Economist Rebecca Boehm on Tyson's stranglehold over Arkansas's poultry industry

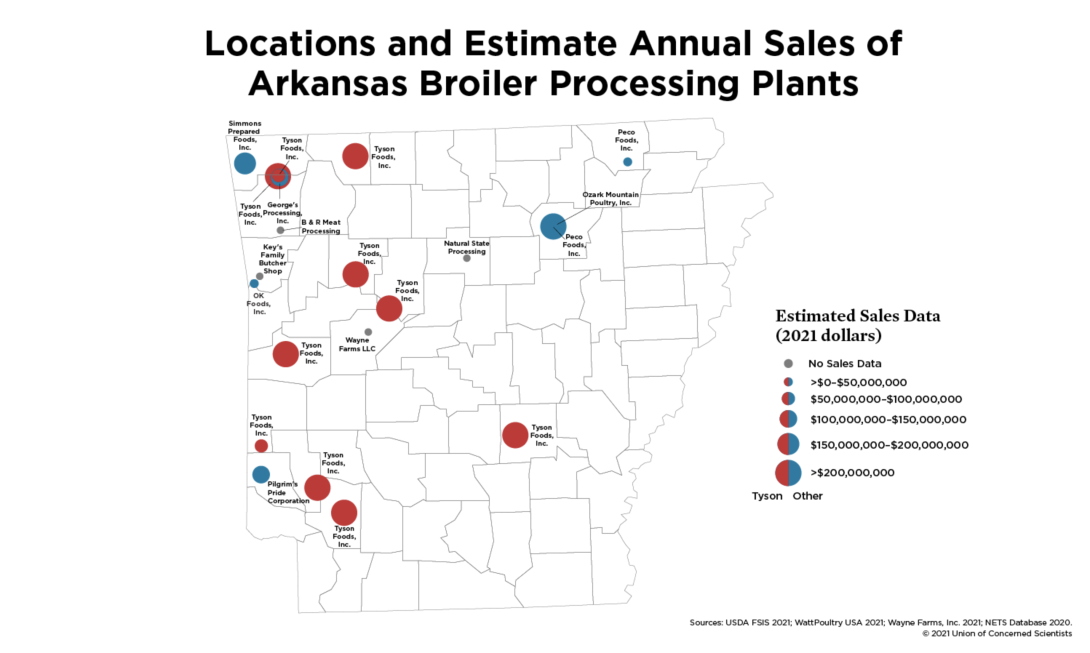

A Union of Concerned Scientists analysis finds that in seven of 14 Arkansas counties with at least one integrator poultry processing plant Tyson accounted for 100% of all estimated poultry processing sales. (Map courtesy of Union of Concerned Scientists)

A new report by economist Rebecca Boehm of the Union of Concerned Scientists titled "Tyson Spells Trouble," released in conjunction with an investigation in The Guardian, dives into the impact of Tyson's lack of serious competition for farmers and workers in the state. Also contributing to the report were organizer Magaly Licolli of the Arkansas workers' justice group Venceremos and Austin Frerick of Yale's Thurman Arnold Project, which studies competition and antitrust enforcement.

The report finds a number of disturbing trends in an industry with a history of consolidation: Arkansas broiler farms are disappearing even as the number of broiler chickens the state produces skyrockets, the state's industry is three times more consolidated than the Department of Justice's antitrust threshold, and farmers face little choice in where to sell their chicken.

Facing South spoke with Boehm, an economist with the Food and Environment program at UCS, about the report's findings and what actions can be taken at the state, local, and federal level to limit the impact of severe industry concentration.

Walk us through the findings of your report. Why did you choose to focus on Tyson and Arkansas?

All across our economy, the issue of competition or lack thereof across different sectors is becoming a more prominent issue among policymakers. We saw the Biden administration's executive order to address competition not just in food and agriculture, but across the economy. There's always been concern and issues around lack of competition in the food and agriculture system — as early as the 1920s in meat and poultry packing.

