see Big Oil divested of both the pipelines and the anti-competitive vertical integration they have fostered. Usually one of the participating companies takes the lead role of operating partner for the pipeline's ownership trust. Shell Oil, for example, is the managing partner in the Capline system, which starts in Louisiana's St. James Parish (county) —the heart of the "American Ruhr Valley" — and winds its way north along the east side of the River to the St. Louis area and then on to Chicago. (Shell operates a big refinery at Norco, Louisiana — also part of the American Ruhr — and another one near St. Louis.) The third major South Coast export pipeline is the Explorer Pipeline Company, which starts in Houston and ends up in Chicago via selected Midwest refining centers west of the Mississippi River.

These three operations alone tie in with almost every major refining center in the Mississippi Valley — but they are also stretching tentacles of energy control in other directions. The Plantation Pipeline loops away from the Colonial and dips through the "Deep South" and the Carolinas en route to Washington, D.C. The Laurel Pipeline from Philadelphia connects the Colonial Pipeline and Delaware Valley refining center to several more Great Lakes area refineries and pipelines en route to Chicago. Yet another major pipeline connection ties Houston to Utah. And several proposed projects would connect Los Angeles to the South Coast's oil reserves as well.

If Texas and Louisiana should seem on the material surface to be the control center for this operation, at least part of the explanation must come from the vast offshore oil reserves along the South Coast's share of the Continental Shelf — particularly that area defined by the prehistoric delta fan of the Mississippi River. The technology for offshore oil and gas exploration and recovery was invented in Louisiana during the 1940's and has been exported to every region of the world since then. Large and therefore comparatively cheap reserves to supplement the abundance of on-shore wells have led inevitably to the national pipeline network we have today. The one-way flow of these products has "hooked" the whole country on South Coast oil — resulting, among other inequities, in "energy crisis" gas station lines that were noticeably shorter in the South than they were in the Northeast.

And now that the pipeline infrastructure is complete, endless price hikes for Yankee users are possible before the investment in an alternative infrastructure will appear to be more feasible. The oil companies have already anticipated these problems, of course, and they have even anticipated the day when all the oil wells in Texas and Louisiana will run dry. And so, to keep those few critically necessary steps ahead of both the public and the government, the oil companies have put together another one of their celebrated joint ventures: the Louisiana Offshore Oil Port, Inc., or LOOP, a consortium of a lucky thirteen of the Mississippi Valley's leading refinery owners.

LOOP proposes to build a so-called "superport" oil unloading depot 21 miles off the coast of Louisiana in the Gulf of Mexico to accomodate deep draft supertankers loaded with Mideast and other foreign crude oil. The supertankers cannot come ashore anywhere in the continental United States except Seattle, so with characteristic abandon, the oil companies have decided to build themselves a floating pump attached to an undersea pipeline — moving the whole unloading operation out into the Gulf of Mexico among their other rigged up toys where the water depth won't get in their way. Four million barrels of oil per day will be pumped through the LOOP facility (by comparison, Louisiana's total rated refinery capacity is only 1.5 million barrels per day) and stored in 100 half million barrel tanks to be built on the banks of the Cajun country's sleepy Bayou Lafourche. This 50 million barrel oil dump will be connected to the Capline with a special new pipeline up the bayou, and from there it will be distributed to over forty refineries in the Valley.

LOOP'S 1450-acre Gulf-side tank farm is planned to rise right in the middle of the state-administered Wisner Wildlife Refuge, on a stretch of land only partially protected from Gulf erosion action by the barrier sandbar reef of Grand Isle. Both Grand Isle and the Wisner Refuge are currently suffering heavy erosion because of the Corps' levee system, leading the Corps into desperate attempts to design and construct a compensatory rock and concrete protective system before the LOOP tank farm is installed. In 1974, Hurricane Carmen almost scored a direct hit on this area, which has been targeted for the superport by the oil companies because it is the only area of Louisiana's marshy coast with a sand base sufficiently deep and stable enough to hold the weight of 50 million barrels of oil. And Louisiana is one of the few states in the country whose public officials have not been actively fighting off superport proposals for its coast.

In fact, there are more than a few minor ironies to the political intrigue surrounding this project. The land under the Wisner Wildlife Refuge is owned by the City of New Orleans through a charitable bequest from the late Edward Wisner, a colorful fin de siecle Louisiana land speculator who ran around offering the state's levee boards money to construct unauthorized additions to their dirt piles if they, in turn, would give him the land the levees drained. Wisner hoped to turn the Louisiana coast into the Holland of the Americas, but his empire fell apart at his death into two chunks: the Wisner bequest administered by the Mayor of the City of New Orleans; and the Louisiana Land and Exploration Company, a New Orleans-based conglomerate which is the nation's largest "independent" oil producer and which owns large tracts of land carefully matched up to the Wisner bequest's "public" land. LOOP'S oil terminal will be built on land that New Orleans Mayor Moon Landrieu — a nominal Southern "liberal" and racial moderate with extensive pinball industry connections and a few vice-presidential ambitions — leased for $72,000 a year, with no bids and no public discussion and only the most cursory notice to the Louisiana Wildlife and Fisheries Commission that its Wisner refuge is suddenly to be no more. Almost all of the land in the southern half of Lafourche Parish is owned either by LL&E or the Wisner bequest, and a curious secessionist movement has recently arisen there to carve out a new and separate parish not subject to the pleasure of the sugar planters in the Lafourche Parish seat of Thibodaux.

