Looting Louisiana: How the Jindal administration is helping Big Oil rip off a cash-strapped state

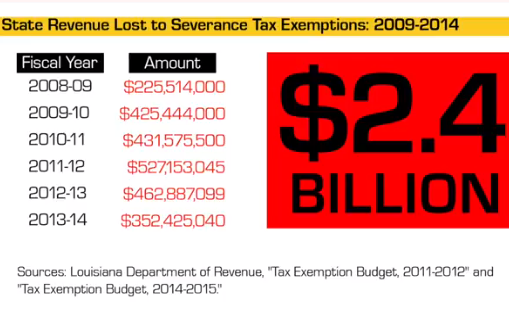

The Jindal administration in Louisiana has helped the oil and gas industry avoid paying billion of dollars in severance taxes and royalties. (Chart from the video below.)

Louisiana is in the throes of a budget crisis, with the state facing a $1.6 billion deficit for the upcoming fiscal year that begins July 1.

Gov. Bobby Jindal (R) has proposed cutting more than $200 million from higher education, leading Louisiana State University to begin drafting paperwork for what is essentially a form of academic bankruptcy. State leaders are also considering cutting health care services for the poor, elderly and disabled. Meanwhile, Moody's Investors Service and Standard and Poor's have said they may lower the state's credit rating if it doesn't come up with a solution.

As the state grapples with how to respond to the shortfall, new details have emerged about a scheme that has helped bring it to this desperate point.

This week, a video produced by Louisiana-based civic activist, writer and independent filmmaker Mike Stagg was sent to every member of the state legislature explaining how the oil and gas industry — with the cooperation and assistance of the Jindal administration and the Department of Natural Resources — has shortchanged the state on severance taxes and oil and gas royalty payments.

The data comes directly from reports by the Louisiana Legislative Auditor and the state Department of Revenue over the past five years. The information has been, as Stagg says, "hiding in plain sight."

Watch the 13-minute video here:

Here's how Stagg summed up his findings in an email to Facing South:

The oil and gas industry has operated in Louisiana for more than 100 years now. The industry's political power has never been greater or on more raw display than it has been during the past five years since the industry and Louisiana's political class locked arms in opposition to the deepwater drilling moratorium that was imposed in the wake of the Deepwater Horizon explosion and the resulting BP Gulf Gusher.

As it turns out, that tight cooperation between industry and the Jindal administration produced changes that led to the results discovered by the Legislative Auditor and outlined in "The Primer."

The most significant change was the decision by the administration to settle a dispute between the Louisiana Department of Revenue and the Department of Natural Resources over which department would assume authority for auditing both severance taxes and royalties. The responsibility had been split, but the Louisiana Streamlining Commission had recommended better coordination between the two departments. Consolidating audit authority became a subject of conversation between the two departments.

At one point, the Legislative Auditor noted in their 2013 report on Severance Tax Audits, audit authority was going to all be concentrated in the Department of Revenue. However, DNR pushed for the authority to reside in their Office of Mineral Resources. The dispute had to [be] kicked upstairs to the Division of Administration and settled by the Commissioner of Administration and (likely) the Governor.

DNR's cozy relationship with the oil and gas industry is common knowledge in Louisiana. The Legislative Auditor had already criticized the Office of Mineral Resources for a lackadaisical approach to audits on royalty payments generated by oil and gas produced on state-owned lands. Giving severance tax audit authority to the Office of Mineral Resources was tantamount to letting the industry self-report.

That is, in fact, what happened for the three years that OMR had responsibility for severance tax audits. Not a single audit was performed on severance tax payments made in connection with leases on private lands in Louisiana between July 2010 and July 2013. 98.1% of the oil and gas leases in Louisiana are on private lands, according to the Legislative Auditor.

The industry's political clout in Louisiana is sustained by two myths.

The first is that the industry is benign. The BP Gulf Gusher and the poisoning of the Gulf of Mexico, combined with extensive damage to Louisiana's coast resulting from drilling and pipeline activities have shredded that myth.

The second sustaining myth is that the industry is benevolent. The saying is that Oil and Gas Built Louisiana. To an extent that is true, but the money that financed that came from severance taxes. Thanks to exemptions passed in the mid-1990s, Louisiana missed out on the revenue that should have come to us from the shale boom in the Haynesville Trend, which was at one point the most productive shale gas field in the country.

But, to benefit from that massive transfer of public wealth into private hands (through severance tax exemptions) and still manipulate and scheme to cheat the state out of still more revenue reveals the industry to be an occupying entity here strictly for the mineral extraction, with no concern for the wellbeing of the state.

Reading the Legislative Auditor's reports on severance tax audits and on royalty audits, it becomes clear that DNR, the Office of Mineral Management and the State Mineral and Energy Board consistently held the interests of the industry above the wellbeing of the state.

The relevance to the rest of the South and the country is that the industry is motivated solely by its own self-interest. They control all of the data upon which all regulation and revenue are derived. They cannot be trusted.

Tags

Sue Sturgis

Sue is the former editorial director of Facing South and the Institute for Southern Studies.