Big Oil's exaggerated claims in new pro-Atlantic drilling ads

The American Petroleum Institute is running pro-Atlantic drilling ads in the Carolinas and Virginia touting economic benefits of offshore oil and gas development, but the ads make questionable claims.

The oil and gas industry has run into a roadblock in its drive to drill the Atlantic from Virginia to Georgia: staunch opposition in coastal communities that would be most directly affected by offshore fossil-fuel production.

Since last year alone, more than 80 East Coast communities have passed resolutions opposing or otherwise expressed concern with offshore oil and gas exploration and drilling, including every coastal town and county in South Carolina. In North Carolina, a recent poll conducted in the state's eight oceanfront counties found that more residents there oppose offshore drilling than support it. The proposal to drill the Atlantic has also drawn opposition from local coastal business groups, including chambers of commerce and tourism boards, and elected leaders from both major parties.

Amid this groundswell of opposition, the American Petroleum Institute (API) — a lobbying group that represents oil and gas interests — along with its state affiliates in North Carolina, South Carolina and Virginia have begun running print and radio ads to promote offshore oil and gas development. The print ads began running last week in the three states, which were included in the Obama administration's draft five-year offshore drilling proposal for 2017 to 2022. API also began airing radio ads with a similar message in those states last month.

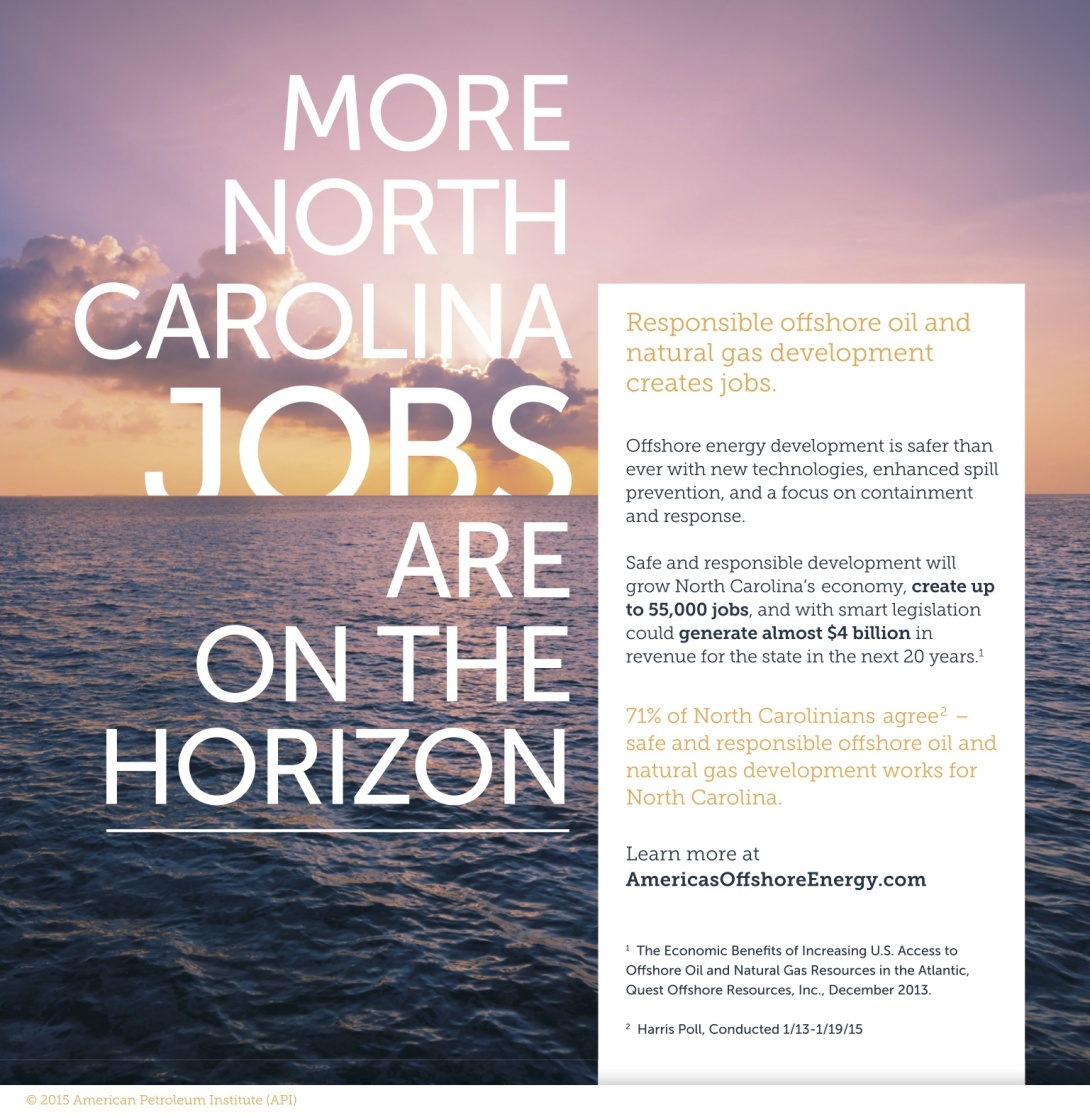

The ads tout offshore drilling as an engine for job creation and enhanced state revenues, with the specific numbers adjusted for each state. This is from the North Carolina ad, pictured above:

Safe and responsible development will grow North Carolina's economy, create up to 55,000 jobs, and with smart legislation could generate almost $4 billion in revenue for the state in the next 20 years.