But even the sugar planters stand to make handsome financial gains from the South Coast land boom the LOOP project has provoked. Every refinery in the Baton Rouge-New Orleans "Ruhr” corridor has announced a plant expansion; one New Orleans group has formed a corporation to build an independent refinery on the back lot of San Francisco plantation; a Dutch oil company is coming in to build another one; and even Aristotle Onassis has been sniffing around. One of the largest sugar corporations to benefit from the boom is Houston-based Southdown, a holding company for select Houston and New Orleans financial interests that control 119,000 acres of California and Lousiana land including most of northern Lafourche, seven thousand acres of prime Mississippi Ruhr refinery land stretching along one 3-3/4 mile riverside corridor, 288 miles of Louisiana rice irrigation canals with which Southdown barters water for crops, the corporations that make Southwestern Portland Cement and Pearl Beer, plus oil lands in several state and foreign countries that help capitalize these ventures.

Another of these new-style South Coast conglomerates poised for a financial killing is Gulf States Land and Industries, the largest single owner of land in the River parish of St. John the Baptist, where its Belle Terre new town hopes eventually to house 80,000 construction and refinery workers and other Ruhr corridor commuters. GSLI has sold off all of its sugar processing facilities to concentrate on land development, but it still retains significant national and international oil properties. Louisiana Land and Exploration, meanwhile, has begun developing an extensive barge-serviced industrial park facility on the Intracoastal Waterway spur at the Baton Route terminus of the "Rhur," and its Jacintoport subsidiary also operates two other such centers in the South Coast ports of Houston and Mobile.

The number of South Coast financiers mixing water and land and oil is endless, but one of the more spectacularly successful representative cases is that of Coca-Cola magnate and social butterfly Richard W. Freeman of New Orleans. Freeman is a member of the board of Middle South Utilities, which operates one of the Mississippi Ruhr's largest generating stations just across the Corps' Bonnet Carre Spillway from Shell's riverside refinery in Norco. Middle South's bus-transit company in New Orleans buys its diesel fuel from Shell, and that company has also constructed a special pipeline from Norco to fuel New Orleans' International Airport — the principal user of which is Atlanta-based Delta Air Lines, the board of which Freeman formerly chaired and on which he continues to sit. Freeman also sits on the board of New Orleans' Hibernia National Bank, which serves as transfer agent for Middle South bonds and which has recently opened a sumptuous branch banking office at the base of Shell Oil's 51 -story southeastern operations headquarters tower in downtown New Orleans. Hibernia's executive vice-president for foreign trade served on a special blue ribbon superport taskforce appointed in 1972 (shortly after his election) by Louisiana Governor Edwin Edwards for the purpose of recommending a state superport policy. Two Middle South executives also sat on the committee which, not surprisingly, called for public financing and construction of a state-owned superport facility that could, in turn, be leased back to LOOP. Freeman's niece was the first major New Orleans financial supporter of Governor Edwards' upset gubernatorial campaign, and she now works as a top aide at City Hall in New Orleans keeping a watchful eye on Wisner trustee Mayor Landrieu.

Just for the sake of the big picture surrounding such sordid vignettes, let's take a brief look at the 13 companies which make up the LOOP consortium: Shell Oil (with 415 tankers, the world's largest private navy), Exxon Pipeline Company (a subsidiary of the industry giant that controls 14 per cent of the world's known oil reserves), Toronto Pipeline Company (a subsidiary of Gulf Oil), Standard Oil of Ohio (an affiliate of British Petroleum), Chevron Pipeline Company, and Texaco, Inc. — six of the "Seven Sisters” of world oil. The other seven partners: Union Oil of California (with big Valley/South Coast refineries in Beaumont and Chicago); Texas Eastern Transmission Company (one of the corporations that was to pipe South Coast oil from Houston to Los Angeles); Clark Oil and Refining Corp., Ashland Oil, Inc., and Marathon Oil Co. (prominent Midwest refiners); Murphy Oil Company (an Arkansas-based conglomerate that owns 20,000 acres of soybean plantations in Louisiana and 50 per cent of Odeco, Inc., the New Orleans-based offshore exploration pioneer); and Tenneco Oil (subsidiary of yet another South Coast wonder-conglomerate we'll examine in more detail later).