Last year, what happened with COVID and Tyson using their political weight to keep their processing facilities open made it clear how big certain companies can get and how powerful, how much they can influence policy and people's lives. Tyson is the largest meat processor in the country, number two in the world. They produce one out of every 5 pounds of chicken, beef, and pork that we eat. It's important to note that they're not just a big food company, they're a big company. They're number 73 on the Fortune 500 list. So they're a huge player in food and agriculture and in corporate America. Their power has a lot of influence over workers in the food and agricultural system, over farmers, and obviously over consumers. That's why we focused on Tyson. Tyson got its start in Arkansas and they have their headquarters there. That's why we chose to focus on Tyson and Arkansas.

The key thing is going to the fundamental economics of this and looking at the level of competition and concentration in poultry processing in Arkansas. That was basically the question we were trying to answer: What's the degree of concentration in Arkansas poultry processing? We used standard quantitative measures that regulators use to evaluate that, including the Herfindahl-Hirschman Index, which is how you assess concentration and competition in a particular industry. We calculated the annual HHI measure from 1990 to 2017, which is the most recent year of data that we had.

We found that the HHI value in poultry processing has dramatically increased in Arkansas since 2005 to levels that are concerning from a policy perspective. Any number above 2,500 is generally accepted as concerning. By our analysis we find that the HHI value in poultry processing in Arkansas was approximately 6,900. There's one player in the market in Arkansas who controls that industry and that's Tyson. We did a separate calculation using more recent data for 2021, and we found that Tyson controls an estimated 67% of poultry processing in Arkansas. There's just a handful of other competitors in the state.

People might be familiar with monopolies or lack of competition in a national context, especially because we hear a lot about Big Tech. Can you explain what a monopoly of a company like Tyson looks like and what the effects of lack of competition are in a region, a locality, or a state?

Tyson controls about a quarter of all poultry processing nationally. From a regulator or policy perspective, it wouldn't be that concerning — although overall, there is a trend towards a concerning level of consolidation nationally because there's only a few companies in control of the majority of total poultry processing in the U.S. Monopoly is what most people are used to thinking about when thinking about antitrust issues and competition. Monopoly is when there's one seller in a market. If you have one supermarket in your community, that's a monopoly. But in the case of poultry processing, or even in the food system generally, monopsonies are really important to think about even though we don't hear about them as much. Monopsony is when there's one buyer of a product. In poultry processing, they're buying chickens from farmers, they're buying labor from workers. We talk about monopoly in this report, but we also talk about monopsony.

Monopoly nationally for poultry processing is about the sales of processed poultry products, but monopsony comes into play when you look at the local and the regional level. Over time, at the local and regional level, the broiler supply chain has become very geographically concentrated because of specialization, economies of scale, and other underlying factors. Today, farmers can't and don't want to transport their chickens very far. USDA data indicate that on average broiler farmers that are supplying chickens to Tyson plants travel about 30 to 60 miles to deliver their chickens. As a result, the buying power that Tyson or other big poultry processors have — it's really important to look at that local scale. It really matters how many poultry processors are in their local area. You can't really look at national data. In our case we did a county-level analysis in addition to a state-level analysis. Farmers can't move their operations. Same issue for workers. Workers can't always pick up and move to a different place to find a new employer. Looking at the regional and local level is really important to understanding monopsony power and in some cases monopoly power.

In the state-level analysis we looked at overall competition and who's dominating, but then we looked at the county level. You can see Tyson's footprint is predominant in every part of the state where there's poultry processing, with a few exceptions. You can imagine as a farmer or worker facing that lack of competition when you're trying to find a job or when you're trying to negotiate a contract with a processor.

There are some farmers who might cross county or state lines to work with a particular poultry processor. We were limited in that way of not being able to know exactly where farmers were in relation to the processors.

Your analysis found that in half of Arkansas counties with "integrator plants," Tyson controls 100% of the sales. What does that mean? And what are the ramifications of that for a grower or for a worker?

