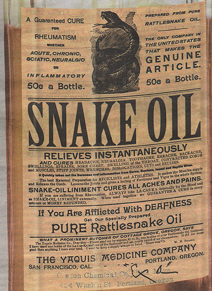

INSTITUTE INDEX: Conservatives are selling economic snake oil; is your state buying?

Under a plan to eliminate North Carolina's corporate and personal income taxes written by supply-side economist Arthur Laffer and commissioned by the conservative Civitas Institute, tax break that would be enjoyed by a family earning $1 million a year: $41,000

According to an analysis by the N.C. Budget and Tax Center, amount by which a family earning $24,000 a year would see its taxes increase under the plan, which hikes the regressive sales tax: $500

Percent of North Carolina households on the wealthy end of the economic spectrum that would enjoy tax cuts under the plan, which is being championed by some legislative leaders: 20

Percent of the state's households on the other end of the economic spectrum that would face tax increases: 60

Rank of the lowest-earning 20 percent of North Carolina households among the economic groups that would experience the greatest tax increase under the plan: 1

Rank of North Carolina's top 1 percent among the economic groups that would experience the greatest tax break: 1

Month in which Louisiana Gov. Bobby Jindal, head of the Republican Governors Association, embraced a similar regressive tax plan for his state: 1/2013

Number of years that the American Legislative Exchange Council (ALEC), an influential conservative advocacy group, has published a report by Laffer rating states using a "competitive index": 5

Number of key measures of economic growth on which the ALEC/Laffer ranking fails to predict a state's performance, according to a recent analysis by Good Jobs First and the Iowa Public Policy Project titled "Selling Snake Oil to the States": 4

Of those four measures, number where the correlation between the ALEC/Laffer index and economic performance was actually negative, meaning states rated as more competitive actually do worse on job creation, growth in per capita income, and state and local revenue collections: 3

Of two other measures used to evaluate the usefulness of ALEC/Laffer index -- median family income and poverty rate -- number where the correlation was also negative, meaning the more competitive states were poorer: 2

Since passing a version of the Laffer tax plan, annual budget deficits that the state of Kansas is now projecting: $800 million

Number of new jobs that have come to Kansas since May: about 2,000

In the same period, number of new jobs that have come to Oklahoma, which rejected the Laffer plan: almost 24,000

Year in which Laffer, a former advisor to President Reagan, helped found the 501(c)(4) Free Enterprise Fund, which has lobbied for causes including Social Security privatization and against toughening corporate disclosure requirements in the wake of the Enron accounting scandal: 2005

Date on which the Civitas Institute published a blog post calling critics of the Laffer income-tax elimination plan "fringe leftists," "economically illiterate," and displaying "dogmatic faith in centralized political power: 1/23/2013

Date on which N.C. Budget Director Art Pope, who runs a discount-retail business, said he personally had "great concerns" with the plan due to the regressive nature of the sales tax: 1/23/2013

Year in which Pope founded the Civitas Institute to "facilitate the implementation of conservative policy solutions": 2005

Percent of the Civitas budget that comes from Pope's family foundation: 97

(Click on figure to go to source.)

Tags

Sue Sturgis

Sue is the former editorial director of Facing South and the Institute for Southern Studies.