In the unlikely event that these collective economic interests can be dislodged from the mouth of Bayou Lafourche (the Barataria Estuary between the Mississippi River and this bayou alone produces 10 per cent of the nation's annual fisheries harvest), they have devised an ingenious alternate plan. It calls for moving the pump and pipeline to an offshore position near the Mississsippi River's Southwest Pass where any spills would be carried out to the Middle of the Gulf by the current and thus, presumably, away from the estuaries of the shore. Moreover, if the secessionist South Lafourche fiefdom fails politically, the alternate plan will do nicely in that department: it is located in Plaquemines Parish, the kingdom-by-the-sea of the late arch-segregationist Leander Perez. Onassis is reportedly considering building his New England-rejected Olympic refinery here on a New Orleans banker's plantation where also to be found are Gulf Oil's Belle Alliance refinery and a twin-reactor nuclear power station under construction by a Middle South subsidiary.

That there should be a sufficient supply of loose capital floating around to finance these ventures and adventures is not especially surprising. With their gasoline price hikes and windfall profits, the big oil companies and their independent producer cousins will be accumulating more capital resources still. But they can't possibly spend all of that money building new refineries, or diversifying their holdings to include coal and uranium reserves. Southdown, LL&E and Murphy Oil suggest the emerging pattern for South Coast conglomerates: put that money back into the land and into improvements upon it, agribusiness plantations in particular. Murphy Oil's soybean investments are exactly the sort of agribusiness diversification maneuver we should expect from the well-managed South Coast conglomerate: produce an oil-based commodity and synthetic raw material which requires the same sort of elaborate refining and processing technologies as petroleum oil; produce an agricultural commodity which takes maximum advantage of the inland waterway transportation system for export to the markets of the world.

A New God Appears

The soybean is the preeminent achievement of twentieth-century agriculture, a raw material with synthetic potentials far surpassing those of timber, cotton or peanuts — potentials surpassed only by petroleum. The waxy beans are crushed and dissolved in hexane, a petroleum-based solvent, to yield up two magically useful basic products: soy oil and soy meal from which hundreds of other items can be made.

Soy oil makes up three fourths of all American salad and cooking oils, and has also found its way into 78.6 percent of all our margarine, 86 per cent of all our mayonnaise and French dressing, and 58.8 per cent of all our shortening. Soy oil has helped create the post-war explosion of franchized quick service restaurants through its use as a cooking oil for frozen French fried potatos, potato chips, pizzas, donuts, fried chicken and other "convenience” foods. The chemical industry uses soy oils in soaps, detergents, drying agents, paints and printing inks. And for many such products with an increasingly costly petroleum base, the soy substitutes are becoming increasingly competitive. This trend has become especially apparent in the glycerine market (split half and half between natural sources and synthetic poetroleum sources) for the production of explosives, drugs and toilet goods, urethane foams, and the processing of tobacco and cellophane.

The explosion in uses for soy oil has, of necessity, created an explosion in the quantities of soy meal left squeezed behind it. Soy meal makes an excellent animal feed, and, in fact, soybeans turned up in two thirds of all high protein feeds in 1970, including 91.3 per cent of all hog feeds and 92.5 per cent of all poultry feeds. Soy meal has also been found to make a chemically well-disguisable people feed, and therein lies the source of the soybean's growing socio-political threat, a threat integral to its South Coast context.

Soybeans can control both the source of supply of meat, milk, poultry and eggs through feedstocks and competitive imitations of those products or "analogs” made directly from the meal without any animal aid. These ersatz foods have proved especially profitable in the so-called "institutional" markets of school and factory cafeterias, airlines, hospitals, military bases and prisons. Soy flours are used in sausage, dog food and baked goods including bread. Soy concentrates are used in processed meats, baby foods, and health foods. Soy isolates have proved profitable in meat loaf and frankfurters. Soy textured proteins — spun from machinery similar to that which spins nylon from petroleum and rayon from timber — makes imitation bacon strips and bits; pork, beef and chicken-flavored chunks; imitation mushrooms, bell pepper bits and other items. These materials, heavily doctored with color and flavor chemical additives, are found in a growing variety of frozen pot pies and TV dinners, hamburger extender products, whipped dessert toppings, coffee whiteners, cheese and milk products.

There are a number of frightening geographic implications to these trends in the production and control of our national and international food supplies: Ninety per cent of the 1972 soybean crop came from 18 Mississippi River Valley states. (The South Atlantic coastal plains of Virginia, Georgia, North and South Carolina produced the bulk of the remainder.)

Soybeans will not grow in the Northeast nor the Far West because of the climate.

U.S. Department of Agriculture projections say that by 1980 up to ten per cent of our national dairy cattle — somewhere between 230,000 and 831,000 of them — will become "obsolete" because of competitive soy substitutes. In the Mississippi Valley, dairy farms can be converted to soybean plantations, but that's not the case in the following states where dairy cattle are the leading moneymaker in agricultural receipts: New Hampshire, Vermont, Massachusetts, Rhode Island, Connecticut, New York, Maryland and Alaska. Dairy products are the number two agricultural industry in New Mexico, Utah, Nevada, Washington, Oregon and California.