Going back to what we know about broiler farmers, they don't travel very far to deliver the chickens to the processor. Having just one company in a county generally would mean that if you were upset with Tyson or another company and said, "I want to switch who I'm working with," it would be really hard to do that because of the lack of competition geographically. That's one implication.

Over time as this industry has specialized, processing has become more mechanized. Economies of scale underpin how this has all happened, along with some changes in federal policy. As that has happened, companies like Tyson and other big processors are called "integrators" because they have essentially taken control over all of the inputs in their supply chain. In the case of broiler supply chains in Arkansas, Tyson controls everything but the farms where the broilers are raised and the hatcheries. Essentially everything else from the feed mills forward is controlled by Tyson. A simpler way to put it is, for farmers raising the broilers, Tyson has outsourced and contracted the raising of those chickens to these independent farmers. There is no market for live chickens anymore; it's a market for services that these farmers provide to the integrator processors like Tyson. That gives integrator processors a lot of control, and there's some real downsides for farmers as a result.

What are some of those downsides?

There's less control over how farmers are able to make management and production decisions. The lack of competition exacerbates that. So again, if you don't have many integrator processors near you it's going to be a lot harder for you to negotiate the terms of the contracts that you have to engage in with the integrator processors. If there are any issues with pricing that the farmers see around the contracts, it's so much harder to negotiate when you've got one buyer in the game. You've got monopsony power occurring.

In addition, Tyson and other major processors' power in the industry has allowed them to lobby policymakers to influence regulations around these contracts. I think that's almost a bigger problem. For example, contracts that farmers currently have with integrator processors require that the farmers can't speak to the media about what they do. For the joint investigation that we did with The Guardian as part of this report, the reporter could not reach any contract farmers that worked for Tyson. They wouldn't comment.

You also found that over the last several decades there's been a major increase in broiler production but a decrease in the number of farmers actually producing those chickens.

This is a trend that you can see all over the agricultural sector where there's larger farms producing more grain or more animals. It's not at all surprising to see this happening in Arkansas in the broiler industry. Just from the USDA census data, the number of broiler farms has declined by 50% since 1978 while the number of broiler chickens has actually increased by 1,000% over the same time period. The other thing we note is that 94% of Arkansas broiler farms are under contract. USDA only started tracking the number of contract farms in 2002, so unfortunately it's hard to know before that what percentage of farms were under contract, but there's always been a high level since USDA started tracking it. The loss of small and mid-sized farms is a general concern across the agricultural sector. This is really no different story.

The concern is that when you have concentration of these farms you also concentrate the waste that the chickens produce. In addition, you have more chickens being raised so that creates more waste. We found that there's 74 billion pounds of chicken poop or chicken litter, as it's called, being produced in Arkansas every year. That has to be stored somewhere and disposed of. Sometimes it's applied to fallow agricultural land, and the nutrients from that waste can enter waterways. That's the public health concern if you live anywhere in these counties near where broiler production is concentrated. That can affect your water quality — whether that's your drinking water or the rivers in areas where you may fish or swim or recreate. The way I see this concentration of waste is as an environmental justice issue. Who's living in those communities where that waste is concentrated? How much power do they have to address that waste and the negative effects it might have on their water quality?

We've written a lot at Facing South about labor conditions in poultry plants. How do monopolies or monopsonies in the industry connect to working conditions for people in plants or for people on broiler farms?

It's the same basic economic concept. When you have one buyer of labor, or buyer of the contract services from the farmers — or you have few, if you have an oligopsony or a duopsony, when you have a handful or two integrator processors — if workers don't like their pay or working conditions, it makes it much more challenging to negotiate the terms of employment. There are just no other options. Tyson and some of the other poultry processors were alleged to have been coordinating wages for their workers. So even when there's a handful of companies, not just when there's one, these issues around pricing and making it harder for workers to negotiate the terms of employment arise even then. That's the underlying problem.