The South Carolina ad claims offshore drilling would create up to 35,000 jobs in the state and bring in $4 billion in state revenue, while the Virginia ad claims the creation of up to 25,000 jobs and almost $2 billion in revenue. The ads disclose that the figures come from a 2013 report that was prepared by Quest Offshore Resources, a Texas-based company that provides research for the deepwater oil and gas industry; the report was paid for by API and the National Ocean Industries Association (NOIA), which represents the U.S. offshore drilling industry.

But an analysis of the API report by Douglas Wakeman, an economics professor at Meredith College in Raleigh, North Carolina, suggests its claims are unrealistic.

For one thing, Wakeman's analysis notes, production is dependent on oil prices. When oil is selling at high prices, like the $120 a barrel it was fetching a few years ago, economically marginal deposits become profitable to pursue. But when the price of oil falls below $50 a barrel, production in high-cost areas drops off. The API report doesn't specify what future price estimates it used. A barrel of oil was selling for over $90 at the time the report was released; it's now selling for $47.90 amid a worldwide glut.

"All economic estimates in the API report may be regarded as likely overestimates," Wakeman's analysis states.

And it's not just economists who are questioning API's claims. Stanley Riggs, a coastal and marine geologist at East Carolina University, was at Carteret Community College in North Carolina last week to deliver a lecture about offshore drilling sponsored by the anti-drilling Sierra Club. Riggs noted that N.C. Gov. Pat McCrory (R) — who's leading the political push for Atlantic drilling as chair of the Outer Continental Shelf Governors Coalition, which includes Virginia's Terry McAuliffe (D) and South Carolina's Nikki Haley (R) — is relying on the same questionable API report. Riggs pointed out that these very numbers were being circulated by the industry 30 years ago.

"It is the same data we had in 1988 that was used to put the moratorium on the Atlantic margin," he said. "It's the same data that we have today in the public domain. There's been no work out there since."

The Obama administration's proposed five-year plan calls for a 50-mile buffer zone along the Atlantic Coast where no drilling would occur. McCrory has been pressing to reduce that to a 30-mile buffer — which Riggs said shows a disconnect between policy and science, as the most significant reserves are thought to be well off the coast in deep water where drilling is more difficult and risky. The API report does not assume a 50-mile buffer. It also does not assume drilling would be limited to a single lease sale, as the proposed plan does. McCrory is calling for at least two lease sales.

There are also big questions about the job creation claims being made in API's ads, and whether they actually represent a net economic benefit for coastal communities. At a forum on offshore drilling held earlier this year in the North Carolina coastal city of New Bern, Lee Nettles, director of the Outer Banks Visitors Bureau, pointed out that the projected number of tourism jobs in coastal counties by 2035 is greater than the mid-range projection for oil and gas jobs. He noted that projected benefits from oil and gas drilling come at the risk of the proven benefits of tourism, which is now the main economic driver of the state's coastal economy.

"Oil and gas is a threat disguised as an opportunity," Nettles told the forum.

Furthermore, the API ads' claims of state revenue benefits from offshore drilling for Virginia and the Carolinas are based on the assumption that federal lawmakers will pass long-shot legislation.

Currently there's no law in place to allow East Coast states to share in drilling revenues, most of which now go to the federal treasury. While a revenue-sharing bill that includes Atlantic Coast states has been introduced in Congress, it's opposed by the Obama administration because it would reduce the net return to taxpayers and add to the federal deficit. The administration has even proposed eliminating revenue sharing with Gulf Coast states, which began under legislation passed in the wake of Hurricane Katrina and is slated to expand in 2017.

Speaking last week to the beach commission in the North Carolina coastal community of Pine Knoll Shores, County Shore Protection Officer Gregory Rudolph said that if the revenue-sharing bill were to pass, he expected President Obama would veto it.

The API's ad campaign comes as the official rule making process on Atlantic drilling approaches another important milestone. The administration's revised five-year drilling plan incorporating public comments submitted earlier this year is expected to be released in early 2016, followed by another public comment period. While the industry is pressing for expanded leasing opportunities in the Atlantic, drilling opponents are working to have the proposed Atlantic lease area dropped from the revised plan altogether.

Tags

Sue Sturgis

Sue is the former editorial director of Facing South and the Institute for Southern Studies.