Beef cattle, poultry and hogs will face eighteen million tons of soy protein competition annually by 1980; in sixteen major processed food categories (not just meats) requiring nine billion pounds of protein annually, USDA says fully one third of those requirements could be met by vegetable proteins by 1980. Beef cattle are the number one agricultural product in Montana, Idaho, Wyoming, Colorado, New Mexico, Utah, Nevada, Oregon and California.

Among U.S. crop receipts for 1972, soybeans were number one in the Mississippi Valley states of Louisiana, Arkansas, and Tennessee, and number two in Ohio, Indiana, Illinois, Minnesota, Iowa, Missouri and Mississippi. Soybeans were also number two in South Carolina and Delaware, number three in North Carolina and Alabama, number four in Michigan and Kentucky. By the 1 980's, USDA says, soybeans will be the number one crop in the nation.

Some thirty per cent of the nation's soybeans are grown on Southern land, and Southern planters have led the entire industry into its present structure through the formation of a little-appreciated organization called the American Soybean Institute. ASI was formed in the late 1960's to help collect and administer a voluntary soybean planter "tax." (In a March, 1972, referendum to extend Louisiana's share of that tax, 831 planters voted "yea" while only 31 voted "nay" — a revealing indication of the small true size of this agricultural cabal.) ASI taxes are now being collected in Louisiana, Arkansas, Mississippi, Texas, Florida, North Carolina, South Carolina and Virginia — plus the Midwest states of Iowa, Minnesota and Illinois, beams ASI president Jim McDaniel, a soybean planter from Tallulah in the upstate Louisiana delta country. Soybean acreage in the tri-state delta region of Louisiana, Arkansas and Mississippi increased thirteen times its 1946-50 average by 1966-70, principally as a replacement for cotton. However, in the ten year period prior to 1 971, an additional 1.2 million acres in Louisiana delta land alone was leveed and drained and brought into production as new farmland — 90 per cent of it for soybeans.

ASI has used its "tax" to develop new soybean varieties for the Southern clime at LSU and other Southern universities. It has also sought — with spectacular success — to increase U.S. soybean exports. Some four out of every eleven bushels of beans produced in this country are exported — 80 per cent of Louisiana's crop, figures ASI's McDaniel — and the Mississippi River Valley's water transportation infrastructure has made the port of New Orleans into the world's largest soybean collection and export terminal.

Japan is our largest single customer, followed by the Netherlands, West Germany, Canada, Spain, Italy, Denmark, Taiwan, Belgium and France — which buys 90 percent of its soybeans from the United States. In a world market where the U.S. controls 90 per cent of the supply, Brazil is the only other export nation of any note, and the jungles of the Amazon basin are being cleared and leveed in imitation of the economic system the Mississippi River Valley is perfecting.

Surprise newcomers to the American soybean export scene include the Soviet Union, which arranged for 36 million bushels of soybeans during the same negotiations that produced the "wheat deal," and the People's Republic of China, which is expected to buy 33 million bushels from us this year. Eastern Europe imports of American foodstuffs are expected to hit $700 million this year, mostly in grain and soybeans, and almost all this "new" business is leaving the country via South Coast ports.

"Food is the new currency,” Minnesota Senator Hubert Humphrey told the World Soy Protein Conference in Munich last year, and for the economic interests of the Mississippi River Valley, at least, he's correct. Soybean sales are the number one source of foreign exchange in this country's international trade, and University of Illinois economist Folke Dovring has suggested (in no less a place than the February issue of Scientific American) that soybean exports could prove to be the nation's most painless way of balancing our payments with our industrial confreres while paying for the increased price of petroleum and other imported "strategic" necessities extracted from the hungry nations of the third and fourth worlds. ASI, correctly intuiting its role as a representative of South Coast regional economic interests, has made especially diligent efforts to increase soybean exports to America's favorite oil-rich ally in the Middle East, Iran.

The Mississippi Valley corporations cashing in on this phenomenon have moved dangerously close to vertical integration of our food supply in much the same way that the oil companies have vertically integrated our energy supply.

A Valley soybean corporate sampler:

CARGILL, INC., Minneapolis — One of the largest privately-held corporations in the country, Cargill operates fourteen soybean processing plants and export terminals at sixty locations. 1972 sales were estimated at $3 billion and the Washington Post says its foreign sales would make Cargill the second largest corporate contributor to the nation's balance of trade. Vertical integration includes Nutrena animal feeds, Burrus flours, poultry-raising, and its own shipping companies..

CENTRAL SOYA, Ft. Wayne — Owners of five soybean processing plants in five Mississippi Valley states, it also owns 26 elevators and 124 barges. Perhaps the most vertically-integrated of the soy traders, it makes and sells "Master Mix” brand feeds through three thousand dealers in 37 states,

plus bulk industrial quantities of soy oil products and fractionates. It also produces poultry and eggs; margarine, mayonnaise and salad dressings ("Mrs. Filbert's"); pre-cooked frozen food items for the grocery and institutional markets; soy flours; and "Plusmeat” brand soy extenders for home use.