On top of that, Tyson, because they're so big, has a lot to gain from political lobbying and influence. They were one of the first companies to advocate for reform to workers' compensation as a way to reduce the cost of their labor force. At the national level, power can affect national or even state policy, and then at the local level when there's only one plant in a particular area it makes it really hard for the workers to negotiate the terms of their employment. That's when we see the things that The Guardian reported on, that brought the economic data down to people's lives and shows how terrible things can get when one company has so much power in a particular area or a particular state. COVID is a perfect example, where workers were forced to go back to their plants after Tyson put these full-page ads in the New York Times and in Arkansas media, and then a week later the Trump administration issued the executive order about keeping these plants open. The underlying economics and the market structure when it's concentrated lays the groundwork for companies to be able to exploit workers or farmers. That's the problem.

In the report, you address both federal and state-level potential policy fixes for industry concentration. Let's start on the state level. What could Arkansas policymakers do to address some of the issues that you highlight in the report?

For workers and people who live in Arkansas, who live in the same communities as poultry plant workers, there was research last year that found that in communities with poultry and meatpacking plants COVID cases were higher than in counties where there wasn't a plant. So not just the workers but the communities have a stake in how these companies treat their workers, because if COVID outbreaks occur in the plants, it increases case rates in communities. Unionization of these workers is something that individuals, lawmakers, and institutions should really support. Unionization essentially helps the workers push back on that near-monopsony or oligopsony power that Tyson and other big processors have.

The other state-level recommendation that we had was ensuring that labor laws and wage laws are being enforced to the fullest extent possible. We also talk about the discrimination and harassment that The Guardian reported on, which Venceremos is working to address. Those are fundamental human rights issues that just should not exist, and those need to be addressed.

Tyson doesn't have a monopoly on chicken sales in grocery stores in Arkansas because chicken is imported to the state. We have a national global market for chicken. But supporting small and mid- sized farmers and small and mid- sized processors — if you can afford it, if those types of establishments exist in your community — is one way you can take action as an individual. And hold your state legislators accountable. Who are they advocating for? Are they ensuring the workers in these plants are safe? Are they addressing the issues with farmers, the loss of farms?

These things are all addressing the symptoms of the level of consolidation in poultry processing in Arkansas, and not addressing the underlying economic issues.

The issue of the underlying economics in this industry has to be addressed federally. Biden's executive order brings more prominence to this issue across the economy, and there were many mentions of USDA's authority and role in that executive order.

Some low-hanging fruit on the federal level: USDA has an agency called the Grain Inspection, Packers and Stockyards Administration, which is tasked with addressing and monitoring competition issues in food and agricultural markets. Their power has been stymied over the years; Congress has used the GIPSA rider in annual appropriations to basically defund them, and has been successful in doing that. The Trump administration actually consolidated GIPSA into the Agricultural Marketing Service in 2018, and some advocates claim that this allows GIPSA to be influenced more heavily by industry interests because AMS has closer ties to industry. Moving GIPSA back and letting it have its standalone authority, fully funding it, and letting it do its job without political influence is something that members of Congress from Arkansas can be supportive of. That's not a hard thing to do.

And then more generally, the Department of Justice and the Federal Trade Commission should scrutinize and regulate mergers and acquisitions in poultry processing with a more discerning eye. As our report showed, Tyson has been particularly aggressive with acquiring competitors and suppliers since the mid-1990s, which was as far back as we could go with data. Scrutinize those things to see how they will affect farmers locally in certain parts of the country where the industry is heavily concentrated. They should use the local and regional approach that we use to ensure there aren't adverse impacts on farmers or workers.

Tags

Olivia Paschal

Olivia Paschal is the archives editor with Facing South and a Ph.D candidate in history at the University of Virginia. She was a staff reporter with Facing South for two years and spearheaded Poultry and Pandemic, Facing South's year-long investigation into conditions for Southern poultry workers during the COVID-19 pandemic. She also led the Institute's project to digitize the Southern Exposure archive.