RALSTON PURINA, St. Louis — The industry heavy of animal feeds, the giant of Checkerboard Square has been steadily diversifying into poultry production, pet foods, Jack-in-the-Box restaurants, Chicken of the Sea tuna (most tuna fish is packed in soy oil), frozen entrees, soybean processing plants, and protein extenders for meat, poultry and fish. Agriculture Secretary Earl Butz came to Washington from Checkerboard Square, changing places with his predecessor, Clifford Hardin. Nixon Administration policies for pushing soybeans into the "number one" crop status for this country by the 1980's are policies developed by USDA under the direction of Hardin and Butz.

But it is the South Coast, rather than Midwest, agribusiness conglomerates that hold some of the most interesting keys to the soybean's imperial future:

ANDERSON-CLAYTON, INC., Houston — This commodity trading-based conglomerate (40.6 per cent of sales) has been steadily abandoning cotton sales for soybean-based food products (now 23 per cent of sales). With soybean crushers in Arkansas and Mississippi, plus five vegetable oil refineries and 23 animal and poultry feed plants, it has been among the first companies to capitalize on the soybean's southward move. It makes salad dressings, margarines, soy isolates, and an imitation cheese loaf advertised to solve the "potentially serious supply problem" caused by the national "decline of milk cow population and milk production." Watergate prosecutor Leon Jaworski of Houston is a member of the Anderson-Clayton board.

COOK INDUSTRIES, INC., Memphis — Another cotton-based commodity-trader-turned-conglomerate, Cook was the fourth largest supplier of the Russian wheat deal. Cook also owns the Bruce Terminix exterminating company, furniture and construction materials factories, charcoal plants, real estate, cotton gins and a soybean processing subsidiary with 25 plants in four valley states. Edward Cook, the company's president, is a member of delta society and belongs to the elite Boston Club of New Orleans, where he knows New Orleans financier Richard W. Freeman and can keep in touch with the New Orleans shipping and trading establishment.

The financial links between Cook Industries and several Texans gives a revealing picture of how and why southern soybean industry has developed and where it is going.

John W. Murchison, a member of the notorious Dallas oil and football family, is another member of the Cook Industries board. He also sits on the board of the First National Bank of Dallas, a subsidiary of the largest bank-holding company in Texas, First In ternational Bancshares with assets of $3.5 billion in 1972. One of Murchison's fellow members of the First National board is Trammell Crow, like Murchison a man who made his money in oil. Crow has recently invested some of that money in 42,000 acres of land in the wildlife-rich Dismal Swamp area of Louisiana's Concordia Parish — where delta Congressman Otto Passman is trying to get a Corps of Engineers pumping station and 400,000 acres of USDA Soil Conservation Service stream channelization projects built, over the vehement protests of parish residents and the same Louisiana Wildlife and Fisheries Commission that earlier lost its Wisner Refuge to the oil companies. Wildlife and Fisheries says the losses in deer hunting alone will amount to more than $1 million a year if the project is completed, but one recent analysis has shown that Crow's soybean plantation (11 per cent of the land area of that parish) could probably make a profit of $1.26 million in his first year of operation using a work crew of 80 men. Counting land acquisition and clearing costs, Crow can recover his entire investment in 10 years or less — especially if the price of soybeans remains high.

If the South Coast's trade in soybeans stays high, it stands to reason, so will Crow's profits. At this point the Murchison family re-enters the picture through their ownership of a 32,000 acre parcel of marshland in New Orleans called "New Orleans East." The Murchisons want to sell 16,000 acres of this land back to a new town building corporation set up under the administration of New Orleans Mayor Landrieu. They would sell the 16,000 acres for the same price they paid for the 32,000 acres in the 1950's. The proposed Pontchartrain New Town would not only make the Murchison's remaining 16,000 acres free and extraordinarily valuable, it would enhance the value of several tracts Richard W. Freeman also has acquired in the immediate vicinity. Many of the people destined to live in Pontchartrain would work at two major installations along the Gulf Intracoastal Waterway that runs along the southern boundary of their settlement: first, a giant international food processing and canning center and free trade zone in the planning stage by the Landrieu Administration's city-owned French Market Corporation, and second, the previously mentioned Centroport barge terminal complex. Soybeans, oil and petrochemicals, farm machinery, and everything else leaving or entering the Mississippi River valley or Intracoastal Waterway by barge will pass by this trading facility, the southern terminus of the American Ruhr Valley and one of its most critical cornerstones, a banker's bonanza.

The chief executive officer of Crow-Murchison's First International Bancshares, Joe L. Albritton, said recently in his Houston offices that he expects a "rapid increase" in American food exports, much of which will be financed and shipped by Texas-based businessmen. "America has learned to produce food in bulk at a cheaper price than anyone else in the world. All along they have been telling us that in ten years, with the population explosion, there will be worldwide shortage of food. Nobody paid much attention to that,” he says, tactfully omitting any reference to Mssrs. Murchison, Crow and Cook. From the energy crisis capital of the world, a phrase perhaps we've heard before: "What we're selling the food for, in private opinion, is not nearly enough. ..."

This sort of thinking runs rampant in Houston, and it runs nowhere as profitably rampant as it does at Tenneco, Inc., the crown jewel of South Coast conglomerates, the nation's 47th largest corporation, number 37 in revenues and number 25 in profits. Among U.S. corporations with agribusiness production, according to the Washington, D C.-based Agribusiness Accountability Project, Tenneco is number twelve in revenues, number five in profits and number three in assets.

Tenneco officials deny that they have either soybean investments or plans to acquire some. Nonetheless, they have quietly assembled one of the world's most astonishing corporate superstructures for the control of oil, agriculture, trade and shipping — all of it based on a surplus government-built pipeline (renamed the Tennessee Gas Pipeline Company, connecting Texas and Louisiana gasfields to the northeast) acquired and mortaged out for capital to finance a dizzying diversification spree in the 1960's.

The Tenneco corporate line-up:

Oil: Tenneco's Chalmette, La., refinery produces oil and motor fuels for sale to farms and motorists in most Midwestern and Eastern states.

Agricultural Machinery: J.I. Case makes most lines of farm equipment and sells them through 2,335 independent dealers and 177 company-owned retail outlets across the country.

Farmland: Tenneco subsidiaries now own or operate 1.4 million acres of farmland, mainly in California, but also in Arizona, Kansas, Michigan and Texas. In the early 1970's, Tenneco began marketing fifteen different California-grown fruit and vegetable items in eleven Western states under its own internally-generated “Sun Giant" brand name.

Packaging: Packaging Corporation of America and its affiliates operate 48 plants in the East and Midwest, specializing in consumer-contact containers for soaps, detergents, food products and beverages.

Transportation: Newport News Shipbuilding and Dry Dock is the nation's largest privately-owned shipyard, making Tenneco the nation's sixth largest defense contractor. Related manufacturing facilities also make truck components.

Retailing: Most new Tenneco gas stations now include fast-service convenience food store outlets, thus completing the circle of Tenneco's food production "chain." Atlanta offices manage distribution operations for these food stores as well as company-owned J.L. Case stores, shipping petroleum and other products to both.

Tenneco's West Coast agricultural production and marketing operations have been kept carefully separate, thus far, from its East-of-the-Rockies oil, packaging, manufacturing and Atlanta-based marketing operations. But Tenneco has the capability, meanwhile, for manufacturing hexane processing solvents; it makes farm equipment necessary for soybean planting, harvesting and transportation to nearby bins and elevators; it owns food storage and packaging facilities, and manufactures printing inks, urethane foams, cellophane and paper products — all of which could package soy foods and absorb soy chemicals in the packaging itself; it can build barges and ships for moving beans and finished products; it owns grocery stores and its own consumer food brand names; its oil operations give it leverage in the control of fertilizers and fuel oil sales to farmers and shippers and competititors; and its accumulated petrochemical technology gives it expertise in exactly those areas of synthetic product manufacturing where soybeans are conquering other chemicals and foodstuffs.

Tenneco is not altogether uninvolved, executive protests aside, in the soybean-rich plantations of the Lower Mississippi Valley's tri-state delta. Tenneco's J.I. Case subsidiary operates one of its 177 company-owned stores on the highway outside Vidalia, the Concordia Parish seat. Concordia is the southernmost tip of the triangle-shaped Louisiana portion of the delta — which contains other company-owned stores in Congressman Otto Passman's district in the towns of Tallulah (the home of ASI's McDaniel), Winnsboro, Monroe and Lake Providence. Salesmen at the Concordia store say new-found farmer Trammel Crow has bought a lot of his land-clearing equipment from them; new tractors and cultivators, tillers' tools and plows are still waiting in the store's showroom window, ready for planting the Dismal Swamp's first crop of soybeans.

One other unamusing coincidence: Ralston Purina's Secretary Butz, whose USDA pushes not only soybean research but also the Soil Conservation Service stream channelization projects that permit soybean plantations to be carved out of Southern swamplands, also has an interesting Houston connection. He just happens to have been a member of the J.I. Case board when Tenneco bought it in 1967.

St. Louis, Memphis, New Orleans, Houston and Washington — are part of a great mid-continent capitalist alliance strengthened by financial, transportation, agricultural, energy and government ties far stronger in the days of Richard Nixon and Gerald Ford than any which that first Republican front man, Abraham Lincoln, could ever have dreamed possible.

And it is probably no mere coincidence that Anderson-Clayton and Tenneco and First International Bancshares and Southdown and most of the major oil companies have all become creatures of Houston. Houston, the nation's third largest port (after New York and New Orleans) is the largest city of the South Coast in both population and wealth. Its control of the oil industry of the nation and fully half of the multi-bank holding company system of Texas permits it to build corporations like Anderson-Clayton and Tenneco that spread out across the land, refashioning it in the new image of the South Coast. But these changes in the land are not limited to levees and rivers, to oil fields and industrial installations, or to soybean plantations and new towns. The landscape of the cities that grew this South Coast creature is beginning to change, to create architectural monuments to the power that has been seized. No look at the Southland raped would be complete without a closer examination of the architectural evidence the South Coast's capitalists are leaving behind them.

Building Babel

Houston is just an unbelievably alien and ugly city. It stretches out on the coastal plain by the Gulf of Mexico like Los Angeles stretches out along the Pacific, but it has none of LA's mountains to redeem its man-made visual delinquency or to render its residents escape from the choking smog.

The skyscraper precinct of its central business district does, however, give its corporate executives a place to dwell in the clouds — and on those low-cloud days of Gulf-bred thundershowers, the tops of the towers touch the sky like a multiple Babel. Blocks in downtown Houston are square and, by other cities' standards, small — producing the urban form of one tower-per-block marching up and down Main Street with a Manhattan-like grandeur that could well rival the size and density of the original model by the end of the century. Exxon and Shell occupy the two highest buildings in the freeway-ringed core; Texas Eastern Transmission owns the largest single parcel of land and plans to erect a micro-city of its own on a raised platform spanning intersecting streets.

Houston is the headquarters city for these corporations and their oil-based cousins ranging in size downwards to Southdown; its metropolitan area is the headquarters for five of the 10 largest Texas bank-holding corporations with combined 1972 assets of $7 billion, and the site of several dozen bank branches and representative offices from Europe and Japan; and it is also the headquarters city for the National Aeronautics and Space Administration (NASA).

NASA animates the spiritual life of Houston in much the same way that Hollywood animates the spiritual life of Los Angeles. The space cowboy myth incorporates elements of alienation and isolation far in excess of that which would be tolerable for Hollywood stars. And Houston's freeways and vernacular architecture reflect this alienation; freeways bigger and uglier than the ones in LA, buildings bigger and gaudier than the ones in LA — worst and foremost among them the Astrodome, which sprouts another micro-city precinct of its own several miles south of the skyscraper core.

The Astrodome sits in the middle of the largest parking lot in Texas, surrounded by high-rise motels, an office tower park owned by Shell Oil, and the Astroworld amusement park's feeble answer to Disneyland. The Astrodome has a floor of plastic grass: a world-famous scoreboard without equal; a well-guarded super-tier of glassed-in, air-conditioned box-seat apartments for the Texas super-rich; and a Coca-Cola consumption rate that causes fountain-service cannisters to pile up in service entrances like bombs in a Nazi bunker. The son of the man who built the dome is now the mayor of Houston, a sure sign that Houston's nouveau riche are beginning to settle down to the standard ruling class tasks of dynasty-building.

The city they will one day rule will not be known merely as Houston but perhaps as HONOMO — the Houston/New Orleans/Mobile slurb corridor now taking form along the spine of the Gulf Intracoastal Waterway(the Erie Canal of the South Coast)and Interstate Highway 10 (the U.S. 1 of the South Coast). The urbanization of Greater Houston already extends into the state of Louisiana — Houstonians come to gamble and race their horses just outside the industrial city of Lake Charles. The Baton Rouge- New Orleans corridor nearby stretches out not only along the American Ruhr Valley, but also around the top edge of Lake Pontchartrain (the South Coast's answer to San Francisco or Chesapeake bay) all the way to Mississippi. The “gold coast'' from Bay St. Louis to Mobile has been rebuilt following 1969's disastrous Hurricane Camille, and Howard Hughes has bought up bargain basement quantities of hotels and underdeveloped property in anticipation of a new international airport and change in Mississippi's laws against casinos.

In the South Coast megalopolis scenario, Houston is to HONOMO what New York or Los Angeles are to their respective coastal slurbs. New Orleans compares to Boston or San Francisco. Pensacola is the South Coast's answer to Norfolk and San Diego. The Mississippi River Valley will drain through HONOMO via Mobile and New Orleans, extending this urban structure into the nation's heartland in a way that the mountains of both the east and west coasts have always prevented their coastal city-states from so doing.

NASA installations in the HONOMO corridor are Lyndon B. Johnson's lasting economic legacy to the South Coast and a remarkable, history-deflecting asset in its power struggle with the rest of the country and the world. The Manned Spacecraft Center on the floodplain between Houston and Galveston ad joins a poorly-planned new town — Clear Lake City — developed by a subsidiary of Exxon. NASA's Michoud Assembly Plant for Saturn boosters in New Orleans is located on the Gulf Intracoastal Waterway adjacent to the Murchisons' New Orleans East tract and the Centroport barge terminal complex. NASA's Mississippi Test Facility in Hancock County is similarly located on the Gulf Intracoastal Waterway system, and is adjacent to the proposed John Stennis International Airport and Hughes' largest South Coast realty holding. Alabama gets NASA money through upstate Huntsville, as does Florida through Cape Kennedy, as do most South Coast universities with aerospace or medicine research facilities tied into this system. NASA puts mastery of the world's skies into South Coast hands, and those hands have been busy. One of the fall-outs from NASA's satellite omnipresence is a project called the Greater New Orleans Systematic Transportation Analysis Research Project (STAR), a proposal to use spy satellites to plan the growth of New Orleans and other cities by counting cars on the streets and using infrared equipment to separate the hot, moving vehicles from the cool, parked ones.

This space cowboy control of the ground is also useful for navigational aids and general supervisory control of the seas. Tenneco's Newport shipyards, Litton Industries' much-debated automated shipyard in Pascagoula, Avondale Shipyards in New Orleans and other, smaller shipyards all over the South have been among the leading beneficiaries of the Navy's post-war push for bigger and better aircraft carriers, submarines and other equipment. The aircraft carrier program is of particular interest to South Coast oil and shipping companies — their mammoth supertankers and containerized cargo vessels have a variety of engineering and steering problems that the Navy has been solving for them at public expense. And naval power will continue to be necessary, even with NASA's satellites, to guarantee these super-ships free imperial access to the oceans and river valleys and raw materials markets of the world.

One of the South Coast's favorite imported raw materials of the moment is travertine marble — the favorite building material of Mussolini and the earlier Roman empire, as well. Buildings of any social note in Houston are lathered with the stuff — Jones Hall, the Houston opera house, carries off the Roman temple theme with considerably more grace than most of its peers. The most bizarre marble building in Houston is the Nieman-Marcus store in the suburban Galleria mall: the only windows in the place are marble sheets shaved so thin they turn translucent and look particularly tomb-like at night. The Galleria is owned by a flashy Houston real estate developer who also owns the tallest pile of marble in Texas — One Shell Plaza, Shell's downtown corporate headquarters tower —and an almost exact duplicate of it that is the tallest pile of marble in Louisiana — One Shell Square, the phallic centerpiece of New Orleans' imperial redevelopment scheme along Poydras Street.

Houston money and travertine marble are spread all over Poydras Street, especially after a good, hard wind. The street has also attracted international banking branch offices of Citizens and Southern Bank of Atlanta and First National of Memphis, joining several other regional corporate biggies in an urban showplace its promoters call the "Park Avenue of the South." It runs a mile from the Mississippi River, where an X-shaped tower for the Inter national Trade Mart architecturally anchors the underlying premise of the entire undertaking, all the way back to where 1-10 comes looping through downtown New Orleans. Among the institutions that have decided to join Shell and the banks on this edifice complex: Lykes Brothers Steamship Company, South Central Bell, the Federal Reserve Bank, and a few new hotels. A passenger cruise liner is being built next to the Trade Mart, part of a massive air rights project full of outside and South Coast money. Further down Poydras, the street passes New Orleans' City Hall and veers around the street's massive mammary complement to One Shell Square, the project that is the biggest building and the biggest scandal in town: the Louisiana Superdome.

The Superdome is bigger than the Astrodome, New Orleanians are fond of reminding the Texas invaders, and it has been built downtown as the cornerstone of an urban revitalization attempt that is running into serious economic difficulties. It was financed entirely with South Coast money after the Chase Manhattan Bank refused to buy its bonds, and it is believed to be the largest such Southern real estate venture ever entirely regionally financed. During the dome's first major financial crisis in-volving the sale of site acquisition bonds, Freeman's Hibernia Bank bought the largest multi-million dollar share of any of the local banks — except for the slightly-larger First National Bank of Commerce, Louisiana's first billion dollar bank, the principal stockholder of which also runs the third largest multi-bank operation in Houston.

Originally scheduled to cost $35 million and now pushing $200 million, the Superdome is owned by a state agency presided over and controlled by none other than New Orleans' Mayor Landrieu. The Superdome is built on what had been the railyard and Southern terminus of the Illinois Central Gulf Railroad — the Mississippi Valley's most important — and its planners shrewdly put the stadium on the property so that a large parcel between the federal building and City Hall would be left vacant and still owned by the suddenly cooperative railroad. The property subsequently came into the hands of something called the Ayshire-LaSalled Joint Venture, which owned by the railroad, the family of New Orleans' omnipresent Richard W. Freeman, and a Houston real estate syndicate. They're building "Poydras Plaza” on it now, an office and hotel superblock featuring an elevated walkway from the Superdome straight through the lobby of what will be, when it is finished, the Regency Hyatt House chain's flagship hotel.

With the River at one end and this domed assembly hall at the other, Poydras Street now resembles a plan once proposed but abandoned for the center city of Berlin. For land-locked Berlin, the passenger terminal was for railroad trains instead of cruise liners; but the boulevard leading to the domed assembly hall was similarly to be lined with office tower headquarters for the largest German corporations. The Berlin plan was developed by Albert Speer, architect to Adolf Hitler and the Third Reich, and it was planned to last a thousand years. Ten years this side of 1984, their plan is finally taking shape on the banks of the Mississippi River instead, and it speaks to the world with an unmistakable Southern drawl.

Tags

Bill Rushton

Bill Rushton’s first book, on the French-speaking Cajuns of South Louisiana, will be issued this fall by Farrar, Straus and Giroux. (1974)